No. 27/36/DKom

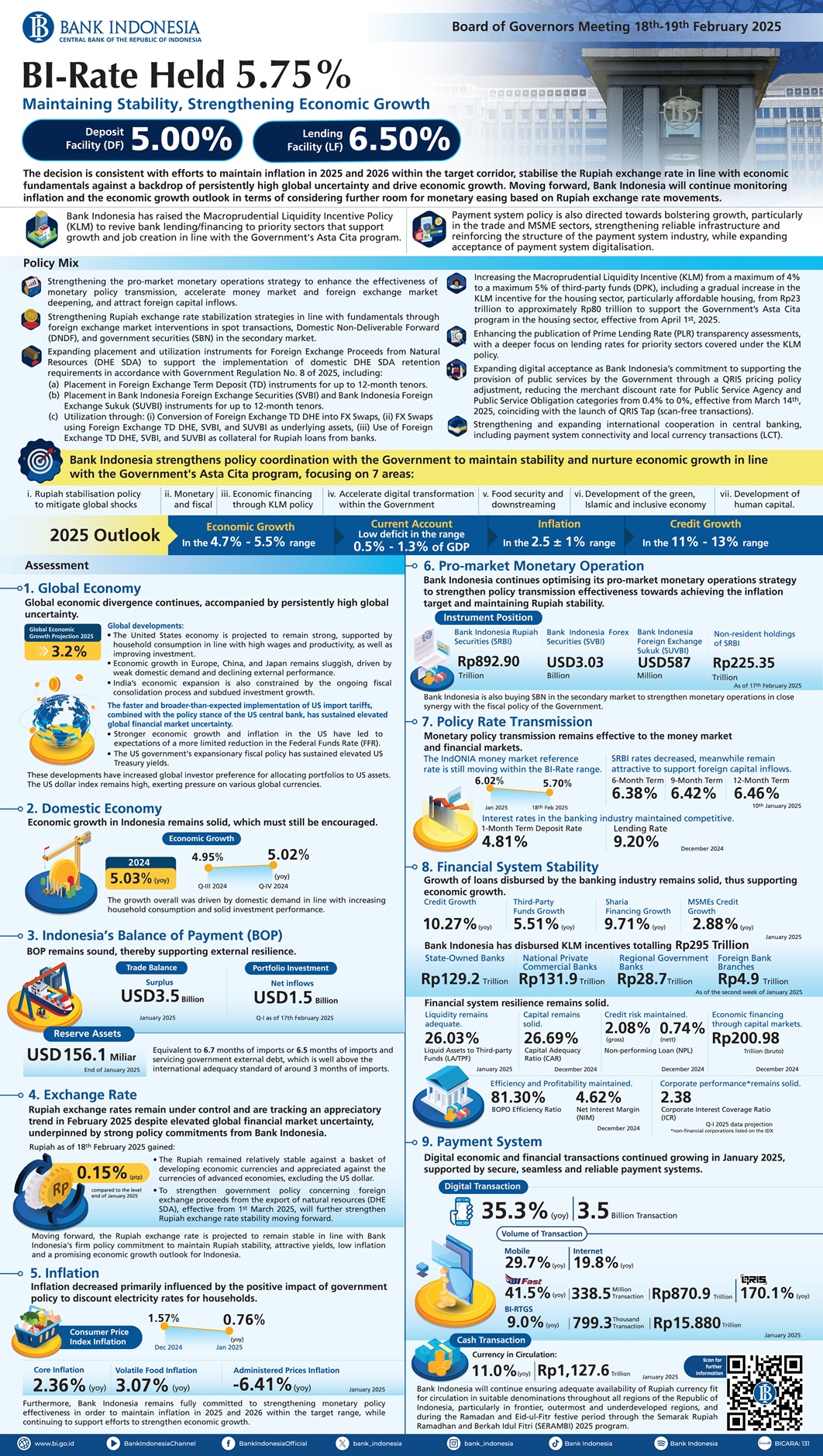

The Bank Indonesia Board of Governors agreed on 18-19th February 2025 to hold the BI-Rate at 5.75%, while also maintaining the Deposit Facility (DF) rate and Lending Facility (LF) rate at 5.00% and 6.50%, respectively. The decision is consistent with efforts to maintain inflation in 2025 and 2026 within the 2.5±1% target corridor, stabilise the rupiah exchange rate in line with economic fundamentals against a backdrop of persistently high global uncertainty and drive economic growth. Moving forward, Bank Indonesia will continue monitoring inflation and the economic growth outlook in terms of considering further room for monetary easing based on Rupiah exchange rate movements. Meanwhile, Bank Indonesia is maintaining pro-growth macroprudential and payment system policies to foster sustainable economic growth. Bank Indonesia has raised the Macroprudential Liquidity Incentive Policy (KLM) to revive bank lending/financing to priority sectors that support growth and job creation in line with the Government's Asta Cita program. Payment system policy is also directed towards bolstering growth, particularly in the trade and MSME sectors, strengthening reliable infrastructure and reinforcing the structure of the payment system industry, while expanding acceptance of payment system digitalisation.

Bank Indonesia has, therefore, strengthened its monetary, macroprudential and payment system policy mix to maintain stability and support sustainable economic growth through the following measures:

- Strengthening the pro-market monetary operations strategy to enhance monetary policy effectiveness, accelerate money market and foreign exchange market deepening and attract foreign capital inflows by:

-

optimising Bank Indonesia Rupiah Securities (SRBI), Bank Indonesia Foreign Exchange Securities (SVBI) and Bank Indonesia Foreign Exchange Sukuk (SUVBI) as pro-market monetary instruments,

-

strengthening the interest rate structure of monetary instruments to attract portfolio inflows to domestic financial assets,

-

strengthening strategies to maintain competitive term-repo and forex swap transactions, and

-

strengthening the function of Primary Dealers (PD) to increase SRBI transactions in the secondary market and repurchase agreement (repo) transactions between market players.

- Stabilising the Rupiah through foreign exchange market intervention with a focus on spot and Domestic Non-Deliverable Forward (DNDF) transactions, as well as government securities (SBN) in the secondary market.

- Expanding the instruments available to retain and utilise foreign exchange proceeds from the export of natural resources, thereby supporting implementation of policies that require proceeds to be retained domestically in accordance with Government Regulation No. 8 of 2025, including:

- placements in term deposits for foreign exchange proceeds of exports with tenors up to 12 months,

- placements in SVBI and SUVBI instruments with tenors up to 12 months,

- Utilisation through: i) conversion of term deposits for forex proceeds of exports (TD forex DHE) into FX swaps, ii) FX swaps using the TD forex DHE, SVBI, and SUVBI as an underlying, and iii) the option to utilize the TD forex DHE, SVBI, and SUVBI as collateral for Rupiah loans disbursed by the banking industry.

- Raising the maximum Macroprudential Liquidity Incentive (KLM) from 4% to 5% of third-party funds, including the KLM incentive for the housing sector, including affordable housing, incrementally from Rp23 trillion to approximately Rp80 trillion to support the Government's Asta Cita program in the housing sector, effective from 1st April 2025.

- Strengthening prime lending rate (PLR) transparency policy with a focus on interest rates by KLM policy priority sectors (Appendix).

- Expanding digital acceptance as a firm commitment of Bank Indonesia to support the provision of public services by the Government through QRIS pricing policy for merchants in the form of public services agencies (BLU) and public service obligations (PSO) from 0.4% to 0%, effective from 14th March 2025, to coincide with the launch of QRIS Tap.

- Strengthening and expanding international cooperation among central banks, including payment system connectivity and local currency transactions (LCT).

Bank Indonesia is also strengthening policy coordination with the Government to maintain stability and nurture economic growth in line with the Government's Asta Cita program. Coordination is focused on 7 (seven) policy areas, namely: (i) rupiah stabilisation policy to mitigate global shocks, (ii) monetary and fiscal policy coordination, (iii) efforts to revive economic financing through KLM policy, (iv) support to accelerate digital transformation within the Government, (v) efforts to strengthen food security and downstreaming, (vi) support to foster development of the green, Islamic and inclusive economy, and (vii) support for the development of human capital. In addition, Bank Indonesia will continue strengthening policy synergy with the Financial System Stability Committee (KSSK) to maintain the stability of the financial system.

Global economic divergence continues, accompanied by persistently high global uncertainty. Economic growth in the United States (US) is forecast to remain solid on the back of household consumption in line with high wages and productivity, coupled with improving investment. Meanwhile, the economies of Europe, China and Japan remain sluggish given soft domestic demand and declining external performance in response to global economic moderation and the impact of import tariffs introduced by the US. Economic expansion in India has been restrained by the fiscal consolidation process and subdued investment performance. Consequently, the global economic growth outlook for 2025 is projected at 3.2%. On the other hand, high global financial market uncertainty persists due to the immediate and broad-based implementation of US import tariffs and the policy stance of the US Federal Reserve. High economic growth and inflation in the United States have strengthened expectations of limited FFR reductions moving forward. Expansionary fiscal policy in the US is sustaining high US Treasury yields, despite retreating slightly on increasing global investor demand for UST. Such developments have triggered a rebalancing among global investors, with portfolio allocations returning to the US. In addition, a high US dollar index is intensifying pressures on various global currencies. Persistently high global uncertainty demands a strong policy response, therefore, to mitigate the adverse impact of global spillovers, maintain stability and drive domestic economic growth.

Economic growth in Indonesia remains solid, which must still be encouraged. Fourth-quarter economic growth in 2024 was recorded at 5.02% (yoy), accelerating from 4.95% (yoy) in the third quarter of 2024, thus bringing growth overall in 2024 to 5.03% (yoy). Domestic demand was the main driver of growth in line with increasing household consumption and solid investment performance. By sector, as major contributors to growth, the manufacturing industry and trade are performing well in line with maintained domestic demand. Spatially, strong growth was recorded in the Sulawesi-Maluku-Papua (Sulampua) region. Moving forward, Bank Indonesia forecasts domestic economic growth in 2025 in the 4.7-5.5% (yoy) range, underpinned by increasing investment, particularly non-building investment. Meanwhile, efforts are required to boost household consumption, thereby bolstering domestic demand. Externally, various efforts to strengthen exports must be increased to mitigate the impact of weaker demand in Indonesia's major trading partner countries. To that end, Bank Indonesia will continue optimising its policy mix to maintain stability and support sustainable economic growth. This will be realised by optimising macroprudential policy stimuli and accelerating payment system digitalisation by Bank Indonesia in synergy with the fiscal policy stimuli of the Government to revive economic growth. Furthermore, Bank Indonesia fully supports implementation of the Government's Asta Cita program, encompassing economic financing, digitalisation as well as food security and downstreaming.

Indonesia's Balance of Payments (BOP) remains sound, thereby supporting external resilience. A BOP surplus is projected in 2024 given the manageable current account deficit and maintained capital and financial account surplus. The trade surplus persisted in January 2025, increasing to USD3.5 billion. This was supported, among others, by exports of several key commodities, including precious metals and jewellery/gems, chemical products as well as rubber and rubber products. Despite high global financial market uncertainty, portfolio inflows in the middle of the first quarter of 2025 (17th February 2025) recorded a net inflow totalling USD1.5 billion, boosted by foreign capital inflows to government securities (SBN) that recorded a net inflow of USD0.5 billion. The position of foreign reserves at the end of January 2025 was recorded high at USD156.1 billion, equivalent to 6.7 months of imports or 6.5 months of imports and servicing government external debt, which is well above the international adequacy standard of around 3 months of imports. In 2025, BOP performance will be supported by a manageable current account deficit in the 0.5-1.3% of GDP range, accompanied by a maintained capital and financial account surplus. The capital and financial account surplus is supported by positive investor perception of the domestic economic outlook and attractive yields on investment.

Rupiah exchange rates remain under control and are tracking an appreciatory trend in February 2025 despite elevated global financial market uncertainty, underpinned by strong policy commitments from Bank Indonesia. Against the US dollar, the Rupiah in February 2025 (as of 18th February 2025) gained 0.15% (ptp) in value from the level recorded at the end of January 2025. This is consistent with Bank Indonesia's stabilisation policy and supported by maintained foreign capital inflows, attractive yields on domestic financial instruments for investment and the promising economic growth outlook for Indonesia. The Rupiah, therefore, has depreciated by just 1.06% (yoy) against the US dollar from the level recorded at the end of December 2024. Notwithstanding, the rupiah remained relatively stable against a basket of DE currencies and appreciated against the currencies of advanced economies (AE), excluding the US dollar. Moving forward, the Rupiah exchange rate is projected to remain stable in line with Bank Indonesia's firm policy commitment to maintain Rupiah exchange rate stability, together with attractive yields, low inflation and a promising economic growth outlook for Indonesia. Furthermore, Bank Indonesia continues optimising the full panoply of monetary instruments available, which includes strengthening its pro-market monetary operations strategy through the SRBI, SVBI and SUVBI instruments to boost policy effectiveness in terms of attracting portfolio inflows and supporting efforts to strengthen the Rupiah exchange rate. The latest measures taken to strengthen government policy concerning foreign exchange proceeds from the export of natural resources (DHE SDA), effective from 1st March 2025, will further strengthen Rupiah exchange rate stability moving forward.

Consumer Price Index (CPI) inflation decreased in January 2025. CPI inflation in January 2025 was recorded at 0.76% (yoy), down from 1.57% (yoy) one month earlier. Lower headline inflation was primarily influenced by the positive impact of government policy to discount electricity rates for households with an installed electrical capacity of ≤2,200VA. Consequently, administered prices (AP) recorded 6.41% (yoy) deflation. On the other hand, core inflation remained under control at a rate of 2.36% (yoy) in line with BI-Rate policy consistency by Bank Indonesia to anchor inflation expectations. Volatile food (VF) inflation also remained under control at 3.07% (yoy), supported by close synergy to manage inflation between Bank Indonesia and the Central and Regional Government Inflation Control Teams (TPIP and TPID) through the National Movement for Food Inflation Control (GNPIP) in various regions. Looking ahead, Bank Indonesia is confident CPI inflation will remain under control and within the 2.5%±1% target corridor. Core inflation is projected to remain manageable in line with anchored inflation expectations, massive economic capacity in response to domestic demand, managed imported inflation in line with Rupiah stabilisation policy by Bank Indonesia, as well as the positive impact of digitalisation. Bank Indonesia also expects volatile food (VF) inflation to remain manageable, underpinned by inflation control synergy between Bank Indonesia and the (central and regional) Government. Furthermore, Bank Indonesia remains fully committed to strengthening monetary policy effectiveness in order to maintain inflation in 2025 and 2026 within the 2.5±1 % target range, while continuing to support efforts to strengthen economic growth.

Bank Indonesia continues optimising its pro-market monetary operations strategy to strengthen policy transmission effectiveness towards achieving the inflation target and maintaining rupiah stability. This policy also aims to accelerate money market and foreign exchange market deepening efforts and attract foreign capital inflows. As of 17th February 2025, the respective positions of SRBI, SVBI and SUVBI instruments stood at Rp892.90 trillion, USD3.03 billion and USD587 million. SRBI issuances have attracted portfolio inflows to Indonesia and strengthened the Rupiah, as reflected by significant non-resident holdings of SRBI totalling Rp225.35 trillion as of 17th February 2025 (25.24% of total outstanding). The implementation of Primary Dealers (PD) since May 2024 has also increased SRBI transactions in the secondary market along with repurchase agreement (repo) transactions between market players, thereby strengthening the effectiveness of monetary instruments that support Rupiah stability and inflation control. In addition, Bank Indonesia is also buying SBN in the secondary market to strengthen monetary operations in close synergy with the fiscal policy of the Government. In 2025 (as of 17th February 2025), Bank Indonesia has purchased SBN to the tune of Rp32.46 trillion, namely through the secondary market totalling Rp19.46 trillion and the primary market totalling Rp12.99 trillion. Moving forward, Bank Indonesia will continue optimising its pro-market monetary operations strategy to enhance the effectiveness of monetary policy transmission, accelerate money market and foreign exchange market deepening and attract foreign capital inflows in close coordination with fiscal policy.

Monetary policy transmission remains effective to the money market and financial markets. In line with the BI-Rate reduction implemented in January 2025, the IndONIA money market reference rate also trended downwards, namely to 5.70% on 18th February 2025 from 6.02% at the beginning of January 2025. Despite decreasing, SRBI rates remain attractive to support foreign capital inflows at 6.38%, 6.42% and 6.46% for tenors of 6, 9 and 12 months (as of 14th February 2025), down from 7.16%, 7.20% and 7.27% at the beginning of January 2025. On the other hand, SBN yields on tenors of 2 and 10 years also remained competitive despite decreasing from 6.96% and 6.98% at the beginning of January 2025 to 6.44% and 6.76% (as of 18th February 2025). Ample liquidity has been maintained in the banking industry given the implementation of KLM strengthening efforts, supported by better pricing efficiency in the banking industry due to PLR transparency policy, thus maintaining competitive interest rates in the banking industry. The 1-month term deposit rate and lending rate were also relatively stable in January 2025 at 4.81% and 9.20%, respectively.

Growth of loans disbursed by the banking industry remains solid, thus supporting economic growth. Credit growth reached 10.27% (yoy) in January 2025, supported by both the supply and demand sides. On the supply side, credit growth is supported by the current bank strategy to reallocate liquid assets to credit growth, massive funding support from third party funds growth as well as ample liquidity due to the positive impact of Bank Indonesia strengthening KLM policy. On the demand side, loan growth is supported by robust corporate performance, as household consumption remains limited. By loan type, credit growth is primarily supported by working capital loans, investment loans and consumer loans, growing 8.40% (yoy), 13.22% (yoy) and 10.37% (yoy), respectively. Furthermore, sharia financing recorded 9.71% (yoy) growth, while MSME loan growth stood at 2.88% (yoy) in the reporting period. Bank Indonesia will continue providing credit growth through various accommodative macroprudential policies in pursuit of economic growth.

Bank Indonesia continues strengthening the effectiveness of KLM implementation. Commencing on 1st January 2025, KLM incentives were oriented towards reviving bank lending to support growth and job creation. KLM incentives are disbursed to sectors that support growth and job creation, including agriculture, trade and manufacturing, transportation, storage and tourism and the creative economy, construction, real estate, and public housing, as well as MSMEs, ultra microfinance and green finance. As of the second week of February 2025, Bank Indonesia has disbursed KLM incentives totalling Rp295 trillion, up Rp36 trillion from Rp259 trillion at the end of October 2024. Thus far, KLM incentives have been distributed to state-owned banks totalling Rp129.2 trillion, national private commercial banks totalling Rp131.9 trillion, regional government banks totalling Rp28.7 trillion, and foreign bank branches totalling Rp4.9 trillion. Bank Indonesia will continue strengthening coordination with the Government to support the success of programs under the umbrella of Asta Cita by raising the KLM incentives to revive bank lending/financing to priority sectors, including housing and agriculture.

Financial system resilience remains solid. Bank liquidity remained adequate in January 2025, as reflected by a high ratio of liquid assets to third-party funds (LA/TPF) at 26.03%. The Capital Adequacy Ratio (CAR) also remained high in December 2024 at 26.69%, supported by low non-performing loans (NPL), as a proxy of credit risk, as indicated by NPL ratios of 2.08% (gross) and 0.74% (nett). The latest BI stress tests indicate solid banking industry resilience against various risks, supported by maintained corporate repayment capacity and profitability. In addition, Bank Indonesia will continue strengthening policy synergy with the KSSK Committee to mitigate various risks that could potentially disrupt financial system stability.

Digital economic and financial transactions continued growing in January 2025, supported by secure, seamless and reliable payment systems. Digital payments[1] grew 35.3% (yoy) to reach 3.5 billion transactions, supported by all components. Transaction volume through mobile banking applications grew 29.7% (yoy), with the volume of transactions via internet banking similarly growing by 19.8% (yoy) in January 2025. In addition, digital payment transaction volume through QRIS continue to enjoy impressive 170.1% (yoy) growth, supported by increasing numbers of users and merchants. From an infrastructure perspective, the volume of retail transactions processed through BI-FAST grew 41.5 % (yoy) to reach 338.5 million transactions, with a value of Rp 870.9 trillion in January 2025. On the wholesale or high-value side, the BI-RTGS system processed 799.3 thousand transactions, down 9.0% (yoy), with a transaction value of Rp15,880 trillion in January 2025. In terms of Rupiah currency management, total currency in circulation grew 11.0 % (yoy) to Rp1,127.6 trillion in January 2025.

Payment system stability has been maintained, supported by stable infrastructure and a sound industry structure. In terms of the infrastructure, payment system stability is reflected in the seamless and reliable payment system maintained by Bank Indonesia, along with an adequate money supply of currency fit for circulation in January 2025. Regarding the structure of the payments industry, payment system interconnection and the digital economy and finance ecosystem continue to expand. Payment transactions based on the National Open API Payment Standard (SNAP) continue to grow as SNAP adoption among various industry players expands. Meanwhile, Bank Indonesia will continue ensuring adequate availability of Rupiah currency fit for circulation in suitable denominations throughout all regions of the Republic of Indonesia, particularly in frontier, outermost and underdeveloped (3T) regions, and during the Ramadan and Eid-ul-Fitr festive period through the Semarak Rupiah Ramadhan and Berkah Idul Fitri (SERAMBI) 2025 program.

Jakarta, 19th February 2025

Communication Department

Ramdan Denny Prakoso

Executive Director

[1] Digital payments include transactions through mobile applications and the internet.