No. 24/350/DKom

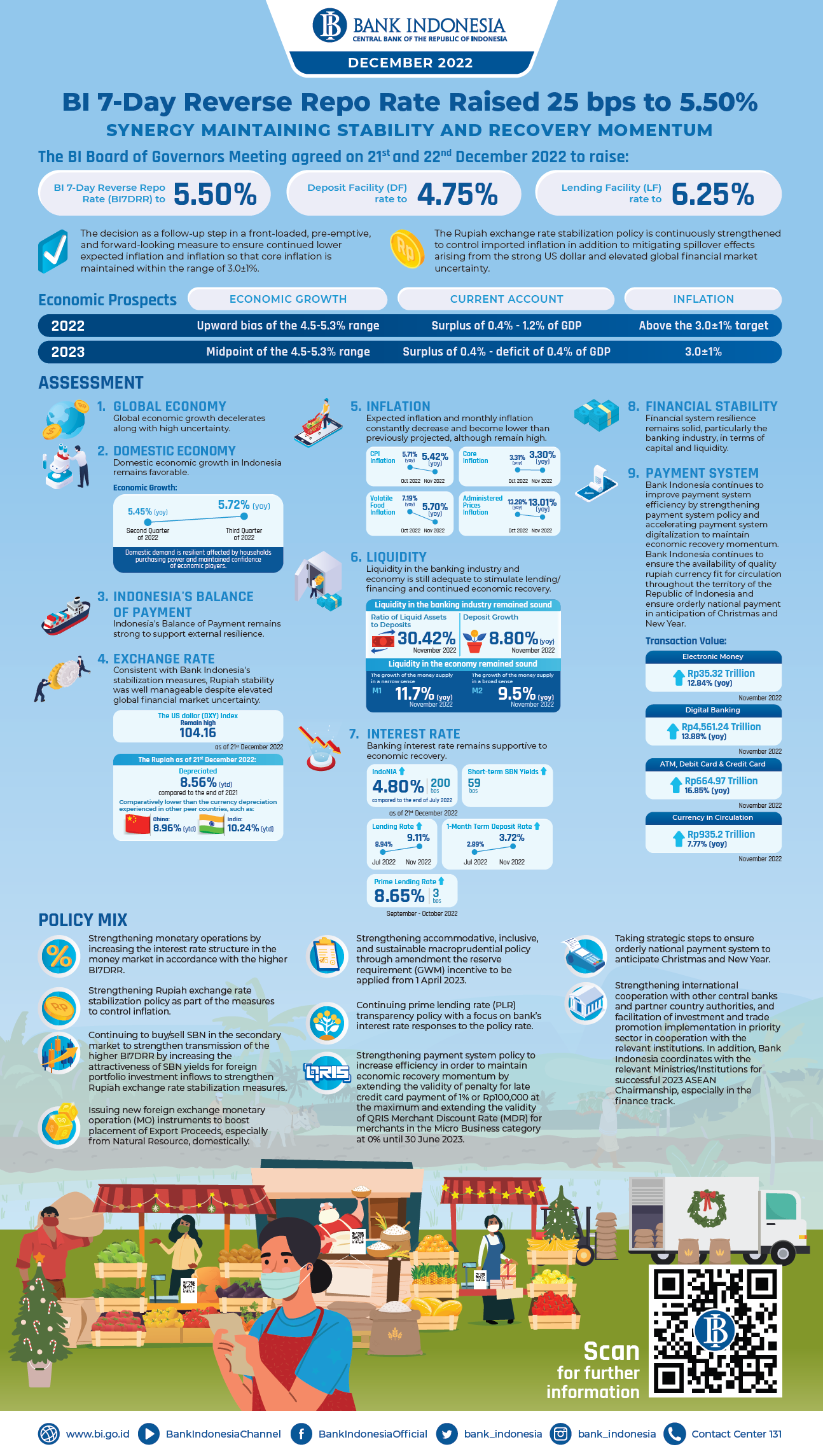

The BI Board of Governors Meeting agreed on 21st and 22nd December 2022 to raise the BI 7-Day Reverse Repo Rate (BI7DRR) by 25 bps to 5.50%, while also raising the Deposit Facility (DF) and Lending Facility (LF) rates by 25 bps to 4.75% and 6.25%, respectively. The more calculated decision on policy rate increase is a follow-up step to ensure continued lower expected inflation and inflation in a front-loaded, pre-emptive, and forward-looking measure to maintain core inflation within the range of 3.0±1%. The Rupiah exchange rate stabilization policy is continuously strengthened to control imported inflation in addition to mitigating spillover effects arising from the strong US dollar and high global financial market uncertainty.

Confirming the direction of Bank Indonesia's policy mix in 2023 as conveyed in the Annual Meeting of Bank Indonesia (PTBI) 2022 on 30 November 2022, monetary policy in 2023 will remain pro-stability while macroprudential policy, payment system digitalization, money market deepening, and inclusive and green economic-financial program are constantly directed towards pro-growth.

In connection therewith, Bank Indonesia consistently strengthens its policy mix response to maintain stability and economic recovery momentum:

- Strengthening monetary operations by increasing the interest rate structure in the money market in accordance with the higher BI7DRR mentioned above;

- Strengthening Rupiah exchange rate stabilization policy as part of the measures to control inflation, primarily imported inflation, through foreign exchange intervention, including spot and Domestic Non-Deliverable Forward (DNDF) transactions, as well as buying/selling Sovereign Securities (SBN) in secondary market;

- Continuing to buy/sell SBN in the secondary market to strengthen transmission of the higher BI7DRR by increasing the attractiveness of SBN yields for foreign portfolio investment inflows to strengthen Rupiah exchange rate stabilization measures.

- Issuing new foreign exchange monetary operation (MO) instruments to boost placement of Export Proceeds, especially from Natural Resource, domestically by banks and exporters to strengthen stabilization, including Rupiah exchange rate stability and national economic recovery. The foreign exchange MO instruments are applied with competitive yields based on a transparent market mechanism and incentives given to banks;

- Strengthening accommodative, inclusive, and sustainable macroprudential policy to boost the growth of credit/financing by banks, primarily non-recovering priority sectors, People's Business Credit (KUR), and green credit/financing, to support economic recovery through amendment the reserve requirement (GWM) incentive to be applied from 1 April 2023, including: (Appendix 1)

- Reclassification of 46 priority sub-sectors in 3 (three) business sector groups, namely resilience group, growth driver group, and slow starter group, according to the latest condition by maintaining credit/financing growth threshold that gets an incentive for slow starters at a minimum of 1%, and increasing threshold for resilience and growth driver groups from initially at least 1% to at least 5% and 3%, respectively.

- Two-fold increase in GWM incentive amount to banks extending People's Business Credit and MSMEs credit becomes 1% at the maximum accompanied by addition of bank groups based on achievement of Macroprudential Inclusive Financing Ratio (MIFR), namely 30% - 50% and above 50%.

- Incentive for green credit/financing in property and/or green automotive is 0.3% at the maximum.

- Total GWM incentive which may be received by banks changes from previously 200bps at the maximum to 280bps at the maximum.

Continuing prime lending rate (PLR) transparency policy with a focus on bank's interest rate responses to the policy rate (Appendix 2);

Strengthening payment system policy to increase efficiency in order to maintain economic recovery momentum by:

Continuing credit card policy by:

Maintaining the maximum limit of credit card interest rate at 1.75% per month.

Extending the validity of minimum payment by a credit card holder of 5% of the total billing amount from 31 December 2022 to 30 June 2023.

Extending the validity of penalty for late credit card payment of 1% or Rp100,000 at the maximum from 31 December 2022 to 30 June 2023.

Extending the validity of QRIS Merchant Discount Rate (MDR) for merchants in the Micro Business category at 0% from 31 December 2022 to 30 June 2023.

Continuing validity of National Clearing System (SKNBI) tariff of Rp1 from Bank Indonesia to banks and maximum of Rp2,900 from banks to customers from 31 December 2022 to 31 June 2023.

Taking strategic steps to ensure orderly national payment system to anticipate Christmas and New Year by:

- Ensuring the availability of quality rupiah currency fit for circulation throughout the territory of the Republic of Indonesia

- Maintaining continuity of payment system operation by Bank Indonesia and payment system industry.

Strengthening international cooperation with other central banks and partner country authorities, and facilitation of investment and trade promotion implementation in priority sector in cooperation with the relevant institutions. In addition, Bank Indonesia coordinates with the relevant Ministries/Institutions for successful 2023 ASEAN Chairmanship, especially through financial track.

Policy coordination with the Central Government, Regional Government, and strategic partners is consistently strengthened. In this regard, coordination with Central and Regional Inflation Control Team (TPIP and TPID) is continued through strengthening of National Movement for Food Inflation Control (GNPIP) in various regions. Policy synergy between Bank Indonesia and the Government, as well as with the Financial System Stability Committee, is also being strengthened to maintain macroeconomic and financial system stability, while reviving credit/financing to businesses in priority sectors to support economic growth and export, while increasing green economic and financial inclusion.

Global economic growth decelerates along with high uncertainty. Global economic growth in 2023 will remain slow as predicted at a high recession risk in several countries, including the United States of America (US) and Europe. The global economic slowdown is influenced by economic, trade, and investment fragmentation due to continued political tension and impacts of aggressive monetary policy tightening in developed countries. Bank Indonesia predicts that global economy will grow by 3.0% in 2022 and decrease by 2.6% in 2023. Meanwhile, inflation pressure remains high despite its slight decline, affected by continued supply chain disruption and tight labor market, mainly in the US and Europe. High inflation results in a constantly tight global monetary policy. The Fed is expected to increase Fed Funds Rate until the beginning of 2023 with a long monetary policy tightening cycle, albeit with a lower FFR. Such condition makes US dollar remain strong and results in high global financial market uncertainty, which then affects weak inflow to developing countries, including Indonesia.

Domestic economic growth in Indonesia remains favorable. Domestic demand is resilient affected by households purchasing power and maintained confidence of economic players. This condition is reflected in various indicators in November 2022 and the last survey result of Bank Indonesia, such as consumer confidence, retail sales, and Manufacture Purchasing Managers' Index (PMI). Meanwhile, export performance is predicted to remain strong, especially boosted by exports of coal, CPO, iron and steel, and service, in line with demands of several strong main trade partners and impacts of positive policies taken by the Government. Spatially, export positive performance is mainly supported by Kalimantan, Sumatera, and Sulawesi-Maluku-Papua (Sulampua), which remains to grow strong. The favorable economic growth is in line with the development of business field where Retail and Wholesale Trade, Processing Industry, and Transportation and Warehouse, grows relatively strong. With such development, economic growth in 2022 is predicted to remain biased above the range of Bank Indonesia's projection at 4.5-5.3%. In 2023, economic growth is predicted to remain strong although it slightly slows down in line with the global economic slowdown to the mean of the range of 4.5-5.3%.

Indonesia's Balance of Payment remains strong to support external resilience. Current account transactions in the fourth quarter of 2022 are predicted to record a surplus in line with the positive performance of trade balance. Trade balance in November 2022 records a surplus of 5.2 billion US dollars, supported by the performance of main commodity exports. Foreign capital inflows in portfolio investments slowly begin to occur November-December 2022, although on a quarterly basis until 20 December 2022 there were still recorded net outflows of 0.4 billion US dollars. Reserve assets of Indonesia as of the end of November 2022 increase compared to the previous month, and are recorded 134.0 billion US dollars, equivalent to 5.9 months of import or 5.8 months of import and the Government's external debt payment, and above the international adequacy standard of around 3 months of import. Overall in 2022, Indonesia's Balance of Payment is predicted to remain maintained as supported by current account surplus in the range of 0.4 – 1.2% of GDP, and favorable performance of capital and financial account, mainly in the form of Foreign Direct Investment. In the midst of high global financial market uncertainty, the performance of Indonesia's Balance of Payment 2023 is also predicted to remain favorable, as supported by a surplus of capital and financial account and solid current account transactions within the range of 0.4% surplus until 0.4% deficit from GDP.

Consistent with Bank Indonesia's stabilisation measures, rupiah stability was well manageable despite elevated global financial market uncertainty. Pressure on Rupiah exchange rate in November-December 2022 decreases, influenced by foreign capital inflows in SBN market and stabilization measures taken by Bank Indonesia. Rupiah performance is relatively positive in the middle of strong US dollar and high global financial market uncertainty. US dollar index (DXY) is recorded high at the level of 104.16 on 21 December 2022. With such development, Rupiah exchange rate until 21 December 2022 is depreciated by 8.56% (ytd) compared to the level at the end of 2021. The depreciation of Rupiah exchange rate is comparatively lower than the depreciation of currencies in some other countries in the region, such as China 8.96% (ytd) and India 10.24% (ytd). Moving forward, Bank Indonesia will continue to strengthen rupiah stabilization policy in line with market mechanisms and the currency's fundamental value in order to support measures to manage inflation and maintain macroeconomic stability.

Expected inflation and monthly inflation constantly decrease and become lower than previously projected, although remain high. CPI inflation in November 2022 is recorded lower than the projection and the previous month's inflation, although it remains high at 5.42% (yoy) and above the target of 3.0±1%. Volatile food (VF) inflation decreased to 5.70% (yoy) both nationwide and in most of areas in Indonesia, as supported by strong policy synergy and coordination between Governments (Central and Regional), Bank Indonesia, and strategic partners through TPID and GNPIP. Administered prices (AP) inflation is also recorded to decrease to 13.01% (yoy) in line with the decreasing airfare and non-subsidized oil fuel price. Meanwhile, core inflation decreases to 3.30% (yoy), affected by continued impact of limited adjustment to oil fuel price on core inflation and inflation pressure from weak demand. Moving forward, Bank Indonesia will continuously strengthen policy responses to ensure continued decrease in expected inflation and CPI inflation so that core inflation remains within the range of 3.0±1%.

Liquidity in the banking industry and economy is still adequate to boost credit/financing and continued economic recovery. In November 2022, ratio of Liquid Assets to Third Party Fund remains high, standing at 30.42%, so that it supports availability of funds for banks to extend credit/financing for businesses. It is in line with the stance of accommodating liquidity policy by Bank Indonesia. Economic liquidity is also in line with economic activities, as reflected from circulation of narrow money (M1) and broad money (M2) which grows by 11.7% (yoy) and 9.5% (yoy), respectively. Meanwhile, implementing the Joint Decree between Bank Indonesia and Ministry of Finance, Bank Indonesia continues to purchase SBN in the primary market to fund the national economic recovery and finance the health and humanitarian aspects of the Covid-19 pandemic. Overall, in 2022, until 21 December 2022, Bank Indonesia has purchased SBN of Rp144.53 trillion, consisting of implementation of Joint Decree (JD) I of Rp49.11 trillion and JD III of Rp95.42 trillion. According to JD III, Bank Indonesia will also remain purchasing SBN in the primary market of Rp128.58 trillion for health and humanitarian budget funding in 2022 State Budget.

Banking interest rate remains supportive to economic recovery. In money market, IndONIA rate on 21 December 2022 increases by 200 bps compared to the end of July 2022 to 4.80%, in line with BI7DRR increase and strengthening of monetary operation strategy of Bank Indonesia. The yield of short-term tenor SBN increases by 59 bps, while the yield of long-term tenor remains controlled. Meanwhile, increase in bank rate, both deposit rate and lending rate, is more limited. One-month term-deposit rate in November 2022 stands at 3.72% or increasing by 83 bps compared to the level in July 2022, while credit rate in November 2022 stands at 9.11% or increasing by 17 bps compared to the level in July 2022. The limited increase in bank rate is affected by loose liquidity. Going forward, Bank Indonesia will continuously boost banks to form efficient, accommodating, and competitive credit rates supportive of economic recovery.

Banking intermediation function continues to improve, boosted by increase in demand and supply. Credit growth in November 2022 stands at 11.16% (yoy), supported by positive growth in all loan types and majority economic sector. Intermediation in the sharia banking industry also continues to recover, with growth recorded at 23.5% (yoy). In MSME segment, MSME credit growth in November 2022 is recorded relatively high at 18.13% (yoy). On the supply side, a stronger intermediation function was supported by adequate bank liquidity and lending standards that remain loose in the banking industry. Meanwhile, on the demand side, credit/financing increase is supported by favorable corporate demand and household consumption. Overall, the positive development of bank intermediation supports economic recovery as well.

Financial system resilience remains solid, particularly the banking industry, in terms of capital and liquidity. The Capital Adequacy Ratio (CAR) in the banking industry remained in October 2022 at 25.08%. In line with the strong capital, risks remain controlled as reflected from (Non-Performing Loan /NPL) ratio in October 2022 recorded at 2.72% (gross) and 0.78% (net). Liquidity in the banking industry was maintained in November 2022, supported by 8,80% (yoy) growth of Third Party Fund (TPF). Bank Indonesia simulations confirmed that bank resilience is sustained. Going forward, Bank Indonesia will constantly strengthen synergy with KSSK to mitigate different domestic and global macroeconomic risks which may disrupt financial system resilience.

Bank Indonesia continues to improve payment system efficiency by strengthening payment system policy and accelerating payment system digitalization to maintain economic recovery momentum. Digital economic and financial transactions continue to increase in line with greater public acceptance and growing public preference towards online retail as well as the expansion and convenience of the digital payment system and the acceleration of digital banking. The value of electronic money transactions grew 12.84% (yoy) in November 2022 to reach Rp35.3 trillion, while the value of digital banking transaction increased 13.88% (yoy) to reach Rp4,561.2 trillion as public mobility continues to normalize. Meanwhile, the value transaction using ATM cards, debit cards and credit cards increased 16.85% (yoy) to reach Rp664.9 trillion in the reporting period. In terms of cash, currency in circulation increased 7.77% (yoy) to reach Rp935.2 trillion in November 2022. Bank Indonesia continues to ensure the availability of quality rupiah currency fit for circulation throughout the territory of the Republic of Indonesia and ensures orderly national payment in anticipation of Christmas and New Year.

Jakarta, 22 December 2022

Head of Communication Department

Erwin Haryono

Executive Director

Information on Bank Indonesia

Tel. 021-131, Email: bicara@bi.go.id

![Infographic_Technical_December_2022.png]()