No. 23/268/DKom

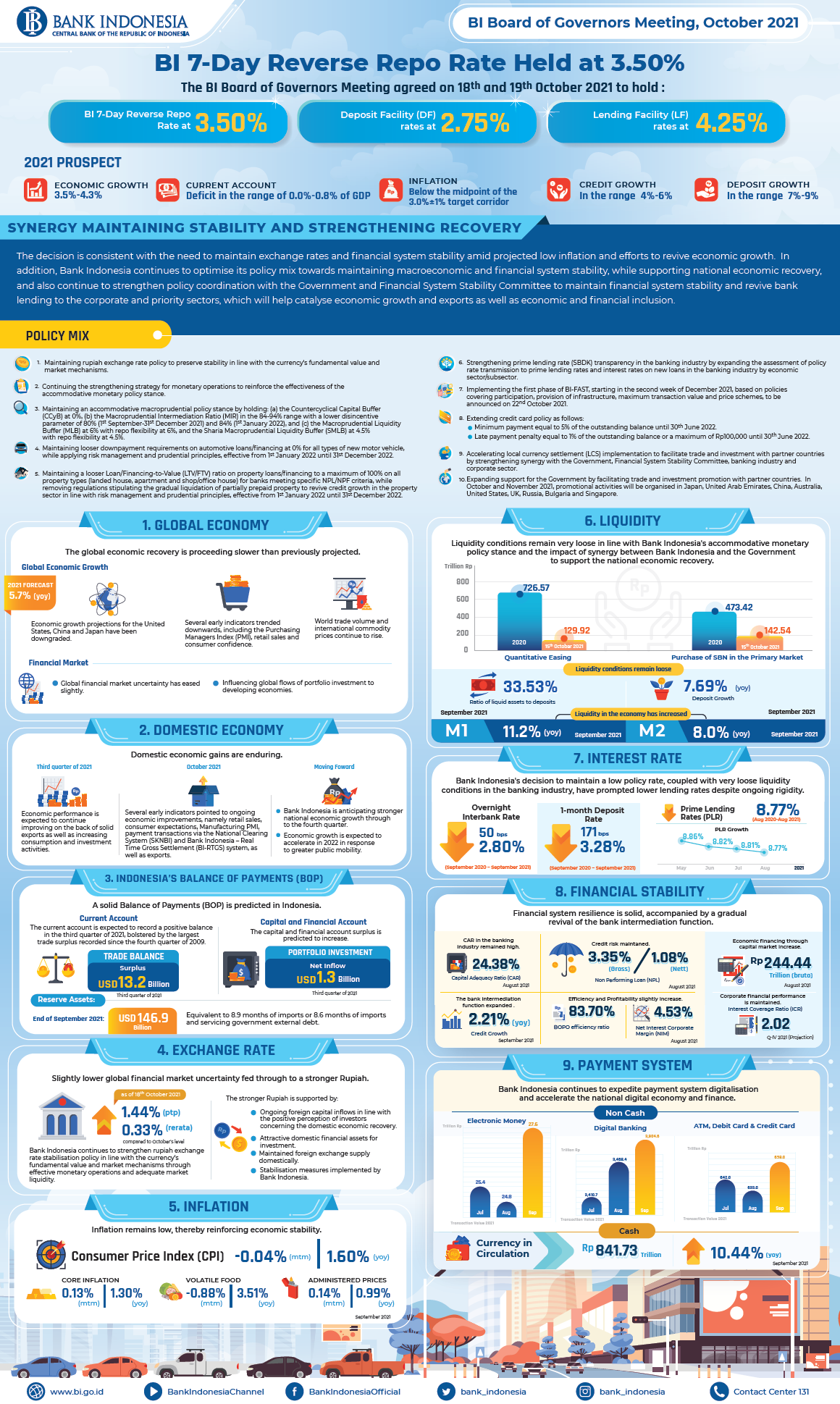

The BI Board of Governors Meeting agreed on 18th and 19th October 2021 to hold the BI 7-Day Reverse Repo Rate at 3.50%, while also maintaining the Deposit Facility (DF) rates at 2.75% and Lending Facility (LF) rates at 4.25%. The decision is consistent with the need to maintain exchange rates and financial system stability amid projected low inflation and efforts to revive economic growth. In addition, Bank Indonesia continues to optimise its policy mix towards maintaining macroeconomic and financial system stability, while supporting national economic recovery efforts through the following measures:

- Maintaining rupiah exchange rate policy to preserve stability in line with the currency's fundamental value and market mechanisms.

- Continuing the strengthening strategy for monetary operations to reinforce the effectiveness of the accommodative monetary policy stance.

- Maintaining an accommodative macroprudential policy stance by holding: (i) the Countercyclical Capital Buffer (CCyB) at 0%, (ii) the Macroprudential Intermediation Ratio (MIR) in the 84-94% range with a lower disincentive parameter of 80% (1st September-31st December 2021) and 84% (1st January 2022), and (iii) the Macroprudential Liquidity Buffer (MLB) at 6% with repo flexibility at 6%, and the Sharia Macroprudential Liquidity Buffer (SMLB) at 4.5% with repo flexibility at 4.5%.

- Maintaining looser downpayment requirements on automotive loans/financing at 0% for all types of new motor vehicle, while applying risk management and prudential principles, effective from 1st January 2022 until 31st December 2022.

- Maintaining a looser Loan/Financing-to-Value (LTV/FTV) ratio on property loans/financing to a maximum of 100% on all property types (landed house, apartment and shop/office house) for banks meeting specific NPL/NPF criteria, while removing regulations stipulating the gradual liquidation of partially prepaid property to revive credit growth in the property sector in line with risk management and prudential principles, effective from 1st January 2022 until 31st December 2022.

- Strengthening prime lending rate (SBDK) transparency in the banking industry by expanding the assessment of policy rate transmission to prime lending rates and interest rates on new loans in the banking industry by economic sector/subsector (Appendix).

- Implementing the first phase of BI-FAST, starting in the second week of December 2021, based on policies covering participation, provision of infrastructure, maximum transaction value and price schemes, to be announced on 22nd October 2021.

- Extending credit card policy as follows: (a) Minimum payment equal to 5% of the outstanding balance until 30th June 2022. (b) Late payment penalty equal to 1% of the outstanding balance or a maximum of Rp100,000 until 30th June 2022.

- Accelerating local currency settlement (LCS) implementation to facilitate trade and investment with partner countries by strengthening synergy with the Government, Financial System Stability Committee, banking industry and corporate sector.

- Expanding support for the Government by facilitating trade and investment promotion with partner countries. In October and November 2021, promotional activities will be organised in Japan, United Arab Emirates, China, Australia, United States, UK, Russia, Bulgaria and Singapore.

Bank Indonesia will also continue to strengthen policy coordination with the Government and Financial System Stability Committee to maintain financial system stability and revive bank lending to the corporate and priority sectors, which will help catalyse economic growth and exports as well as economic and financial inclusion.

The global economic recovery is proceeding slower than previously projected. Economic growth projections for the United States, China and Japan have been downgraded due to the impact of the highly contagious Delta variant of Covid-19, coupled with supply chain disruptions and global energy limitations. In contrast, a faster economic recovery in Europe remains intact, thus offsetting global moderation. In September 2021, several early indicators trended downwards, including the Purchasing Managers Index (PMI), retail sales and consumer confidence. Therefore, Bank Indonesia revised its global economic growth projection for 2021 to 5.7% from 5.8%. World trade volume and international commodity prices continue to rise, thus supporting the export outlook in developing economies. The global economic recovery is predicted to endure in 2022 but the impact of supply chain disruptions and energy limitations demand vigilance. Global financial market uncertainty has eased slightly despite concerns of tighter global monetary policy sooner than previously expected in line with persistently higher inflation. Such conditions are influencing global flows of portfolio investment to developing economies, particularly countries offering attractive financial assets for investment and promising economic conditions.

Domestic economic gains are enduring. In the third quarter of 2021, economic performance is expected to continue improving on the back of solid exports as well as increasing consumption and investment activities in line with greater public mobility. By sector, the Manufacturing Industry, Mining, Trade as well as Information and Communications continue to perform well. Spatially, the main contributors to the domestic economic recovery include the regions of Sulampua (Sulawesi, Maluku, Papua), Java, Sumatra and Kalimantan, driven by exports. Several early indicators in October 2021 pointed to ongoing economic improvements, namely retail sales, consumer expectations, Manufacturing PMI, payment transactions via the National Clearing System (SKNBI) and Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system, as well as exports. Bank Indonesia is anticipating stronger national economic growth through to the fourth quarter, with overall growth for 2021 projected at 3.5-4.3%. In addition, economic growth is expected to accelerate in 2022 in response to greater public mobility given the faster vaccination rollout, persistently strong export performance, broader reopening of priority sectors and ongoing policy stimuli.

A solid Balance of Payments (BOP) is predicted in Indonesia. The current account is expected to record a positive balance in the third quarter of 2021, bolstered by the largest trade surplus recorded since the fourth quarter of 2009, totalling USD13.2 billion. Performance is supported by higher exports of major commodities, such as crude palm oil (CPO), coal, organic chemicals and metal ores, despite higher imports, mainly raw materials, to fuel the domestic economic recovery. Meanwhile, the capital and financial account surplus is predicted to increase on foreign capital inflows in the form of foreign direct investment and portfolio investment. In the third quarter of 2021, portfolio investment recorded a net inflow of USD1.3 billion, followed by an inflow of USD0.2 billion from 1st-15th October 2021. At the end of September 2021, the position of reserve assets increased to USD146.9 billion, equivalent to 8.9 months of imports or 8.6 months of imports and servicing government external debt, which is well above the 3-month international adequacy standard. Looking ahead, Bank Indonesia projects a lower current account deficit in the 0.0-0.8% of GDP range in 2021 and a manageable current account deficit in 2022, thus supporting external sector resilience in Indonesia.

Slightly lower global financial market uncertainty fed through to a stronger rupiah. As of 18th October 2021, the rupiah appreciated 1.44% (ptp) and 0.33% on average compared with the September 2021 level. Rupiah appreciation is supported by ongoing foreign capital inflows in line with the positive perception of investors concerning the domestic economic recovery, attractive domestic financial assets for investment, maintained foreign exchange supply domestically and stabilisation measures implemented by Bank Indonesia. Compared with the level at the end of 2020, therefore, the rupiah has depreciated by just 0.43% (ytd) in 2021 (as of 18th October), which is relatively lower than the depreciation experienced in several other peer countries, including India, Malaysia and the Philippines. Bank Indonesia continues to strengthen rupiah exchange rate stabilisation policy in line with the currency's fundamental value and market mechanisms through effective monetary operations and adequate market liquidity.

Inflation remains low, thereby reinforcing economic stability. In September 2021, the Consumer Price Index (CPI) recorded deflation of 0.04% (mtm), bringing headline inflation to 0.80% (ytd). Annually, CPI inflation stood at 1.60% (yoy), up marginally from 1.59% (yoy) in August 2021. Core inflation remains low in line with compressed domestic demand, maintained exchange rate stability and consistent Bank Indonesia policy to anchor inflation expectations to the target corridor. Milder inflationary pressures on volatile food stemmed from adequate supply, contrasting a build-up of inflationary pressures on administered prices as a corollary of higher tobacco excise duty. Consequently, inflation in 2021 is projected below the midpoint of the 3.0%±1% target and within the target corridor in 2022. Bank Indonesia is firmly committed to maintaining price stability and strengthening policy coordination with the central and regional governments through national and regional inflation control teams (TPI and TPID) to maintain headline inflation within the target.

Liquidity conditions remain very loose in line with Bank Indonesia's accommodative monetary policy stance and the impact of synergy between Bank Indonesia and the Government to support the national economic recovery. Bank Indonesia has injected liquidity through quantitative easing (QE) to the banking industry totalling Rp129.92 trillion in 2021 (as of 15th October 2021). In addition, Bank Indonesia continues to purchase SBN in the primary market to fund the 2021 State Revenue and Expenditure Budget (APBN), totalling Rp142.54 trillion (as of 15th October 2021), with Rp67.08 trillion through primary auction and Rp75.46 trillion through greenshoe options (GSO). The expansive monetary policy stance supports very loose liquidity conditions in the banking industry, as reflected in September 2021 by a high ratio of liquid assets to deposits of 33.53%. On the other hand, deposit growth has moderated to 7.69% (yoy), impacted by recoveries of business activity and private consumption. Liquidity in the economy has increased, as indicated by narrow (M1) and broad (M2) money supply aggregates, which grew 11.2% (yoy) and 8.0% (yoy) respectively in the reporting period, primarily driven by bank lending to finance the national economic recovery.

Bank Indonesia's decision to maintain a low policy rate, coupled with very loose liquidity conditions in the banking industry, have prompted lower lending rates despite ongoing rigidity. In the markets, the overnight interbank rate and 1-month deposit rate have fallen 50bps and 171bps since September 2020 to 2.80% and 3.28% in September 2021. In the credit market, the banking industry continues to lower prime lending rates (PLR) and interest rates on new loans. Increasing economic activity and public mobility have improved risk perception in the banking industry, prompting lower interest rates on new loans. Bank Indonesia expects the banking industry to continue lowering lending rates as part of the joint efforts to revive lending to the corporate sector.

Financial system resilience is solid, accompanied by a gradual revival of the bank intermediation function. The Capital Adequacy Ratio (CAR) in the banking industry remained high in August 2021 at 24.38%, with persistently low NPL ratios of 3.35% (gross) and 1.08% (nett). Stoked by growing demand for corporate and consumptive loans in response to greater public mobility, the bank intermediation function expanded 2.21% (yoy) in September 2021. On the supply side, the banking industry relaxed lending standards in line with lower risk perception, coupled with loose liquidity conditions and lower interest rates on new loans. All loan types recorded positive growth, led by consumer loans and working capital loans, while housing loans recorded higher growth at 8.67% in September 2021. Similarly, growth of MSME loans reached 2.97% (yoy), thus demonstrating further MSME sector improvements. Bank Indonesia will maintain an accommodative macroprudential policy stance to revive bank lending. Therefore, credit growth in 2021 is projected in the 4-6% range with deposit growth of 7-9%.

Bank Indonesia continues to expedite payment system digitalisation and accelerate the national digital economy and finance. Bank Indonesia is accelerating various payment system digitalisation programs, including QRIS expansion, the National Open API Payment Standard (SNAP) and regulatory reforms, as well as BI-FAST implementation. Digital economic and financial transactions continue to proliferate given greater public acceptance and growing public preference towards online retail as well as the expansion of digital payments and digital banking. The value of e-money transactions increased 45.05% (yoy) to Rp209.81 trillion in the third quarter of 2021 and is projected to grow 38.75% (yoy) to Rp284 trillion overall in 2021. Similarly, the value of digital banking transactions increased 46.72% (yoy) to Rp28,685.48 trillion in the third quarter of 2021 and is projected to grow 43.04% (yoy) to Rp39,130 trillion overall in 2021. Bank Indonesia continues to strengthen policy coordination with the Government in relation to trialling social aid program (bansos) digitalisation, while optimising and accelerating bansos disbursements. On the cash side, currency in circulation in September 2021 grew 10.44% (yoy) to reach Rp841.73 trillion. Bank Indonesia continues to ensure cash availability in all regions of Indonesia, while strengthening the cash distribution strategy and reopening cash services based on prevailing public activity restrictions (PPKM) in each respective region.

Jakarta, 19th October 2021

Head of Communication Department

Erwin Haryono

Executive Director

Information about Bank Indonesia

Tel. 021-131, Email: bicara@bi.go.id