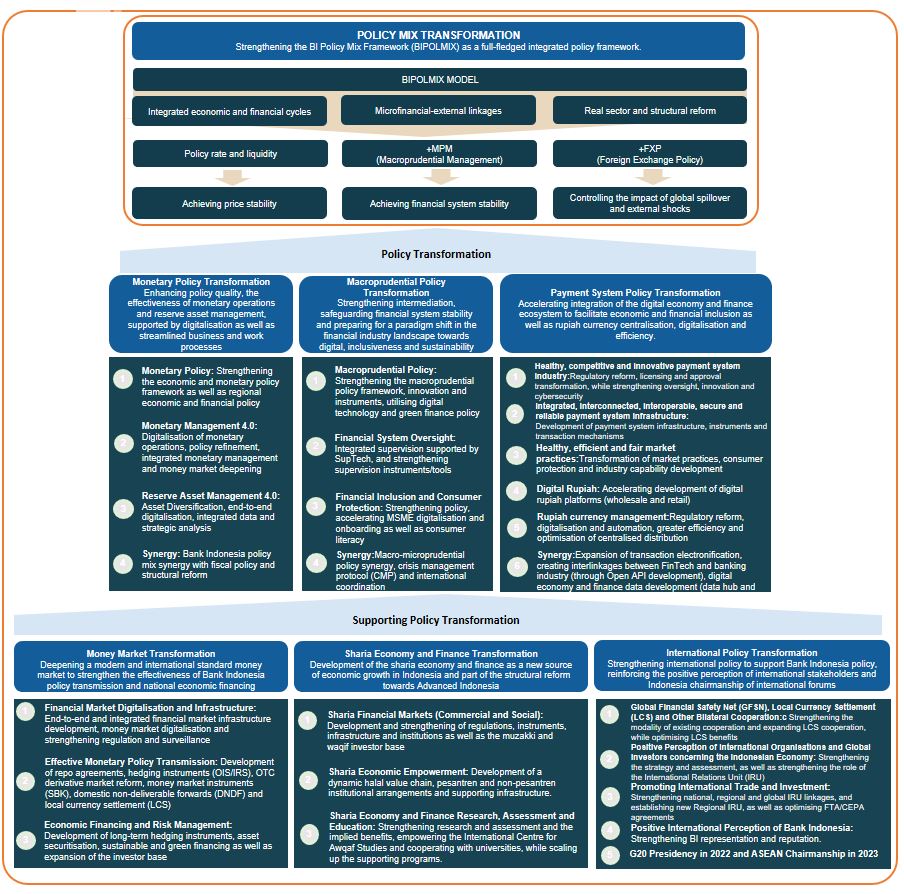

In line with the strategic direction, policy transformation at Bank Indonesia aims to strengthen the policy mix framework (BIPOLMIX) as well as each respective policy area.

Figure 2. Policy Transformation

Institutional transformation of Bank Indonesia involves strengthening the organisation and business processes, human resources and work culture as well as digitalisation. In 2021, Bank Indonesia developed an institutional policy mix framework based on effective, efficient and governed performance (2EG) to strengthen institutional management.

Figure 3. Institutional Transformation

The implementation and achievements of Bank Indonesia transformation are monitored and evaluated regularly to ensure alignment with Bank Indonesia's vision and missions amid a dynamic strategic environment. In addition, Bank Indonesia transformation implementation and achievements are reported periodically via the Bank Indonesia Institutional Report (

link) and Bank Indonesia Annual Report (

link).