The Licensing Information for Prospective Payment System Service Providers on the official website of Bank Indonesia provides comprehensive and transparent information to relevant stakeholders in order to meet the licensing requirements in accordance with prevailing regulations.

The Payment System Service Providers stipulated in Bank Indonesia regulations concerning Payment Transaction Processing are as follows:

- Issuers (Credit Cards, ATM Cards, Debit Cards, Electronic Money)

- Acquirers (Credit Cards, Debit Cards, Electronic Money)

- Principals (Credit Cards, ATM Cards, Debit Cards, Electronic Money)

- Clearing Providers (Credit Cards, ATM Cards, Debit Cards, Electronic Money)

- Settlement Providers (Credit Cards, ATM Cards, Debit Cards, Electronic Money)

-

Payment Gateway Operators

- e-Wallet Providers

-

Switching Companies

- Funds Transfer Providers

Licence Application Procedure For Payment System Service Providers

Through self-assessment, ensure all required documents submitted to Bank Indonesia meet the requirements stipulated in prevailing BI regulations.

- Register through the e-Licensing system to obtain access

- Select the type of application to be submitted

- Complete the corporate profile information on the ‘Applicant Profile’ page

- Complete the institutional information and upload the required documents in accordance with prevailing Bank Indonesia regulations on the ‘Payment System Licensing’ page

- Click the ‘Submit’ button

Licence applications tendered through the e-Licensing system must be accompanied by a written application letter and submitted to:

- Licence applications for providers of Card-Based Payment Instruments, Electronic Money, Payment Gateways, e-Wallets, Switching services and Funds Transfers as a feature of Electronic Money should be submitted to:

|

Bank Indonesia

Departemen Kebijakan Sistem Pembayaran

Gedung D Lantai 5, Jl. MH. Thamrin No.2

Jakarta Pusat 10350

|

- Licence applications for funds transfer providers should be submitted to:

Nearest Bank Indonesia Representative Office

|

Licensing Stages For Payment System Service Providers

The licensing stages for prospective payment system service providers are as follows:

Licence Processing Flow for Prospective Payment System Service Providers

- Document submission through Bank Indonesia e-Licensing system

- Document verification through Bank Indonesia e-Licensing system

- Hardcopy verification

- On-site visits

- Licence approval/rejection

Notes :

- Licence applications for Payment System Service Providers must be submitted in writing and accompanied by supporting documents via https://www.bi.go.id/elicensing for verification..

- Bank Indonesia will verify the documents through the e-Licensing application.

- After the documents have been verified by Bank Indonesia, the e-Licensing application will send a notification together with a receipt to the applicant’s email that must be printed by the Applicant.

- The hardcopies must be presented to DKSP together with the receipt for verification.

- Bank Indonesia will verify the hardcopies.

- After the documents have been verified, Bank Indonesia will arrange on-site visits to ensure operational preparedness as well as system security and integrity, including an on-site visit to the datacentre.

- Licence approval or rejection.

Contact Us

For further enquiries, please contact:

Email: bicara@bi.go.id

Telephone: (area code) 500-131

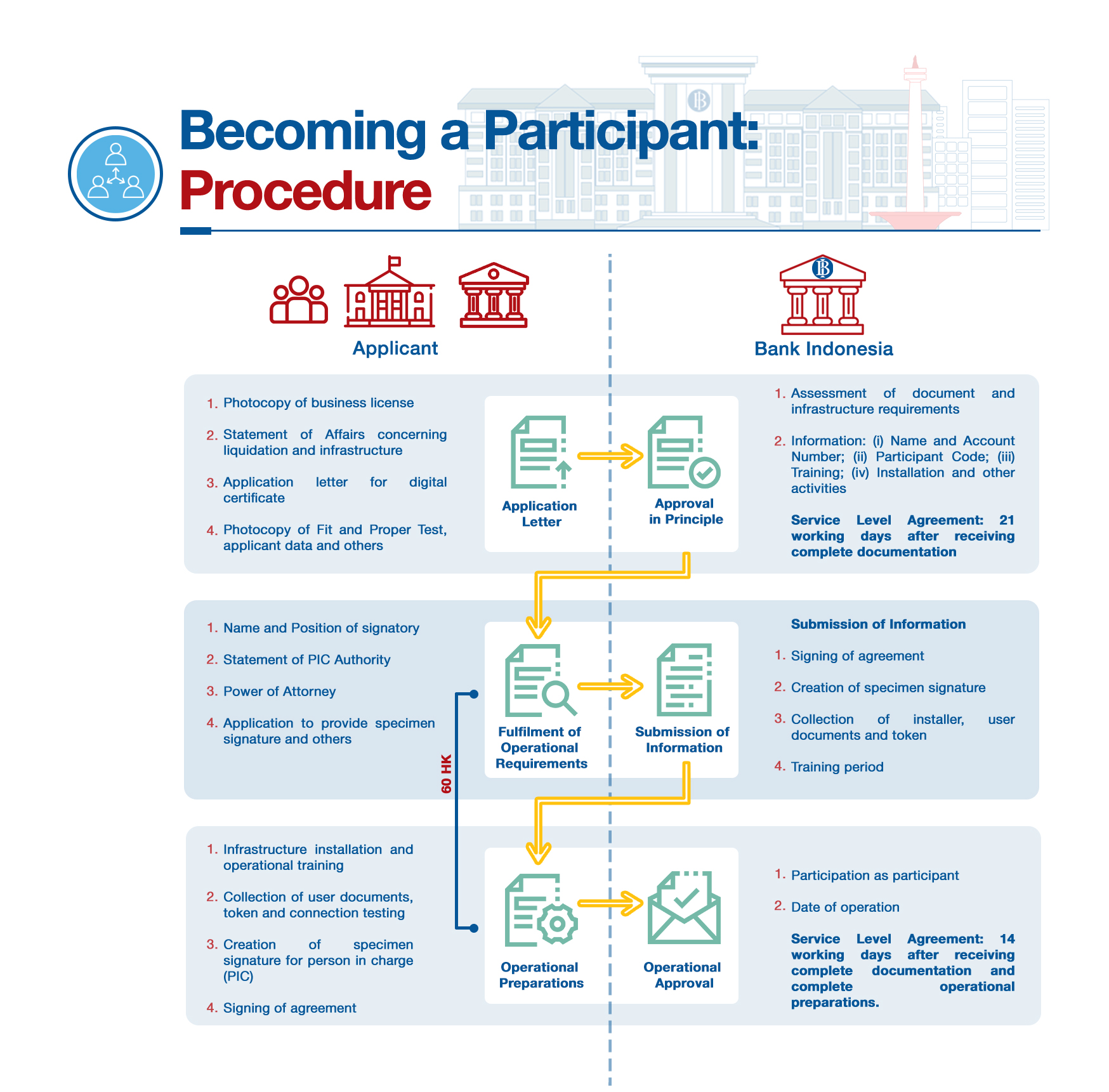

Becoming a Participant Procedure

BI Payment System Licensing Procedure

Change of Participant Data

Change of Participant Data Procedure

Change of Participant Data Procedure

Services Participation Process Flow

![Alur-Proses-Kepesertaan-SKNBI-[pt1]-en.jpg](/en/fungsi-utama/sistem-pembayaran/perizinan/PublishingImages/default/Alur-Proses-Kepesertaan-SKNBI-[pt1]-en.jpg)

![Alur-Proses-Kepesertaan-SKNBI-[pt2]-en.jpg](/en/fungsi-utama/sistem-pembayaran/perizinan/PublishingImages/default/Alur-Proses-Kepesertaan-SKNBI-[pt2]-en.jpg)

- Payment system participant applications for a bank (newly established or undertaking fundamental and strategic measures) are submitted to the Financial System Surveillance Department (DSSK) of Bank Indonesia and subsequently forwarded to the Payment System Management Department (DPSP). Meanwhile, nonbanks (funds transfer services providers) are required to submit their application directly to the Payment System Management Department (DPSP).

- The Payment System Management Department (DPSP) will check and verify the application, including the document requirements. DPSP will send an approval in principle or rejection letter no later than 21 working days after the complete documentation is received by DPSP. For prospective Bank Participants, the approval in principle will be sent through the Financial System Surveillance Department (DSSK) or directly by DPSP for nonbank funds transfer providers.

- If approval in principle is granted, DPSP will oversee the operational preparations at the prospective Participant, including JKD installation, soft token and signature specimen of person in charge, as well as provide training. The Participant has 60 working days to meet the operational preparations from the date the approval in principle is issued by DPSP. DPSP will send operational approval and an effective date no later than 14 working days after the operational preparations have been successfully completed.

- For a bank, operational approval is sent through the Financial System Surveillance Department (DSSK) or directly through the Payment System Management Department (DPSP) for a nonbank funds transfer provider.

To improve effectiveness, efficiency and governance at head office and branch offices, PJPUR licensing has been separated into two stages, namely the principal licence and operating licence.

PJPUR Activity

Head Office Principal Licence

![Alur-[workflow]-izin-prinsip-pusat-EN.jpg](/en/fungsi-utama/sistem-pembayaran/perizinan/PublishingImages/default/Alur-[workflow]-izin-prinsip-pusat-EN.jpg)

- Applicant submits application for PJPUR principal licence together with the requirements stipulated in accordance with the Bank Indonesia Regulation (PBI) concerning PUR.

- Bank Indonesia will verify the administrative requirements of the documentation submitted by the applicant.

- For incomplete documentation, the applicant has 14 working days to provide additional documents. Failure to comply will result in the application being returned.

- If the administrative requirements have been met, Bank Indonesia will verify the substantive accuracy of the documents submitted by the applicant.

- After all documents have been verified complete, correct and accurate, Bank Indonesia will interview the commissioners and directors of the PJPUR.

- Commissioners or directors who do not meet the requirements set by Bank Indonesia must be replaced by the PJPUR.

- Bank Indonesia will decide on the application for a principal licence submitted by the PJPUR.

Head Office Operating Licence

![Alur-[workflow]-izin-operasional-pusat-en.jpg](/en/fungsi-utama/sistem-pembayaran/perizinan/PublishingImages/default/Alur-[workflow]-izin-operasional-pusat-en.jpg)

- Applicant submits application for PJPUR operating licence together with the requirements stipulated in accordance with the Bank Indonesia Regulation (PBI) concerning PUR.

- Bank Indonesia will verify the administrative requirements of the documentation submitted by the applicant.

- For incomplete documentation, the applicant has 14 working days to provide additional documents. Failure to comply will result in the application being returned.

- If the administrative requirements have been met, Bank Indonesia will verify the substantive accuracy of the documents submitted by the applicant.

- After all documents have been verified complete, correct and accurate, Bank Indonesia will conduct an on-site inspection of the PJPUR head office.

- If findings are revealed by the on-site inspection, the PJPUR is required to resolve the findings and align the follow-up results within 14 working days.

- Bank Indonesia will decide on the application for an operating licence submitted by the PJPUR.

Branch Office Principal Approval

-Persetujuan-Prinsip-Cabang-EN.jpg)

-

Applicant submits application for PJPUR principal approval together with the requirements stipulated in accordance with the Bank Indonesia Regulation (PBI) concerning PUR.

- Bank Indonesia will verify the administrative requirements of the documentation submitted by the applicant.

- For incomplete documentation, the applicant has 14 working days to provide additional documents. Failure to comply will result in the application being returned.

- If the administrative documents are complete and correct, Bank Indonesia will verify the substantive accuracy of the documents submitted by the applicant.

- After all documents have been verified complete, correct and accurate, Bank Indonesia will investigate the performance of the PJPUR branch office.

- Bank Indonesia will decide on the application for a principal approval submitted by the PJPUR.

Branch Office Operational Approval

-Persetujuan-Operasional-Cabang-EN.jpg)

-

Applicant submits application for PJPUR operational approval together with the requirements stipulated in accordance with the Bank Indonesia Regulation (PBI) concerning PUR.

- Bank Indonesia will verify the administrative requirements of the documentation submitted by the applicant.

- For incomplete documentation, the applicant has 14 working days to provide additional documents. Failure to comply will result in the application being returned.

- If the administrative documents are complete and correct, Bank Indonesia will verify the substantive accuracy of the documents submitted by the applicant.

- After all documents have been verified complete, correct and accurate, Bank Indonesia will conduct an on-site inspection of the PJPUR branch office.

- If findings are revealed by the on-site inspection, the PJPUR is required to resolve the findings and align the follow-up results within 14 working days.

- Bank Indonesia will decide on the application for operational approval submitted by the PJPUR.