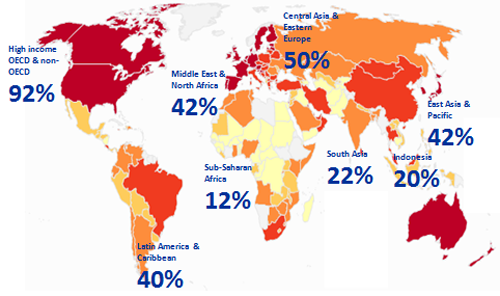

Source: Findex-WorldBank-2011

Financial inclusion emerged as a trending topic after the 2008 crisis, primarily due to the crisis impact on those at the bottom of the pyramid (low and irregular income, isolated, living with disabilities, undocumented workers, disadvantaged communities), who are typically unbanked and numerous in developing economies.

At the G20 Pittsburgh Summit in 2009, G20 members agreed to increase access to finance for this group, which was subsequently reiterated at the Toronto Summit in 2010, by issuing nine Principles for Innovative Financial Inclusion as development guidelines for financial inclusion, namely leadership, diversity, innovation, protection, empowerment, cooperation, knowledge, proportionality and frameworks.

Since then, numerous international forums have focused on financial inclusion, such as CGAP, World Bank, APEC, Asian Development Bank (ADB) and the Alliance for Financial Inclusion (AFI), as well as international standard-setting bodies, namely the Bank for International Settlements (BIS) and Financial Action Task Force on Money Laundering (FATF), including developing economies like Indonesia.

Lacking a standard definition of financial inclusion, several international institutions have put forward the following definitions:

“A state in which all working age adults have effective access to credit, savings, payments, and insurance from formal service providers. Effective access involves convenient and responsible service delivery, at a cost affordable to the customer and sustainable for the provider, with the result that financially excluded customers use formal financial services rather than existing informal options" (CGAP-GPFI).

“Financial inclusion involves providing access to an adequate range of safe, convenient and affordable financial services to disadvantaged and other vulnerable groups, including low income, rural and undocumented persons, who have been underserved or excluded from the formal financial sector" (FATF).

“The process of ensuring access to appropriate financial products and services needed by all sections of the society in general and vulnerable groups such as weaker sections and low-income groups in particular, at an affordable cost in a fair and transparent manner by regulated, mainstream institutional players" (RBI/Reserve Bank of India).

There are many supply (service providers) and demand-side (consumers) reasons for those languishing at the bottom of the pyramid to remain unbanked, including price barriers, information barriers, product design barriers and channel barriers. In response, financial inclusion overcomes those barriers by providing a wealth of benefits to be enjoyed by consumers, regulators, the government and private sector as follows:

-

Increasing economic efficiency

-

Supporting financial system stability

-

Reducing shadow banking and irresponsible finance

-

Supporting financial market deepening

-

Unlocking potential new markets for the banking industry

-

Raising the Human Development Index (HDI)

-

Contributing to sustainable local and national economic growth

-

Reducing inequality and low-income trap rigidity, thus ameliorating public prosperity and ultimately alleviating poverty

Around the world, governments are combating financial exclusion through two salient approaches. First, a comprehensive national strategy, such as those implemented in Indonesia, Nigeria and Tanzania. Second, a range of separate programs, for instance financial education, as pursued by the US Administration since the 2008 crisis. In general, a comprehensive national strategy contains three key aspects, namely providing appropriate services, providing appropriate products as well as responsible finance through financial education and consumer protection. Financial inclusion is typically implemented in stages, starting with a clear target, such as the recipients of government social aid or migrant workers, before gradually rolling out to the public in general.

The financial inclusion strategy is not an isolated initiative and, therefore, not only involves the participation of Bank Indonesia yet also the regulator, government ministries and other institutions to offer financial services to the public. Through the national financial inclusion strategy, close and structured collaboration between the government and various other stakeholders is expected.

.jpg)