No. 25/317/DKom

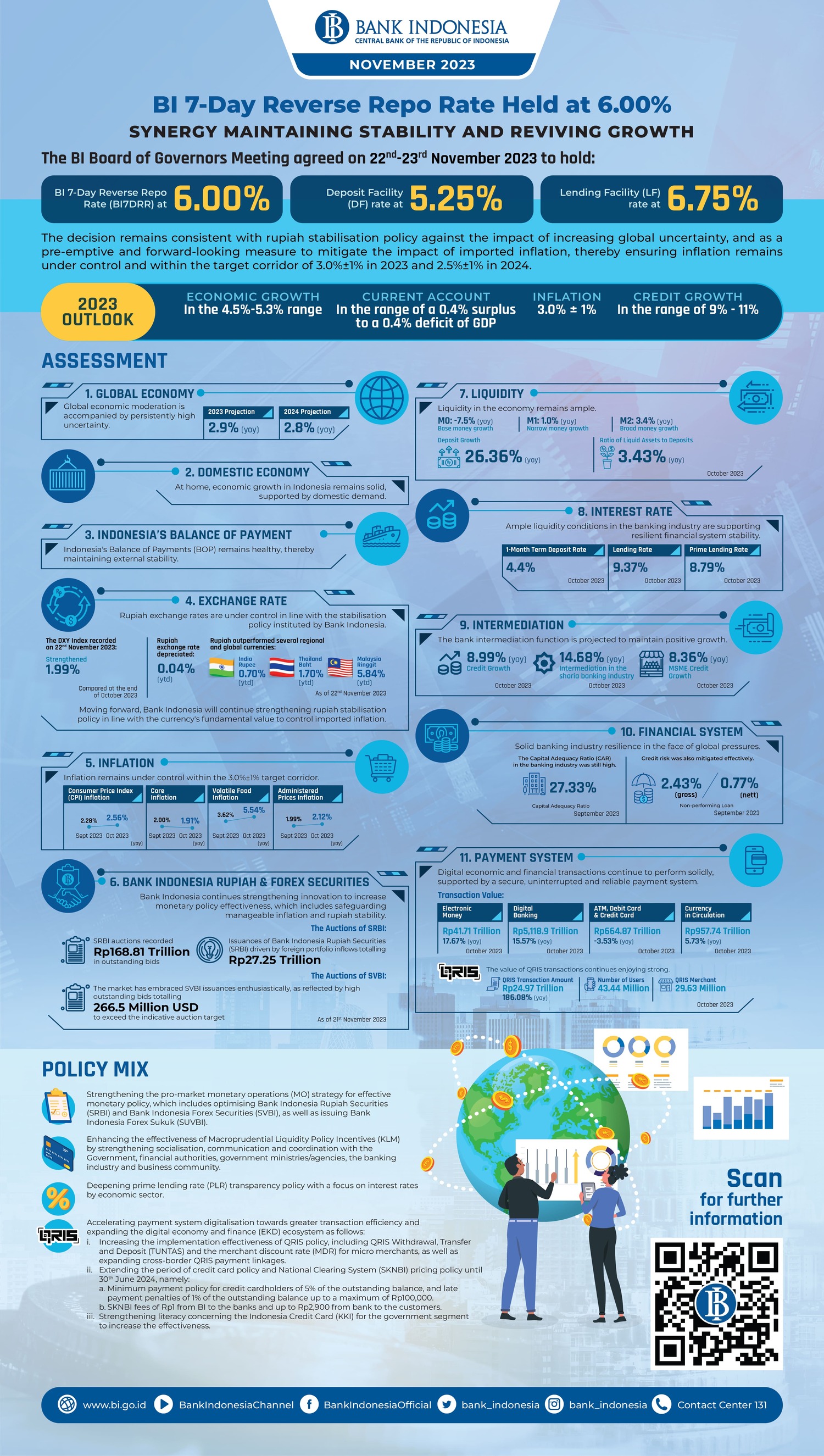

The BI Board of Governors Meeting agreed on 22-23rd November 2023 to hold the BI 7-Day Reverse Repo Rate (BI7DRR) at 6.00%, while also maintaining the Deposit Facility (DF) rate and Lending Facility (LF) rate at 5.25% and 6.75% respectively. The decision remains consistent with rupiah stabilisation policy against the impact of increasing global uncertainty, and as a pre-emptive and forward-looking measure to mitigate the impact of imported inflation, thereby ensuring inflation remains under control and within the target corridor of 3.0%±1% in 2023 and 2.5%±1% in 2024. Meanwhile, supporting sustainable economic growth, the accommodative macroprudential policy stance has been maintained by strengthening implementation of Macroprudential Liquidity Policy Incentives (KLM) and by lowering the Macroprudential Liquidity Buffer (MPLB) to revive lending/financing to businesses. Payment system digitalisation has also been accelerated to expand digital economic and financial inclusion, including the electronification of central and regional government transactions.

Bank Indonesia has, therefore, strengthened its mix of monetary, macroprudential and payment system policies to maintain stability and foster sustainable growth through the following measures:

- Rupiah stabilisation through foreign exchange market intervention with a focus on spot and Domestic Non-Deliverable Forward (DNDF) transactions, as well as buying government securities (SBN) in the secondary market.

- Strengthening the pro-market monetary operations (MO) strategy for effective monetary policy, which includes optimising Bank Indonesia Rupiah Securities (SRBI) and Bank Indonesia Forex Securities (SVBI), as well as issuing Bank Indonesia Forex Sukuk (SUVBI).

- Enhancing the effectiveness of Macroprudential Liquidity Policy Incentives (KLM) by strengthening socialisation, communication and coordination with the Government, financial authorities, government ministries/agencies, the banking industry and business community.

- Deepening prime lending rate (PLR) transparency policy with a focus on interest rates by economic sector (Appendix).

- Accelerating payment system digitalisation towards greater transaction efficiency and expanding the digital economy and finance (EKD) ecosystem as follows:

- Increasing the implementation effectiveness of QRIS policy, including QRIS Withdrawal, Transfer and Deposit (TUNTAS) and the merchant discount rate (MDR) for micro merchants, as well as expanding cross-border QRIS payment linkages,

- Extending the period of credit card policy and National Clearing System (SKNBI) pricing policy until 30th June 2024, namely: (a) minimum payment policy for credit cardholders of 5% of the outstanding balance, and late payment penalties of 1% of the outstanding balance up to a maximum of Rp100,000, and (b) SKNBI fees of Rp1 from BI to the banks and up to Rp2,900 from bank to the customers.

- Strengthening literacy concerning the Indonesia Credit Card (KKI) for the government segment to increase the effectiveness.

Policy coordination between Bank Indonesia and the Government is also constantly improved to maintain macroeconomic stability and bolster economic growth. Bank Indonesia strengthens policy coordination with the (central and regional) Government and strategic partners, including the National Movement for Food Inflation Control (GNPIP) in various regions within the Central and Regional Inflation Control Teams (TPIP and TPID), as well as P2DD Teams to Accelerate and Expand the Electronification of Central and Regional Government Transactions. Furthermore, policy synergy between Bank Indonesia and the Financial System Stability Committee is also strengthened to maintain financial system stability and revive lending/financing to businesses, particularly in priority sectors. Bank Indonesia is also expanding cooperation with other central banks in partner countries, while facilitating investment and trade promotion in priority sectors in synergy with the relevant institutions.

Global economic moderation is accompanied by persistently high uncertainty. The US economy continues to post solid growth on the back of household consumption and domestic-oriented services, while China's economy is improving on consumption and the impact of fiscal stimuli. Overall, Bank Indonesia still projects global economic growth in 2023 at 2.9% before moderating to 2.8% in 2024. Inflation in advanced economies remains above target, with pressures beginning to ease. Consequently, monetary policy rates, including the Federal Funds Rate (FFR), are expected to remain higher for longer. Government bond yields in advanced economies, particularly US Treasury yields, have tracked sharp upward trends due to long-term risk premia (term-premia) linked to the strong need for fiscal financing. Financial market uncertainty persists, leading to volatile capital flows and currency pressures in emerging market economies (EMEs).

At home, economic growth in Indonesia remains solid, supported by domestic demand. In the third quarter of 2023, the economy grew 4.94% (yoy) in response to strong household consumption and increasing investment despite lower government consumption and export performance. Growth was also supported by positive performance in most sectors of the economy, particularly the manufacturing industry, wholesale and retail trade, as well as construction. Spatially, all regions of the Indonesian archipelago maintained solid growth, led by the Sulampua region (Sulawesi-Maluku-Papua). Furthermore, robust economic growth is expected to persist in the fourth quarter of 2023, as reflected in a number of early indicators, such as consumer confidence, income expectations and the Manufacturing Purchasing Managers Index (PMI). Overall, economic growth in 2023 is projected in the 4.5-5.3% range before accelerating in 2024 as a corollary of solid consumer confidence, the upcoming general election and ongoing development of national strategic projects (PSN). Bank Indonesia will continue strengthening fiscal-monetary stimulus synergy with macroprudential stimuli to drive economic growth, particularly from the demand side.

Indonesia's Balance of Payments (BOP) remains healthy, thereby maintaining external stability. A narrow BOP deficit was recorded in the third quarter of 2023 at USD1.5 billion, significantly lower than the USD7.4 billion recorded in the previous period. The narrower deficit was supported by a larger trade surplus and lower capital and financial account deficit against a backdrop of global economic uncertainty. Entering the fourth quarter of 2023, positive trade balance performance persisted, with the surplus reaching USD3.5 billion in October 2023. Furthermore, foreign capital inflows returned to domestic financial markets in the form of portfolio investment, recording a net inflow of USD2.6 billion (qtd) as of 21st November 2023. The position of reserve assets at the end of October 2023 stood at USD133.1 billion, equivalent to 6.1 months of imports or 5.9 months of imports and servicing government external debt, which is well above the international adequacy standard of around 3 months of imports. Looking ahead, BOP performance in 2023 is forecast to remain sound, supported by a manageable current account maintained in the range of a 0.4% surplus to a 0.4% deficit of GDP. In 2024, BOP performance is expected to improve, supported by foreign capital inflows in line with the solid domestic economic outlook.

Rupiah exchange rates are under control in line with the stabilisation policy instituted by Bank Indonesia. As of 22nd November 2023, the rupiah gained 1.99% in value against the level recorded at the end of October 2023. Year-to-date, the rupiah is stable, with modest 0.04% depreciation from the level at the end of December 2022, thereby outperforming the Indian rupee, Thai baht and Malaysian ringgit, which recorded 0.70%, 1.70% and 5.84% depreciation respectively in the reporting period. Rupiah appreciation stemmed from foreign capital inflows to domestic financial markets in line with positive investor perception concerning the promising national economic outlook, accompanied by maintained stability and attractive yields on domestic financial assets for investment, despite persistently high global financial market uncertainty. Moving forward, Bank Indonesia will continue strengthening rupiah stabilisation policy in line with the currency's fundamental value to control imported inflation. In addition, Bank Indonesia will optimise the pro-market MO strategy through the SRBI and SVBI instruments to enhance liquidity management at domestic financial institutions and attract portfolio inflows from abroad. Meanwhile, Bank Indonesia continues strengthening coordination with the Government, banking industry and business community to support the effective implementation of instruments that retain the proceeds of natural resources exports in accordance with Government Regulation Number 36 of 2023 (PP DHE SDA).

Inflation remains under control within the 3.0%±1% target corridor. Consumer Price Index (CPI) inflation was manageable in October 2023 at 2.56% (yoy), despite increasing slightly from 2.28% (yoy) the month earlier. Core inflation continued tracking a downward trend to 1.91% (yoy) from 2.00% (yoy) as a result of interest rate policy consistency and rupiah stabilisation by Bank Indonesia. Volatile food (VF) inflation was controlled at 5.54% (yoy) in line with close inflation control synergy between Bank Indonesia and the (central and regional) Government within the TPIP and TPID teams by strengthening the GNPIP movement in various regions. Administered prices (AP) inflation increased slightly to 2.12% (yoy) from 1.99% (yoy) the month earlier. Moving forward, Bank Indonesia will continue monitoring several risks that could undermine inflation control, including the impact of high international energy prices, domestic food prices, and rupiah depreciation pressures on imported inflation. To that end, Bank Indonesia continues strengthening its monetary policy mix and synergy with the (central and regional) Government to ensure inflation remains under control in the 3.0%±1% target this year and 2.5%±1% in 2024.

Bank Indonesia continues strengthening innovation to increase monetary policy effectiveness, which includes safeguarding manageable inflation and rupiah stability. To that end, Bank Indonesia is optimising the SRBI and SVBI pro-market monetary instruments to strengthen money market deepening policy and support efforts to attract portfolio inflows, while optimising the SBN and forex securities held by Bank Indonesia as underlying assets. As of 21st November 2023, SRBI auctions recorded Rp168.81 trillion in outstanding bids, driven by foreign portfolio inflows totalling Rp27.25 trillion. In addition, Bank Indonesia also issued SVBI as a forex monetary instrument with the first auction held on 21st November 2023. The market has embraced SVBI issuances enthusiastically, as reflected by high outstanding bids totalling USD266.5 million to exceed the indicative auction target of USD200 million. Furthermore, Bank Indonesia plans to issue the SUVBI vehicle through the first auction on 28th November 2023. Such innovative instruments are expected to support the pro-market MO strategy and attract foreign capital inflows to strengthen the external resilience of Indonesia's economy from the impact of global spillovers.

Liquidity in the economy remains ample. Reserve balances held at Bank Indonesia have decreased in line with implementation of Macroprudential Liquidity Policy Incentives (KLM), leading to a base money (M0) contraction of 7.5% (yoy) in October 2023. Meanwhile, the broad money (M2) monetary aggregate recorded 3.4% (yoy) growth in October 2023, underpinned by strong growth of quasi-money at 7.8% (yoy) and Currency Outside Banks (COB) at 6.7% (yoy). Based on the affecting factors, M2 growth was driven by solid growth of loans disbursed by the banking industry and expansionary fiscal policy. Expansionary financial operations by the Government in October 2023 stood at Rp85.43 trillion after recording a Rp269.36 trillion contraction as of September 2023.

Ample liquidity conditions in the banking industry are supporting resilient financial system stability. In October 2023, the ratio of liquid assets to third-party funds (LA/TPF) remained high at 26.36%. SRBI issuances also added flexibility in the banking industry for liquidity management to maintain lending capacity. The latest liquidity developments have impacted interest rates positively in the banking industry, with the 1-month term deposit rate and lending rate averaging 4.40% and 9.37% respectively in October 2023. Adequate bank liquidity is also supported by the implementation of Macroprudential Liquidity Policy Incentives (KLM), effective from 1st October 2023, providing additional liquidity to the tune of Rp138 trillion as of November 2023. Bank Indonesia will continue improving the effective implementation of Macroprudential Liquidity Policy Incentives (KLM) to revive bank lending/financing to priority sectors and support sustainable economic growth.

The bank intermediation function is projected to maintain positive growth, supported by sound lending capacity in the banking industry in line with adequate liquidity conditions. Growth of third-party funds (TPF) reached 3.43% (yoy) in October 2023, while loans disbursed by the banking industry grew 8.99% (yoy) in the same period, supported by higher demand for financing in line with maintained corporate performance and household consumption. By sector, loan growth is primarily supported by the social services sector, corporate services and mining. Furthermore, sharia finance increased 14.68% (yoy) in October 2023. In the MSME segment, growth reached 8.36% (yoy), predominantly boosted by increasing disbursements of People's Business Loans (KUR). Moving forward, Bank Indonesia will continue reviving bank lending/financing and strengthening synergy with the Government to maintain economic growth momentum, particularly in priority and inclusive sectors as well as the green economy. Consequently, Bank Indonesia still forecasts credit growth in 2023 in the 9-11% range before accelerating further in 2024.

Financial system stability resilience is also supported by a strong capital base and low credit risk. The Capital Adequacy Ratio (CAR) in the banking industry is still high at 27.33% recorded in September 2023, with credit risk mitigated effectively, as reflected by low NPL ratios of 2.43% (gross) and 0.77% (nett). The results of BI stress tests further confirmed solid banking industry resilience in the face of global pressures. Bank Indonesia will continue strengthening synergy with the Financial System Stability Committee (KSSK) to mitigate various domestic and global economic risks that could disrupt financial system stability and economic recovery momentum.

Digital economic and financial transactions continue to perform solidly, supported by a secure, uninterrupted and reliable payment system. The value of electronic money transactions in October 2023 increased 17.67% (yoy) to reach Rp41.71 trillion, while the value of digital banking transactions grew 15.57% (yoy) to Rp5,118.89 trillion. The value of QRIS transactions continues enjoying impressive 186.08% (yoy) growth, amounting to Rp24.97 trillion, with users and merchants totalling 43.44 million and 29.63 million respectively, dominated by MSMEs. Bank Indonesia continues accelerating payment system digitalisation and expanding cross-border payment linkages towards greater economic and financial inclusion as well as expansion of the digital economy and finance. Meanwhile, the value of card-based payments using ATM, debit and credit cards reached Rp664.87 trillion in the reporting period, down 3.53% (yoy). In terms of rupiah currency management, total currency in circulation in October 2023 grew 5.73% (yoy) to Rp957.74 trillion. In addition, Bank Indonesia continues ensuring the availability of rupiah currency fit for circulation in all regions of the Republic of Indonesia, particularly ahead of the busy Christmas and New Year festive period. Meanwhile, Bank Indonesia also maintains the availability of rupiah currency fit for circulation through programs to circulate the rupiah in 3T (outermost, frontier, remote) regions as well as mobile cash services, cash deposit services and the Sovereign Rupiah Expedition.

Jakarta, 23rd November 2023

Communication Department

Erwin Haryono

Executive Director