all payment transactions can be facilitated by the same QR Payment Code, namely

QRIS, even when using different payment instruments by the end user.

QRIS is considered a game changer in terms of digital payments, oriented towards

fostering inclusivity and increasing cross-border payment connectivity/linkages.

First, QRIS serves as an entry point into the digital ecosystem for MSMEs

to support economic and financial inclusion.

Second, QRIS can facilitate various payment instruments and sources of

funds. The provision of various alternative payment methods through QRIS, both

offline and online, is expected to increase the business activity of merchants

as well as the quality of services offered to end users, supported by cost

efficiency.

Third, expanding access to digital payments will unlock compelling

opportunities to expand access to other digital financial services, including

financing and investment.

On the other hand, QRIS also supports cross-border payment linkages

through QRIS Cross-Border, which prioritises the use of local currencies to

support macroeconomic stability.

A merchant needs only to open an account with one QRIS PSP licensed

by Bank Indonesia.

Merchants can then receive payments from consumers using QRIS from any PSP

application. So, let's use QRIS!

Parties in QRIS Transaction Processing

The parties involved in QRIS transaction processing include Payment Service

Providers (PSPs), Switching Institutions, Standard-Setting Institutions and

National Merchant Repository managers. PSPs include front-end PSPs, such as

issuers and/or acquirers. PSPs and Switching Institutions involved in processing

QRIS transactions must be approved by Bank Indonesia.

Sources of Funds for QRIS Transactions

QRIS transactions use funding sources in the form of bank accounts and/or

payment instruments, such as debit cards, credit cards, credit facilities and/or

server-based electronic money (e-money). The use of funding sources and/or

payment instruments is implemented based on the proposals from Standard-Setting

Institutions approved by Bank Indonesia.

QRIS Transaction Value

QRIS Transaction Value is limited to a maximum of Rp10 million per transaction.

Issuers can also set daily and/or monthly cumulative limits on QRIS transactions

for each QRIS end user based on the risk management conducted by the issuer.

PAKAI QRIS. In

Indonesian, PAKAI

is an abbreviation for Praktis,

Aman, Kekinian, Andal and Inklusif,

or Practical, Secure, Modern, Reliable and Inclusive.

-

Practical: Hassle-free

payments without the need to carry cash. One QR code for all payment

applications. Convenient, just scan and click Pay.

-

Secure: More convenient

transactions, protected by an international standard security system. QRIS

PSPs are licensed and supervised by Bank Indonesia.

-

Modern: Suitable for a

modern, digital lifestyle.

-

Reliable: Seamless

transactions anywhere, anytime and without limits.

-

Inclusive: QRIS is

available to all.

QRIS Benefits

QR Code standardisation with QRIS provides numerous benefits, including:

For Users of Payment Applications: Just scan and pay!

-

Fast and modern

- Hassle-free and cashless

-

Universal and worry-free

- Protected as all QRIS PSPs are licensed

and supervised by Bank Indonesia

For Merchants:

- Potentially

higher sales by accepting QR-based payments

- Greater branding

-

Modern

- Practical due to universal QRIS standard

- Reduce

cash handling costs

- Avoid counterfeit money

- Cash float

not required

- Automated transaction recording with real-time

monitoring

- Separation of business and personal finances

-

Reconciliation and fraud prevention in cash bookkeeping

- Build a

credit profile to unlock future access to credit

QRIS accommodates 2 (two) payment models using QR Code, namely Merchant

Presented Mode (MPM) and Consumer Presented Mode (CPM). Implementation,

however, refers to the QRIS standards set by Bank Indonesia as the national

standard.

1. Merchant Presented Mode (MPM)

Static MPM

The simplest method. Merchants present one QRIS sticker or printout, which

is free. Consumers just scan, enter the value, input their PIN and click

Pay. A transaction notification is received immediately by the consumer and

merchant. Static QRIS MPM is intended primarily for micro and small

merchants.

Dinamic MPM

QRIS is issued via an electronic device, such as an EDC or mobile phone, and

is free. The merchant must input the value of the payment first, which is

followed by the consumer scanning the QRIS barcode presented.

QRIS Dynamic MPM is intended for medium and large enterprises or merchants

with high transaction volume.

2. Consumer Presented Mode (CPM)

The user presents the QRIS barcode displayed in the consumer’s payment

application for the merchant to scan. QRIS CPM is intended for merchants

requiring fast transaction speeds, such as transportation, parking and

modern retail providers.

Expanding QRIS acceptance is supported by the sustainable innovation of QRIS

features to help accelerate the digital economy and finance (EKD) through

the development of QRIS TTM (facilitating remote payments without

face-to-face contact), QRIS Withdrawal, Transfer and Deposit (TUNTAS) and

QRIS Cross-Border.

QRIS Tanpa Tatap Muka

QRIS TTM facilitates remote payments without direct face-to-face contact. A

merchant can share a QRIS code through a photo, catalogue or invoice, which

the consumer can scan, enter the value and pay. The transaction is settled

in real time. This solution is intended for online retail or donations, with

security guaranteed and a more practical process than manual transfers.

Cash withdrawals, transfers and deposits are now easier than ever with

QRIS TUNTAS! As the latest innovation of the digital payment system,

QRIS TUNTAS allows users to transfer funds between QRIS users as well as

withdraw and deposit cash at ATM/CDM machines or QRIS TUNTAS agents by

scanning the QRIS code using the interconnected payment application

between bank and non-bank PSPs. QRIS TUNTAS is available using a bank

account or server-based electronic money as the source of funds.

QRIS Withdrawal, Transfer and Deposit (TUNTAS) is an innovative QRIS

feature that supports digital economic and financial inclusion by

allowing consumers to transfer funds between QRIS users as well as

withdraw and deposit cash via Automated Teller Machines (ATM)/Cash

Deposit Machines (CDM) or QRIS TUNTAS agents by scanning a QRIS code

using an interconnected payment application between bank and non-bank

PSPs.

QRIS TUNTAS transactions are available using a bank account or

server-based electronic money as the source of funds, while providing a

notification feature for the users.

QRIS TUNTAS implementation is oriented towards:

-

Supporting digital economic and financial inclusion, particularly

for the unbanked and underserved communities.

- Ensuring

efficiency on the user and merchant sides as well as effective

service delivery by the industry.

- Accommodating

interconnectivity and interoperability between banks and non-banks

when facilitating bank accounts and server-based electronic money.

QRIS TUNTAS Pricing Scheme

With QRIS Cross-Border, Indonesian travellers have access to

convenient transactions abroad using their domestic payment

application to scan a QR code displayed by a merchant in a partner

country. Likewise, international travellers can make payments in

Indonesia by scanning a QRIS code using a participating payment

application.

QRIS Cross-Border aims to facilitate trade

and tourism sector activity, particularly for MSMEs,

while strengthening macroeconomic

stability using local currencies through bilateral Local

Currency Transactions (LCT). QRIS Cross-Border is an innovative QRIS

feature that connects Indonesian QR payments with partner countries.

With QRIS Cross-Border, the cross-border payment process is more

practical and efficient.

Currently, QRIS Cross-Border is available through collaboration

with several partner countries, including Thailand, Malaysia and

Singapore, among others.

QRIS Cross-Border PSPs

The following PCPs facilitate QRIS

Cross-Border in each country:

No

|

Country

|

Indonesian Travellers Transacting in Partner Countries

|

International Travellers Transacting in Indonesia |

|

PSP Issuer |

QR Standard in Partner Country

|

Transaction Limit |

PSP Issuer |

|

1 |

Thailand | -

BCA

- Bank Mandiri

- Bank Sinarmas

-

Bank Permata

- Bank Syariah Indonesia

- CIMB

Niaga

- Bank Mega

- BPD Bali

- DANA

-

LinkAja

- Ottocash

- OCBC NISP

- INA

Perdana

- BTN

|

PromptPay | Refer

to Bank Indonesia Regulations concerning QRIS | -

Bangkok Bank

- Krungthai Bank

- Krungsri

Bank

- CIMB Thai

|

|

2 |

Malaysia | -

BCA

- Bank Mandiri

- Bank Sinarmas

-

Bank Permata

- Bank Syariah Indonesia

- CIMB

Niaga

- Bank Mega

- BPD Bali

- DANA

-

LinkAja

- Ottocash

- Finpay

-

ShopeePay

- INA Perdana

- BTN

|

DuitNow QR | | -

CIMB Bank Berhad

- Hong Leong Bank Berhad

-

Malayan Banking Berhad

- Public Bank Berhad

-

TNG Digital Sdn. Bhd

- Bank of China

-

Finexus Malaysia

- BigPay Malaysia

|

|

3 |

Singapura | -

BCA

- BRI

- Bank Mandiri

- Bank

Sinarmas

- Bank Permata

- Bank Syariah

Indonesia

- CIMB Niaga

- Bank Mega

-

BPD Bali

- DANA

- Netzme

- INA Perdana

|

NETS QR | | -

OCBC Bank

- UOB

- DBS

|

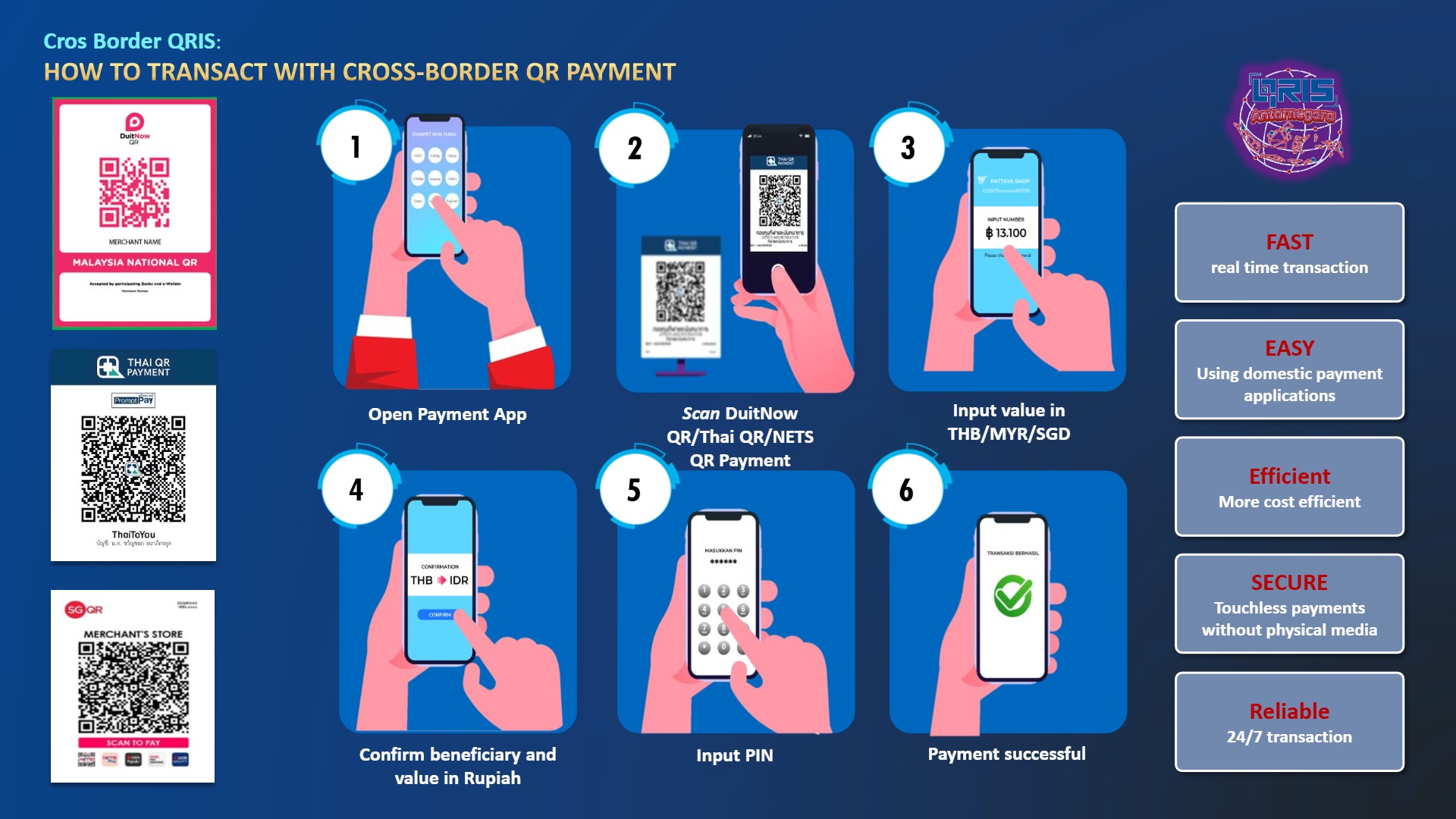

How to Use QRIS Cross-Border

Pengguna Indonesia:

Using QRIS Cross-Border:

Indonesian Travellers Abroad

-

Open payment application

- Scan DuitNow QR/Thai QR/NETS QR

code

- Enter value in Malaysian ringgit/Thai

baht/Singaporean dollar

- Confirm recipient and value in

rupiah

- Enter PIN

- Payment Successful

QRIS Cross-Border; Fast (Real-Time Transactions); Convenient (Use

Indonesian payment application); Affordable (Competitive fees);

Secure (Contactless payments without physical media); Reliable

(Anytime and anywhere)

International Travellers in Indonesia

International travellers can make payments at all QRIS merchants in

Indonesia as follows:

-

Open payment application

- Scan QRIS code

- Enter

value of payment in rupiah

- Confirm recipient and value

in respective home currency

- Enter PIN

- Payment

Successful

Contoh Tampilan QRIS

For Merchants in Indonesia:

QRIS Cross-Border offers convenience when accepting payments from

international travellers. Merchants can use their existing QRIS code

to accept payments by international travellers from partner

countries. Most QRIS PSPs can already facilitate this type of

transaction, but merchants are urged to reconfirm with their

respective PSP whether they can accept QRIS Cross-Border payments.

Interestingly, even though the payment is made in a foreign

currency, the merchant receives payment in rupiah equivalent to the

value paid. No additional fees are charged to merchants for

accepting QRIS Cross-Border payments.

The Merchant Discount Rate (MDR) for processing QRIS MPM and QRIS CPM

transactions is as follows:

|

Merchant Type |

Category

|

% MDR |

Regular

|

Micro Enterprise (UMI)

|

Transaction value of ≤Rp500,000.00 (less or equal to five hundred

thousand rupiah) |

0%

|

|

Transaction value of >Rp500,000.00 (more than five hundred thousand

rupiah) |

0.3% |

Small (UKE), Medium (UME) and Large (UBE) Enterprises

|

0.7% |

Special

|

Education |

0.6% |

| Public Gas Stations (SPBU) |

0.4% |

Public Services Agencies (BLU), Public Service Obligations (PSO), Government-to-People (G2P) such as social aid program (bansos) disbursements, People-to-Government (P2G), including tax, passports, and social donations (non-profit).

|

0%

|

As a Merchant

- Non-account holders must open a

merchant account by visiting the branch office or registering

online at one of the QRIS PSPs listed here [or

visit www.aspi-qris.id]

-

Submit the business data and documents requested by the PSP.

-

After completion of the verification process, the PSP will

create a Merchant ID and QRIS code.

- The PSP will forward

a softcopy of the QRIS code.

- Install the merchant

application or access the merchant webpage of the PSP.

As a User

- Non-account holders must register by

downloading the application of a QRIS PSP listed here.

-

Complete the registration process in line with PSP procedures.

-

Top up your account.

- Use the application to make

payments at QRIS merchants based on the instructions provided.

Open the application, look for the scan icon or QRIS logo, scan

the QRIS code presented by the merchant, enter the value, input

your PIN, click Pay, check the notification.