JOINT PRESS RELEASE

SP- 46/KLI/2024

No. 26/208/DKom

SP 141/GKPB/OJK/IX/2024

No. APUVINDO/BPI/18/2024

Jakarta, 27th September 2024 – The National Working Group on Benchmark Reform (NWGBR)[1] has issued the Jakarta Interbank Offered Rate (JIBOR) Transition Guidelines in accordance with Bank Indonesia's decision to discontinue JIBOR publication on 1st January 2026. The guidelines provide information concerning the background behind JIBOR discontinuation, the transition timeline as well as preparation guidance and recommendations for JIBOR transition as a reference for market players. Furthermore, the guidelines are expected to support a seamless JIBOR transition process, while assisting market players and all relevant stakeholders to understand the benchmark rate reform process when transitioning from JIBOR to IndONIA.

In the guidelines, the NWGBR also recommends that market players with JIBOR exposure undertake four main measures as follows:

- Apply Alternative Reference Rates (ARR), namely IndONIA and Compounded IndONIA, to all new financial contracts gradually from 1st January 2025. The transition includes overnight to 1-week tenors from 1st January 2025, 1-month to 3-month tenors from 1st April 2025, and 6-month to 12-month tenors from 1st June 2025.

- Create and maintain a Transition Team to ensure a seamless JIBOR transition process.

- Ensure legacy contracts have adequate fallback clause language[2], including re-papering[3] if required.

- Remain up to date with domestic benchmark reform developments.

A component of calculating the JIBOR fallback rate is the spread adjustment, which is a method of adjusting for differences in risk characteristics between JIBOR and the Alternative Reference Rate (ARR), namely IndONIA. The spread adjustment for each tenor is calculated based on data from the past 5 years from the trigger date on 27th September 2024. In addition, Bank Indonesia will publish the spread adjustment at the end of October 2024.

The information contained in the guidelines is based on discussions between NWGBR members and market players, referring to international recommendations and best practices. Information is also provided concerning the alternative reference rate (ARR) and spread adjustment conventions that market players can consider when preparing new financial contracts and fallback rates on legacy JIBOR contracts that will mature after JIBOR discontinuation.

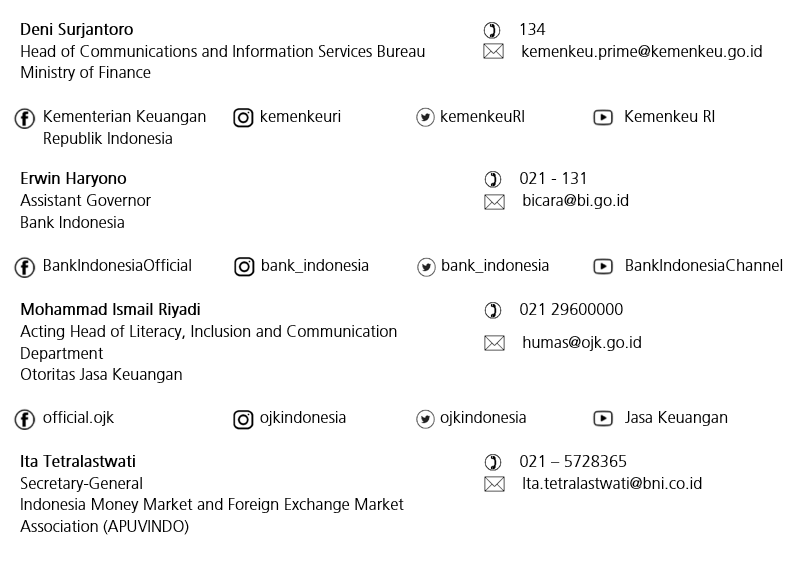

Media Contacts:

[1] With members including the Ministry of Finance, Bank Indonesia, Financial Services Authority (OJK) as well as Indonesia Money Market and Foreign Exchange Market Association (APUVINDO), the NWGBR functions to provide information to market players concerning the benchmark reform agenda along with recommendations for reference rates in the domestic financial markets.

[2] Fallback clause language refers to contractual provisions during the contract period concerning further mechanisms/agreements to accommodate changes in the initial agreement.

[3] Through a contract addendum to agree changes in the initial agreement.