Climate change presents new challenges for central banks in maintaining financial system stability (FSS). The risks posed by climate change have significant potential for systemic impact on the economy and finance (FSB, 2022) due to their irreversible, multidimensional, simultaneous, and unpredictable nature, affecting various economic sectors. Climate change risks to the economy and finance include both physical risks and transition risks.

Physical risks refer to the potential losses arising from natural disasters (such as floods, earthquakes, etc.), which may undermine agricultural and manufacturing productivity and, ultimately, lead to price volatility.

Transition risks refer to the potential losses arising from the shift towards a low-carbon economy (such as policies to phase out coal or changes in consumer preferences toward green products), which could precipitate structural economic changes and pose challenges for businesses.

These climate change risks can result in financial losses and reduce corporate repayment capacity, thereby affecting asset quality within the financial system. Consequently, central banks must consider both the risks and opportunities associated with climate change and support mitigation and adaptation efforts, including fostering a financial system resilient to climate change. This is essential to achieve monetary and financial stability in the near term, as well as sustainable economic growth.

Bank Indonesia is committed to supporting a just and orderly transition process to achieve the Enhanced Nationally Determined Contribution (Enhanced NDC) target, in collaboration with the Financial Services Authority (OJK) and the Ministry of Finance. In fulfilling its mandate as the monetary and macroprudential authority, Bank Indonesia continues to explore potential support for sustainable economic and financial development, serving as a catalyst for a just and orderly transition toward the Enhanced NDC goals for Indonesia and long-term sustainable growth.

Bank Indonesia Macroprudential Policies to Support Green Finance

To date, Bank Indonesia has implemented three macroprudential policies to promote sustainable economic growth as follows:

-

First, Bank Indonesia has issued loan-to-value (LTV) policy for green property loans and downpayment requirements on green automotive loans since December 2019. This policy differentiates LTV ratios and minimum downpayment requirements for financing of green and non-green products. LTV for financing green buildings is set at up to 100%, while the minimum downpayment requirement on electric vehicles has been reduced to 0%, in accordance with risk assessments conducted by the lending banks. These accommodative LTV and downpayment policies are expected to increase demand and access to green loans and encourage consumer preferences for green property and vehicles. The policies are also believed to accelerate the growth of green finance and stimulate the economy while addressing environmental risk.

-

Second, Bank Indonesia formulated the Macroprudential Inclusive Financing Ratio (Rasio Pembiayaan Inklusif Makroprudensial, RPIM) under Bank Indonesia Regulation (PBI) No. 24/3/PBI/2022 to enhance inclusive financing and ensure sustainable financial system stability. Banks determine their own RPIM target based on a self-assessment and are obligated to achieve that target with evaluations conducted at the end of each year. The RPIM policy expands the modalities of inclusive financing to include: (i) direct financing and supply chain financing, (ii) financing through financial service institutions, public service agencies (Badan Layanan Umum, BLU) and business entities, and (iii) inclusive financing securities (Surat Berharga Pembiayaan Inklusif, SBPI). To support sustainable finance growth, the types of securities in modality 3 have been expanded to include securities for development or sustainability purposes. Banks, therefore, can purchase sustainable finance instruments to meet their RPIM target.

-

Third, Bank Indonesia has implemented Macroprudential Liquidity Incentive Policy (Kebijakan Insentif Likuiditas Makroprudensial, KLM) by relaxing the average reserve requirements for banks that extend loans to specific sectors, including inclusive sectors, such as ultra micro enterprises, green sectors and other sectors designated by Bank Indonesia (PBI No. 11 of 2023). Through KLM, Bank Indonesia provides incentives to banks through a tiering system for achieving RPIM targets up to 100bps, which can be fulfilled through the purchase of inclusive financing securities (Surat Berharga Pembiayaan Inklusif/SBPI). This policy allows eligible banks to receive incentives of up to 50bps, increasing from 30bps previously, if their green loans exceed 5% of their total credit portfolio. Strengthening this policy is expected to provide an incentive for banks to support a just and orderly transition by incorporating sustainable practices in loan assessments and increasing their portfolio allocation for financing green activities.

Bank Indonesia's Support for the Development of Sustainable Finance

As part of its efforts to promote Sustainable Finance in Indonesia, Bank Indonesia has initiated the development of innovative tools that can be utilized by banks and businesses in the transition process toward sustainability. Bank Indonesia, in collaboration with the Coordinating Ministry for Maritime and Investment Affairs and other relevant government ministries and agencies, developed the Green Calculator application.

Green Calculator enables banks and businesses to quantify the greenhouse gas emissions generated by their activities. In the pursuit of economic sustainability, the banking industry plays a key role in financing an orderly, just and affordable transition. Consequently, all businesses borrowing from a bank are required to proportionately record their emissions. The development of the Green Calculator initiative aims to respond to the needs of businesses, especially those lacking the capacity to quantify emissions independently and ensuring compliance with sustainability standards.

The

Green Calculator is an application to quantify the greenhouse gas (GHG) emissions generated. The application can be used voluntarily and free of charge for banks and businesses.

Supporting efforts to quantify and report the greenhouse gas (GHG) emissions, Bank Indonesia in collaboration with the Coordinating Ministry for Maritime Affairs and Investment, supported by the Ministry of the Environment and Forestry and the Ministry of Energy and Mineral Resources, along with the National Greenhouse Gas Methodology Panel Team, has provided the

Green Calculator Application, accompanied by

Guidance Book.

The Green Calculator was developed based on global standards for emission quantification and reporting . For the current early stage, the Green Calculator is limited to quantifying Scope 1 (fuel combustion) and Scope 2 (purchase of electricity) emissions. Going forward, the scope of Green Calculator development will be expanded gradually in line with global developments.

The availability of the Green Calculator is expected to improve transparency and accountability of banks and businesses in sustainability reporting and promote the emission reduction efforts, to achieve a net-zero economy.

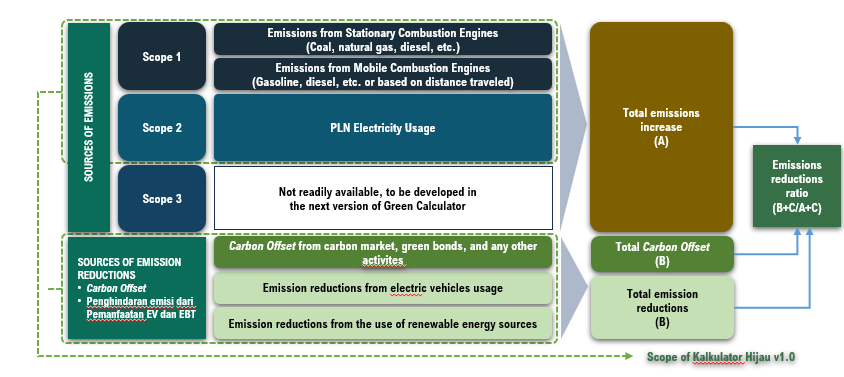

As a voluntary tool, the Green Calculator provides a benchmark for the quantification of greenhouse gas emissions by the banking and business sectors. Banks and businesses are encouraged to comprehensively quantify their emissions to support economic and financial sustainability. The Green Calculator currently covers: (i) sources of emissions and (ii) sources of emission reduction and emission avoidance activities. The emission quantification in the Green Calculator utilizes national emission factors (emission factors based on national samples[1]), except for coal briquette and charcoal emissions, which use global emission factors (emission factors based on international samples/Intergovernmental Panel on Climate Change - IPCC[2])

Sources of Emissions

Scope 1

Emissions produced from the use of stationary fuel combustion

(coal, natural gas, diesel and others)

Emissions produced from the use of mobile fuel combustion

(petroleum, diesel, or based on distance travelled)

Scope 2

Emissions produced from the use of electricity sourced from National Electricity Company (PLN)

Scope 3

Not Available, is planned for future development.

Sources of Emission Reduction

- Carbon offset

- Emission reduction from utilization of electric vehicles and renewable energy

Carbon offset from carbon market, green bonds and other activities

Emission reduction using electric vehicles

Emission reduction using new and renewable energy sources

Total Additional Emissions (A)

Total Carbon Offset (B)

Total Emission Reduction (C)

Emission Reduction Ratio (B+C/A+C)

Scope of Green Calculator

Green Calculator Guidance

Green Calculator Work Sheet

Green Calculator Application

FAQ - Green calculator

Available as a link for download

Contact

For inquiries regarding the Green Calculator, please direct your emails to bicara@bi.go.id or contact BICARA 123

-

Nurturing sustainable economic and financial growth, Bank Indonesia has issued several publications in the form of research papers and working papers, which can be referred to by stakeholders to support growth of green finance. The research papers and working papers are listed as follows:

List Research:

List Working Papers: