The promulgation of Act Number 4 of 2023, known as the Financial Sector Development and Strengthening (P2SK Act), establishes a solid legal basis for Bank Indonesia's mandate, policies, and institutional arrangements. The P2SK Act also provides a strong foundation for Bank Indonesia to strengthen its governance system in the face of increasingly complex demands. In addition, Article 58 of the P2SK Act strengthens accountability by improving the quality of BI reporting on institutional performance.

Towards that end, Bank Indonesia is strengthening its previous governance framework, based on Board of Governors Regulation (PADG) Number 17/13/PADG/2015 concerning Bank Indonesia Governance, by formulating the Bank Indonesia Policy and Institutional Governance System to better support implementation of Bank Indonesia’s duties and authority to effectively, efficiently and accountably achieve the objectives mandated in Act Number 4 of 2023 concerning Financial Sector Development and Strengthening in accordance with prevailing principles.

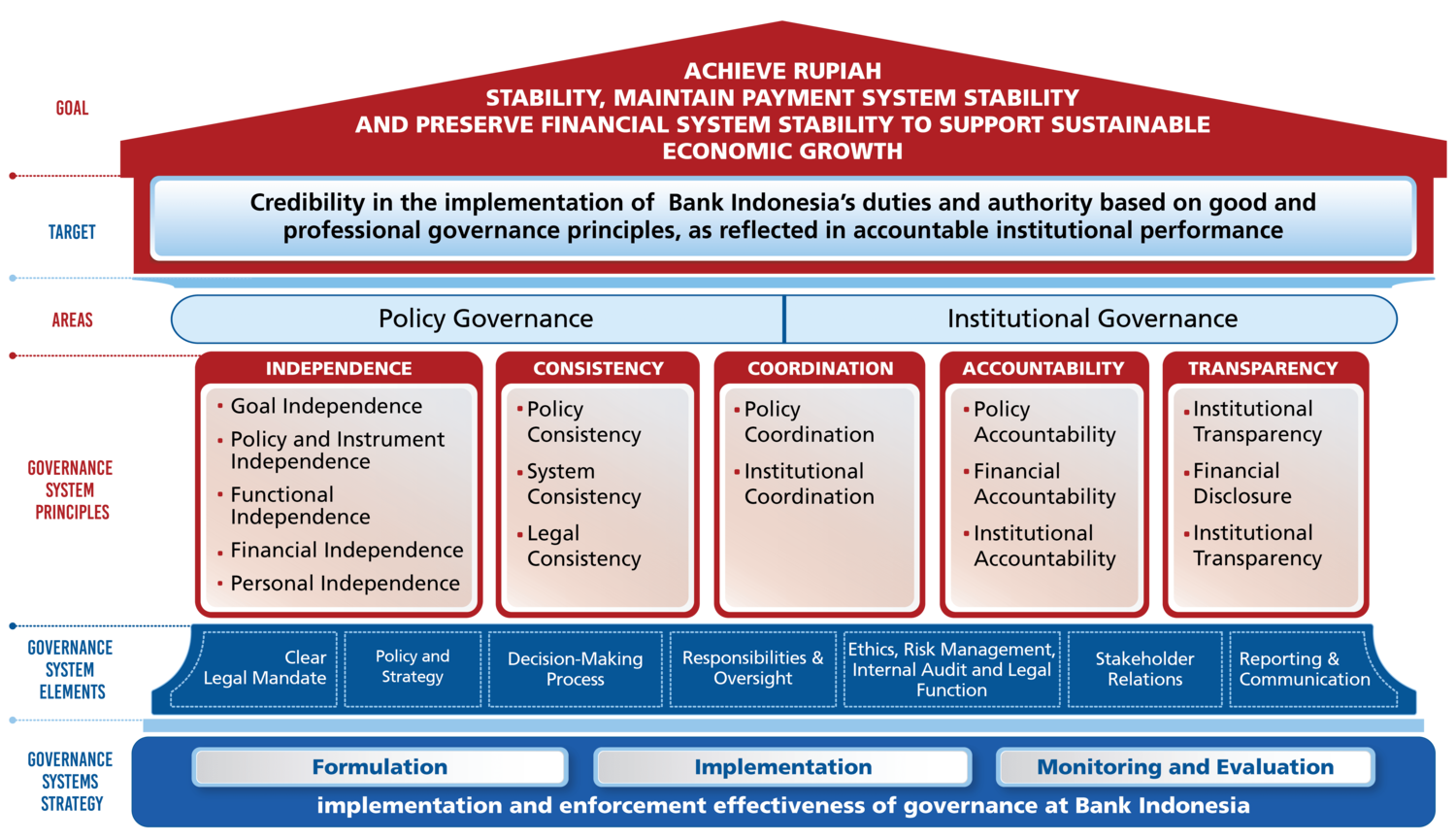

In general, strengthening measures relate to:

- The definitions, goal and target of the Bank Indonesia governance system;

- The implementation of the Bank Indonesia governance system, primarily in the policy and institutional areas;

- The principles of the governance system and their implementation through the elements of the governance system; and

- The application strategy for the Bank Indonesia governance system.

Image: Bank Indonesia Policy and Institutional Governance System Framework

Referring to the governance concept and practices applicable for public institutions and central banks, the Bank Indonesia Governance System comprises the norms, rules, regulations and procedures applied by the Board of Governors to regulate and control the institutional arrangements and ensure the goal of Bank Indonesia's mandate is achieved effectively and efficiently based on prevailing principles and public accountability.

In line with the concept of central bank governance, the goal of the governance system is to achieve the objectives of the central bank as mandated in accordance with prevailing laws. The goal of the Bank Indonesia Governance System, therefore, can be formulated consistently with the goals of Bank Indonesia, as stipulated in Act Number 4 of 2023 concerning Financial Sector Development and Strengthening, namely “achieving rupiah stability, maintaining payment system stability and preserving financial system stability to support sustainable economic growth.”

Seeking to be more in line with generally accepted governance concepts and sound business practices, the overarching goal of the existing Governance Framework can be adjusted to become the goal of the governance system, namely credibility in the implementation of Bank Indonesia’s duties and authority based on good and professional governance principles, as reflected in accountable institutional performance.

The Bank Indonesia governance framework must be strengthened comprehensively based on the characteristics specific to the central bank as policymaker and public institution. As a policymaker, Bank Indonesia institutes policies with broad implications for the financial system and economy as a whole, with commensurately broad accountability to the public at large.

Consequently, Bank Indonesia must apply optimal policy governance when formulating and instituting BI policies to ensure alignment with the norms, rules and procedures as well as prevailing laws and regulations in pursuance of the mandate for the public interest.

As a public institution, Bank Indonesia is an independent service organisation that must apply institutional governance in line with sound business practices to ensure effective, efficient and accountable institutional management in accordance with prevailing principles.

Based on the mandate of Act Number 4 of 2023 concerning Financial Sector Development and Strengthening (P2SK Act), as well as the concepts and practices of central bank governance, the Principles of the Bank Indonesia Governance System are Independence, Consistency, Coordination, Accountability and Transparency (IKKAT).

Elements of the Bank Indonesia Policy and Institutional Governance System are the core aspects that must be implemented for the application of IKKAT principles in the day-to-day implementation of Bank Indonesia's duties and function.

Implementation of the Bank Indonesia Policy and Institutional Governance System is translated into three strategies, namely Formulation, Implementation, as well as Monitoring and Evaluation. The Bank Indonesia Policy and Institutional Governance System strategies are required for continuous improvement as an effort to implement good and professional governance practices. Monitoring and evaluation in the policy and institutional governance system aim to garner feedback through internal and external assessments to increase the implementation and enforcement effectiveness of governance at Bank Indonesia.