No. 24/83/DKom

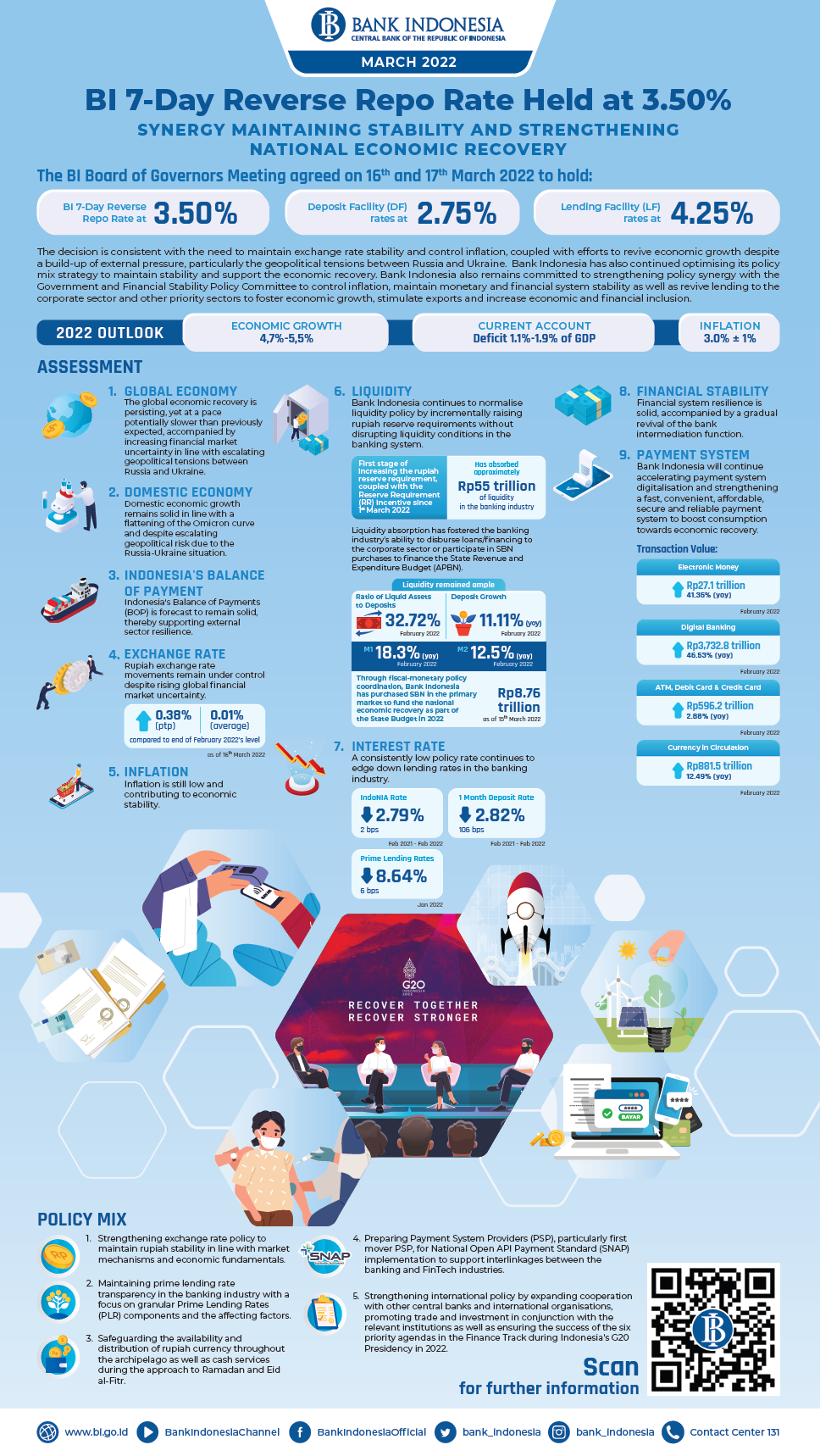

The BI Board of Governors Meeting agreed on 16th and 17th March 2022 to hold the BI 7-Day Reverse Repo Rate at 3.50%, while also maintaining the Deposit Facility (DF) rates at 2.75% and Lending Facility (LF) rates at 4.25%. The decision is consistent with the need to maintain exchange rate stability and control inflation, coupled with efforts to revive economic growth despite a build-up of external pressure, particularly the geopolitical tensions between Russia and Ukraine. Bank Indonesia has also continued optimising its policy mix strategy to maintain stability and support the economic recovery through the following policy measures:

- Strengthening exchange rate policy to maintain rupiah stability in line with market mechanisms and economic fundamentals.

- Maintaining prime lending rate transparency in the banking industry with a focus on granular Prime Lending Rates (PLR) components and the affecting factors (Appendix).

- Safeguarding the availability and distribution of rupiah currency throughout the archipelago as well as cash services during the approach to Ramadan and Eid-ul-Fitr.

- Preparing Payment System Providers (PSP), particularly first mover PSP, for National Open API Payment Standard (SNAP) implementation to support interlinkages between the banking and FinTech industries.

- Strengthening international policy by expanding cooperation with other central banks and international organisations, promoting trade and investment in conjunction with the relevant institutions as well as ensuring the success of the six priority agendas in the Finance Track during Indonesia's G20 Presidency in 2022.

Bank Indonesia also remains committed to strengthening policy synergy with the Government and Financial Stability Policy Committee to control inflation, maintain monetary and financial system stability as well as revive lending to the corporate sector and other priority sectors to foster economic growth, stimulate exports and increase economic and financial inclusion.

The global economic recovery is persisting, yet at a pace potentially slower than previously expected, accompanied by increasing financial market uncertainty in line with escalating geopolitical tensions between Russia and Ukraine. The geopolitical tensions, together with unprecedented sanctions against Russia, are affecting world trade, international commodity prices and global financial markets as Covid-19 infections begin to subside. Economic growth in Europe, United States, Japan, China and India is potentially lower than previously projected. A similar trend is affecting world trade volume in line with a more subdued global economic recovery and ongoing supply chain disruptions. International commodity prices are rising, including energy, food and metal, thereby intensifying global inflationary pressures. Escalating geopolitical tensions between Russia and Ukraine are increasing global financial market uncertainty, coupled with the Federal Reserve's recent policy rate hike and faster monetary policy normalisation in other advanced economies in response to a build-up of inflationary pressures triggered by higher energy prices. Such conditions have restrained capital flows, while increasing the risk of a capital reversal to safe-haven assets and currency pressures in developing economies, including Indonesia.

Domestic economic growth remains solid in line with a flattening of the Omicron curve and despite escalating geopolitical risk due to the Russia-Ukraine situation. The national economic growth projection is supported by stronger household consumption and non-building investment, accompanied by positive government consumption growth. Externally, exports are expected to remain strong, though moderating on the previous period given the geopolitical fallout and sluggish world trade activity. Spatially, export performance is still robust, primarily in the Java, Sulawesi-Maluku-Papua (Sulampua) and Bali-Nusa Tenggara (Balinusra) regions. Several economic indicators at the beginning of March 2022 remained upbeat, including retail sales, consumer confidence, cement sales and community mobility in various regions. Moving forward, economic performance is projected to remain sound as the vaccination program continues to roll out quickly, together with looser mobility restrictions, broader reopening of the economy as well as ongoing policy stimuli from Bank Indonesia, the Government and other relevant authorities. Economic growth in 2022, therefore, is still projected in the 4.7-5.5% range.

Indonesia's Balance of Payments (BOP) is forecast to remain solid, thereby supporting external sector resilience. A low and manageable current account deficit is predicted for the first quarter of 2022 on the back of a maintained goods trade surplus. Overall, a positive trade balance was recorded in February 2022, posting a USD3.8 billion surplus, supported by a larger non-oil and gas trade surplus in response to higher international commodity prices, including coal, iron and steel as well as crude palm oil (CPO), yet offset by a larger oil and gas trade deficit. Meanwhile, foreign capital inflows to domestic financial markets were impacted by elevated global financial market uncertainty, as reflected by a net outflow of portfolio investment totalling USD0.4 billion for the period from January to 15th March 2022. The position of reserve assets at the end of February 2022 stood at USD141.4 billion, equivalent to 7.5 months of imports or 7.3 months of imports and servicing government external debt, which is well above the 3-month international adequacy standard. BOP performance in 2022 will be maintained with a low and manageable current account deficit projected in the 1.1-1.9% of GDP range. In addition, the capital and financial account is expected to maintain a surplus, primarily in the form of foreign direct investment (FDI), given the conducive domestic investment climate.

Rupiah exchange rate movements remain under control despite rising global financial market uncertainty. As of 16th March 2022, the rupiah appreciated 0.38% (ptp) and by 0.01% on average compared with the level recorded at the end of February 2022. Rupiah exchange rate developments are supported by domestic foreign-exchange supply and positive perception concerning the domestic economic outlook despite elevated global financial market uncertainty. As of 16th March 2022, therefore, the rupiah has depreciated 0.42% since the end of 2021, comparatively less than the currency depreciation experienced in several other developing economies, such as Malaysia (0.76% ytd), India (2.53% ytd) and the Philippines (2.56% ytd). Moving forward, the value of the rupiah is expected to remain stable in line with solid economic fundamentals in Indonesia. Furthermore, Bank Indonesia will continue to strengthen exchange rate stabilisation policy in line with market mechanisms and economic fundamentals through measures to enhance the effectiveness of monetary operations and preserve adequate market liquidity.

Inflation is still low and contributing to economic stability. In February 2022, the Consumer Price Index (CPI) recorded 0.02% (mtm) deflation or 2.06% (yoy) inflation annually, down from 2.18% (yoy) one month earlier. Headline inflation has been influenced by low core inflation despite early signs of growing domestic demand, maintained exchange rate stability and policy consistency by Bank Indonesia to anchor inflation expectations. Volatile food inflation has moderated, primarily due to maintained supply and increasing production. On the other hand, the knock-on effect of higher tobacco duties and adjustments to household fuel prices continue to impact administered prices, though the effect has begun to fade. Inflation in 2022 is predicted to remain under control and within the 3.0%±1% target corridor in line with adequate supply to meet increasing demand, anchored inflation expectations, rupiah exchange rate stability as well as the policy response instituted by Bank Indonesia and the Government. Several risks to inflation demand vigilance, including the impact of rising international commodity prices. Bank Indonesia remains firmly committed to maintaining price stability and strengthening policy coordination with the central and regional governments through the national and regional inflation control teams (TPIP and TPID) to control CPI inflation within the target.

Bank Indonesia continues to normalise liquidity policy by incrementally raising rupiah reserve requirements without disrupting liquidity conditions in the banking system. In net terms, the first stage of increasing the rupiah reserve requirement, coupled with the Reserve Requirement (RR) incentive since 1st March 2022, has absorbed approximately Rp55 trillion of liquidity in the banking industry. Liquidity absorption has not reduced the banking industry's ability to disburse loans/financing to the corporate sector or participate in SBN purchases to finance the State Revenue and Expenditure Budget (APBN). In February 2022, the ratio of liquid assets to deposits remained high at 32.72%, with deposit growth recorded at 11.11% (yoy). Meanwhile, through fiscal-monetary coordination in accordance with the Joint Decree of the Minister of Finance and Governor of Bank Indonesia, effective until 31st December 2022, Bank Indonesia has purchased SBN in the primary market to fund the national economic recovery as part of the State Budget in 2022 totalling Rp8.76 trillion (as of 15th March 2022) via primary auction and greenshoe options. SBN purchases by Bank Indonesia take into careful consideration SBN market conditions and the impact on liquidity in the economy. In February 2022, liquidity in the economy remained ample, as reflected by narrow money (M1) and broad money (M2) aggregates, which grew 18.3% (yoy) and 12.5% (yoy) respectively, primarily driven by stronger growth of loans disbursed by the banking industry and fiscal expansion by the Government.

A consistently low policy rate continues to edge down lending rates in the banking industry. In the markets, the IndONIA rate and 1-month deposit rate have fallen by 2bps and 106bs respectively since February 2021 to 2.79% and 2.82% in February 2022. In the credit market, the banking industry continues to lower lending rates on new loans, falling 30bps (yoy) in the same period, in line with improving risk perception as economic activity continues to recover. Bank Indonesia acknowledges an opportunity for the banking industry to increase lending/financing, including through lower lending rates, to expedite the national economic recovery.

Financial system resilience is solid, accompanied by a gradual revival of the bank intermediation function. The Capital Adequacy Ratio (CAR) in the banking industry remained high in January 2022 at 25.78%, with persistently low NPL ratios of 3.10% (gross) and 0.88% (nett). Bank intermediation continued to improve in February 2022, with credit growth accelerating to 6.33% (yoy), affecting various bank groups, loan segments and economic sectors as corporate and household activity gain recovery momentum. Corporate performance is improving, as reflected by stronger sales, repayment capacity and capital expenditure. On the supply side, the banking industry continues to relax lending standards, particularly for the manufacturing industry and trade sector, in line with lower credit risk perception. In addition, MSME loan growth accelerated to 14.32% (yoy) in February 2022.

Bank Indonesia will continue accelerating payment system digitalisation and strengthening a fast, convenient, affordable, secure and reliable payment system to boost consumption towards economic recovery. Digital economic and financial transactions are developing rapidly in line with greater public acceptance and growing public preference towards online retail as well as the expansion and convenience of digital payments and digital banking. In February 2022, the value of electronic money transactions grew 41.35% (yoy) to Rp27.1 trillion and the value of digital banking transactions increased 46.53% (yoy) to Rp3,732.8 trillion. Bank Indonesia continues to foster payment system innovation, including BI-FAST acceptance by expanding payment channels, assisting participants and educating the public. Seeking to boost private consumption, Bank Indonesia continues SIAP program implementation to create and maintain a healthy, innovative and secure QRIS system to support 15 million new QRIS users in 2022. Coordination with the Government is constantly strengthened to build synergy and accelerate digitalisation of the payments space by accelerating electronification of social aid program (bansos) disbursements, regional government transactions and various transportation modes. Meanwhile, the value of transactions using card-based payment instruments expanded 2.88% (yoy) to Rp596.2 trillion in the reporting period. In terms of cash, currency in circulation in February 2022 grew 12.49% (yoy) to reach Rp881.5 trillion.

Jakarta, 17th March 2022

Head of Communication Department

Erwin Haryono

Executive Director

Information on Bank Indonesia

Tel. 021-131, email: bicara@bi.go.id