Definition (PBI APMK No. 11/11/PBI/2009, as amended by PBI No. 14/2/PBI/2012 concerning Card-based Payment Instruments): Card-based payment instruments are payment instruments in the form of credit cards, ATM cards and debit cards.

Credit Card

Definition (PBI APMK No. 11/11/PBI/2009, as amended by PBI No. 14/2/PBI/2012 concerning Card-based Payment Instruments): A credit card is a card-based payment instrument used for payments of obligations arising from economic activity, including shopping transactions and/or cash withdrawals, in which the payment obligation of the cardholder is settled in advance by the acquirer or issuer and the cardholder is required to execute payment at an agreed term in a lump sum (charge card) or instalments.

Characteristics of Credit Cards:

Characteristics of Credit Cards:

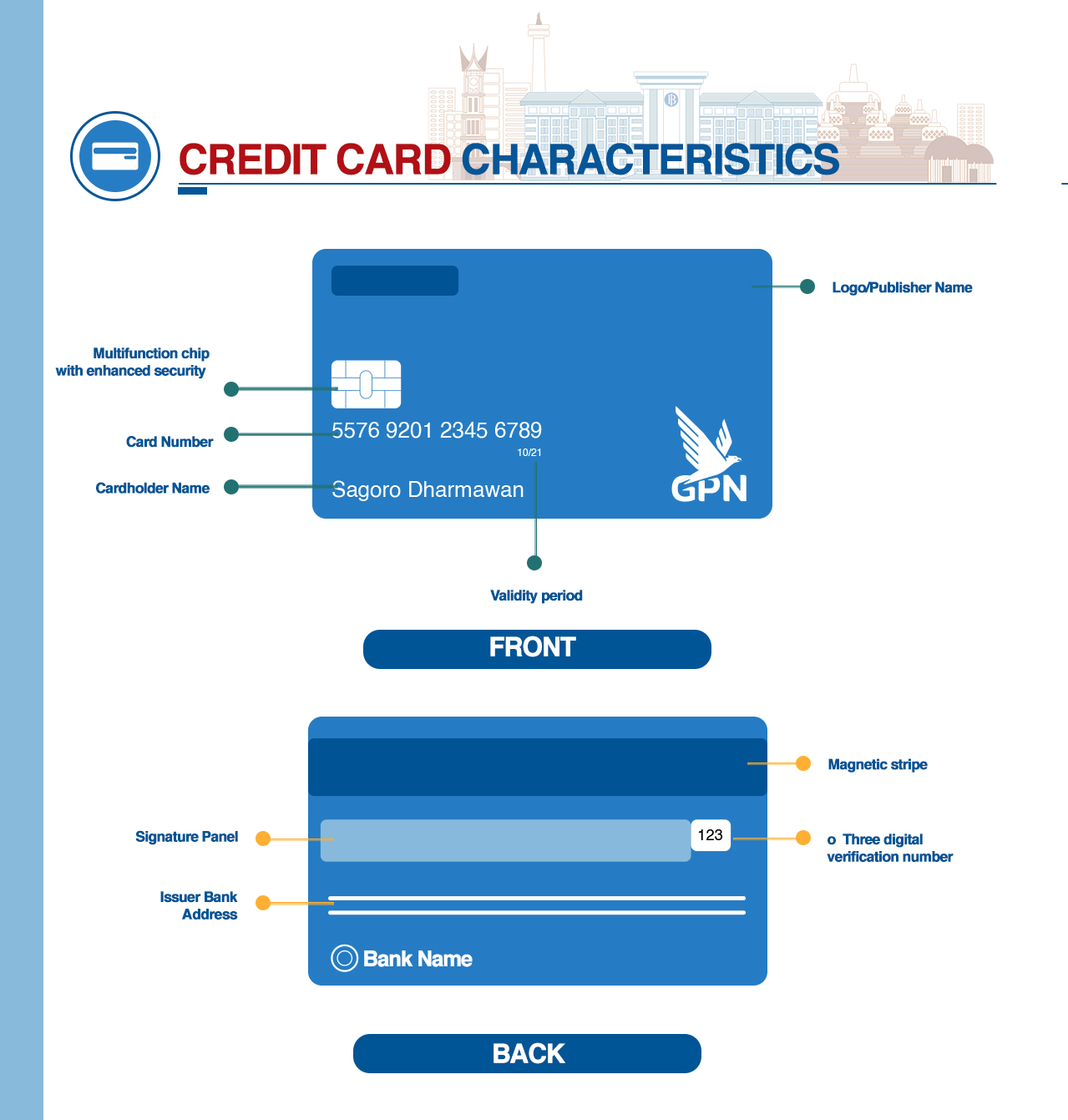

Features of Chip-based Credit Cards

Obverse:

-

The chip is always located on the front of the card, which adds various applications to encrypt and secure the data

-

16-digit credit card number

-

Name of Cardholder

-

Name of Card Issuer

-

Expiry Date of Credit Card

-

Network Logo of Credit Card

Reverse:

-

Magnetic Stripe, which can still be used for overseas transactions

-

Signature Panel containing the signature of the cardholder on the credit card

-

3-digit Verification Code

-

Address of Issuing Bank

-

Name/Logo of Issuer

Using a Chip-Based Credit Card

The mechanism for using a chip-based credit card has changed little since the previous iteration. During a transaction, pay attention to the following:

-

Ensure the credit card handed over to the cashier is processed by dipping the chip-based card into the EDC machine. At the moment of dipping, the credit card is encrypted before being linked and verified online with the issuer.

-

After the verification process, the EDC machine will issue a sales draft which must be signed by the cardholder initiating the transaction.

-

Transaction is complete

The mechanism is just as straightforward as the previous magnetic stripe technology. The main difference is that cards are no longer swiped, they are dipped. If your credit card is swiped, it implies the credit card or EDC machine are not equipped with chip technology. If this is the case, immediately request a replacement card from the issuer listed on your credit card (***).

ATM Card

Definition (PBI APMK No. 11/11/PBI/2009, as amended by PBI No. 14/2/PBI/2012 concerning Card-based Payment Instruments): ATM cards are card-based payment instruments that may be used for cash withdrawals and/or fund transfers in which the obligations of the cardholder are settled in real-time through a direct debit of the cardholder’s account at a bank or nonbank institution authorised to mobilise funds under prevailing laws and regulations.

Characteristics of ATM Cards:

Characteristics of ATM Cards:

Obverse:

-

Multifunctional chip with enhanced security features

-

Card Number

-

Name of Cardholder

-

Name of Network

-

Expiry Date

-

Issuer Logo/Name

Reverse:

-

Signature Panel

-

Address of Issuer

-

Magnetic Stripe

-

3-digit Verification Code

Obverse:

-

The chip is always located on the front of the card, which adds various applications to encrypt and secure the data

-

16-digit credit card number

-

Name of Cardholder

-

Name of Card Issuer

-

Expiry Date of ATM Card

-

NPG Logo. Pursuant to Bank Indonesia Regulation (PBI) No. 19/8/PBI/2017 concerning the National Payment Gateway (NPG), all cards issued by issuers within the NPG ecosystem are required to display the GPN logo on the payment instrument.

Reverse:

-

Magnetic Stripe, which remains in limited use on ATM/debit cards issued on a deposit account with a maximum balance of Rp5 million based on a written agreement between the issuer and customer.

-

Signature Panel containing the signature of the cardholder on the card

-

3-digit Verification Code

-

Address of Issuing Bank

-

Name/Logo of Issuer

Debit Card

Definition (PBI APMK No. 11/11/PBI/2009, as amended by PBI No. 14/2/PBI/2012 concerning Card-based Payment Instruments): A Debit Card is a card-based payment instrument that may be used for payments of liabilities arising from economic activity, including shopping transactions, in which the obligation of the cardholder is settled in real-time through a direct debit of the cardholder’s account at a bank or nonbank institution authorised to mobilise funds under prevailing laws and regulations.

Characteristics of Debit Cards:

Obverse:

-

Multifunctional chip with enhanced security features

-

Card Number

-

Name of Cardholder

-

Name of Network

-

Expiry Date

-

Issuer Logo/Name

Reverse:

-

Signature Panel

-

Address of Issuer

-

Magnetic Stripe

-

3-digit Verification Code

Obverse:

1. The chip is always located on the front of the card, which adds various applications to encrypt and secure the data

2. 16-digit credit card number

3. Name of Cardholder

4. Name of Card Issuer

5. Expiry Date of Debit Card

6. NPG Logo. Pursuant to Bank Indonesia Regulation (PBI) No. 19/8/PBI/2017 concerning the National Payment Gateway (NPG), all cards issued by issuers within the NPG ecosystem are required to display the GPN logo on the payment instrument.

Reverse:

1. Magnetic Stripe, which remains in limited use on ATM/debit cards issued on a deposit account with a maximum balance of Rp5 million based on a written agreement between the issuer and customer.

2. Signature Panel containing the signature of the cardholder on the card

3. 3-digit Verification Code

4. Address of Issuing Bank

5. Name/Logo of Issuer

Electronic Money

Definition (Bank Indonesia Regulation (PBI) No. 20/6/PBI/2018 concerning Electronic Money):

Electronic money is a payment instrument that meets the following criteria:

-

Issued based on the value of currency deposited with the issuer

-

The electronic store of monetary value is server-based or chip-based

-

The value of electronic money managed by the issuer is not the same as deposits referred to in prevailing banking regulations.

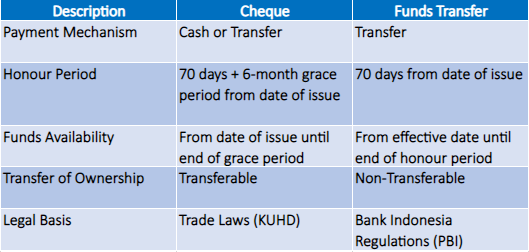

Understanding Cheques and General Principles

A cheque is an unconditional order by a bank’s customer to pay a specific amount on a certain date. The following general principles apply to cheques:

-

An order to pay cash or transfer funds.

-

Transferable.

-

Issued in rupiah.

Types of Cheque

a) Cheques consist of the following types:

-

Order cheque (Aan Order), namely with the payee’s name written on the cheque. The drawee only makes a payment to the Payee written on the cheque.

.jpg) Figure 2 : Contoh Cek Atas Nama

Figure 2 : Contoh Cek Atas Nama

-

Bearer Cheque (Aan Toonder), namely with no payee written on the cheque. The drawee will make a payment to any bearer that presents the cheque to the drawee.

.jpg)

Figure 3 : Sample of a Bearer Cheque

b) For security purposes, the drawer can restrict who is eligible to cash the cheque as follows:

-

Crossed Cheque, namely a cheque that has been marked specifying an instruction on the way it is to be redeemed. There are two types of crossed cheque as follows:

-

General Crossed Cheque, namely that only bears two parallel traverse lines, without a special instruction or any writing. The drawee can only cash a general crossed cheque by:

-

Specific Bank Crossed Cheque, namely where the crossing has the name of a specific bank between the two parallel traverse lines. Therefore, the drawee can only make a payment into an account at the specified bank. If the name on the crossing is the drawee itself, the crossing may be paid to a customer of the drawee.

Figure 5 : Sample of a Specific Bank Crossed Cheque

- Verrekenings Cheque, which is restricted to a funds transfer. The distinction is made by writing “untuk dimaasukkan ke dalam rekening” or similar across the obverse of the cheque.

Figure 6 : Sample of a Verrekenings Cheque

Unsur/Syarat Formal Cek

a) The elements of the cheque, which are also known as the formal terms, are as follows:

-

‘Cek’ must be printed on the cheque.

-

An unconditional order to pay a specific amount.

-

Drawee, the bank where the cheque can be presented for payment.

-

An instruction to whom the payment must be made.

-

Date and place of issue.

-

Signature of drawer.

b) Cheques that do not meet the formal terms are not valid.

c) If the place of payment it is not explicitly stated on the cheque, the following regulations apply:

-

If no place of payment is specified, the place written next to the drawer is considered the place of payment.

-

If no place of payment is specified anywhere on the cheque, the cheque must be redeemed at the head office of the drawee.

d) In practice, however, technology now allows the drawee to verify the drawer’s data nationally, therefore, the cheque does not have to be paid at the head office of the Drawee.

Figure 7: Formal Elements of a Cheque

Figure 7 Note

Honour Period and Expiration

a) Banks are only legally required to honour cheques presented by the payee for up to 70 days from the date of issue.

b) A 6-month grace period is given before the expiration of the cheque.

Figure 8: illustration of Appointment and Payment of Cjeques

Figure 8 Note

-

Honour period: Jangka 70 days from the date of issue.

-

Date of Issue: Date the cheque was issued.

Cheque Transfers

a) As a security or negotiable instrument, cheques are transferrable.

b) Transfer to Bearer is achieved by physically handing over the cheque to the bearer.

c) Transfer to Payee is achieved using two methods:

-

An Order Cheque with or without a specific payee instruction can be transferred through endorsement.

-

An Order Cheque with a specific payee instruction (Rekta Cek) can only be transferred by issuing a cessie certificate

d) Endorsing a Cheque:

-

Sign the cheque and write the name of the endorsed payee (General Endorsement).

-

Sign the cheque without writing the name of the endorsed payee (Blank Endorsement).

e) By transferring the cheque, all payment rights are also transferred to the new payee.

Corrections on Cheques

The drawer can make changes to a cheque by crossing out the mistake, writing the correction above and initialling the correction.

Figure 9: Sample of a Corrected Cheque

Cancelling and Blocking Cheques

a) A Drawer cannot cancel a cheque during the honour period.

b) A cheque can only be cancelled after the honour period has lapsed.

c) A cheque can only be cancelled by the Drawer by submitting a written cheque cancellation , request to the Drawee, containing information on the cheque number, date of issue, amount and date of cancellation. A photocopy of the account holder’s ID card must be attached to the cancellation request.

d) A Drawer can request to block a cheque payment as a result of loss or theft.

-

If lost, the Drawee can block the cheque based on a request to block a cheque submitted by the Drawer, accompanied by an original police report.

-

If the Drawer is suspected of criminal activity, the Drawee can block the cheque based on a request from an authorised institution.

'Cessie is a transfer of rights in accordance with Article 613 of the Civil Law Code.

Understanding Funds Transfers and General Principles

A Funds Transfer is an order from the Drawer to the Drawee to transfer a specific amount to the Payee’s account. The following general principles apply:

-

An order to transfer funds

-

Non-transferable

-

Issued in rupiah

-

Written in Indonesian

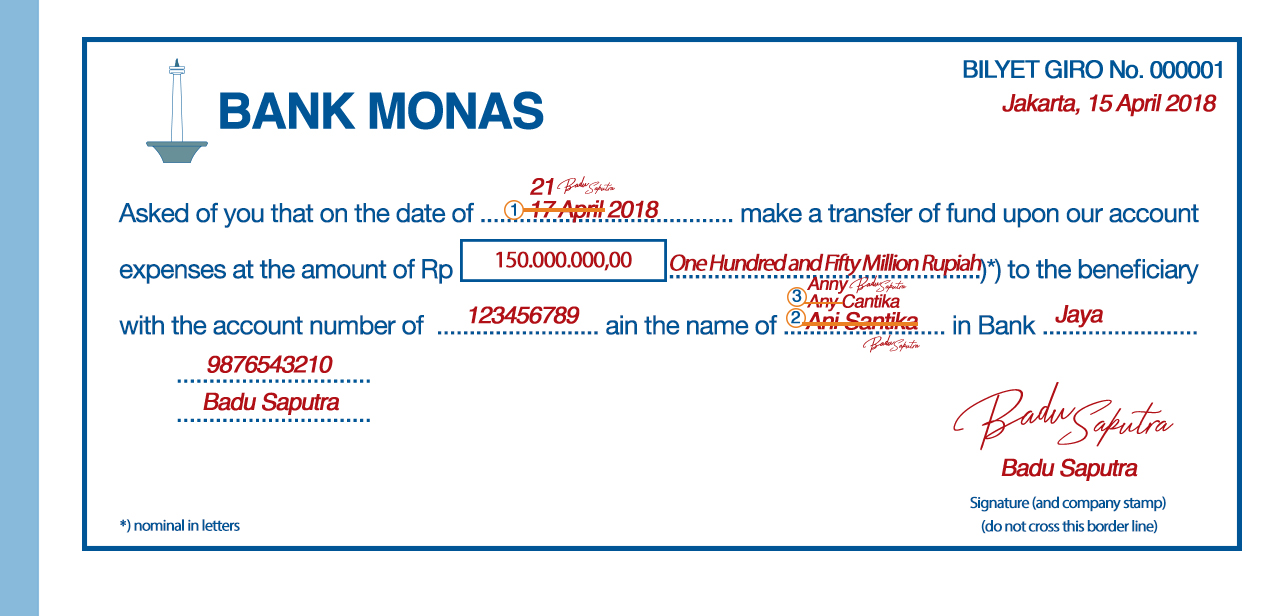

Figure 1: Sample of Funds Transfer

Formal Terms of Funds Transfers

-

A Funds transfer must meet the following formal terms:

-

Name ‘Bilyet Giro’ and Bilyet Giro number.

-

Drawee Name.

-

Clear and unconditional order to transfer funds from the Drawer’s account.

-

Payee name and account details.

-

Name of Beneficiary Bank.

-

Amount to be transferred, expressed in numbers and words.

-

Date of Issue.

-

Effective Date

The effective date must be within the honour period.

-

Drawer’s Name.

The Drawer’s name can be pre-printed clearly by the Drawee on personalised funds transfer forms, which must be the same as the name registered with the Drawee. The name of the Drawer does not have to be written on the funds transfer form if it has been personalised by the Drawee. If the Drawer is a business entity, the name of Drawer is the name of the that entity.

-

Signature of Drawer.

The Signature of Drawer must match the specimen administered by the Drawee. If the Drawer is a business entity, the funds transfer form is signed by an authorised person in charge (PIC) representing the entity, the specimen of whom is administered by the Drawee. The signature of drawer may be complemented with a business stamp if stipulated in the account agreement.

-

The formal terms must be completed in Indonesian, with additional English equivalents permitted.

-

The formal terms referred to in points (1) – (3) are the responsibility of the Drawee when printing the funds transfer forms, while points (4) – (10) are the responsibility of the Drawer when issuing the funds transfer.

-

Funds Transfers forms that do not meet the formal terms are not valid.

Figure 2: Formal Terms of Funds Transfer Form

Figure 2 Note

-

Drawer: Account Holder who issues the Funds Transfer.

-

Drawee: Bank instructed by the Drawer to transfer funds using a Funds Transfer.

-

Payee: Account holder stated on the Funds Transfer Form who receives the funds.

-

Beneficiary Bank: Bank administering the Payee account.

-

Date of Issue: Date on the funds transfer form, representing the date of issue of the funds transfer.

-

Effective Date: Date on the funds transfer form, representing the date upon which the funds can be transferred.

Responsibilities and Obligations when using Funds Transfers

-

Responsibilities and Obligations of Drawee:

-

Print the formal terms on the Funds Transfer Form, including Bilyet Giro name and number, name of Drawee as well as a clear and unconditional funds transfer order.

-

Administer the Drawer’s Account.

-

Administer the Funds Transfer Forms provided to the Drawer.

-

Verify the Funds Transfer drawn by the Drawer.

-

Transfer the amount stated on the funds transfer order.

-

Block a Funds Transfer payment based on a request from the drawer and/or authorised party.

-

Reject a Funds Transfer, accompanied by

-

Administer the use of Funds TransfersMenatausahakan penggunaan Bilyet Giro.

-

Responsibilities and Obligations of Drawer:

-

Complete the formal terms of the Funds Transfer when issuing the funds transfer order.

-

Ensure sufficient funds are available during the honour period.

-

Inform the Drawee concerning a blocked payment.

-

Responsibilities and Obligations of Beneficiary Bank:

-

Ensure the formal terms on the Funds Transfer Form received by Payee are complete.

-

Verify the Funds Transfer Form received by Payee as follows:

-

Check the number of corrections on the Funds Transfer Form.

-

Check the effective date of the Funds Transfer.

-

Ensure the bearer of the Funds Transfer Form is the Payee or party with power of attorney granted by the Payee.

-

Forward the Funds Transfer Order to the Drawee.

-

Reject a Funds Transfer order that fails to meet the requirements.

-

Transfer the funds received from the Drawee to the Payee account.

-

Disclose information to the Payee if the Funds Transfer has been rejected by the Drawee along with a valid reason for the rejection.

-

Responsibilities and Obligations of Payee:

-

Ensure the formal terms on the Funds Transfer form are complete.

-

Reject a Funds Transfer order with incomplete formal terms on the Funds Transfer form.

-

Request the Drawer to block the Funds Transfer, if required.

-

Drawee is responsible for losses incurred due to incomplete formal terms on the Funds Transfer Form that must be completed in full by the Drawee.

-

Drawer is responsible for losses incurred due to incomplete formal terms on the Funds Transfer Form that must be completed in full by the Drawer.

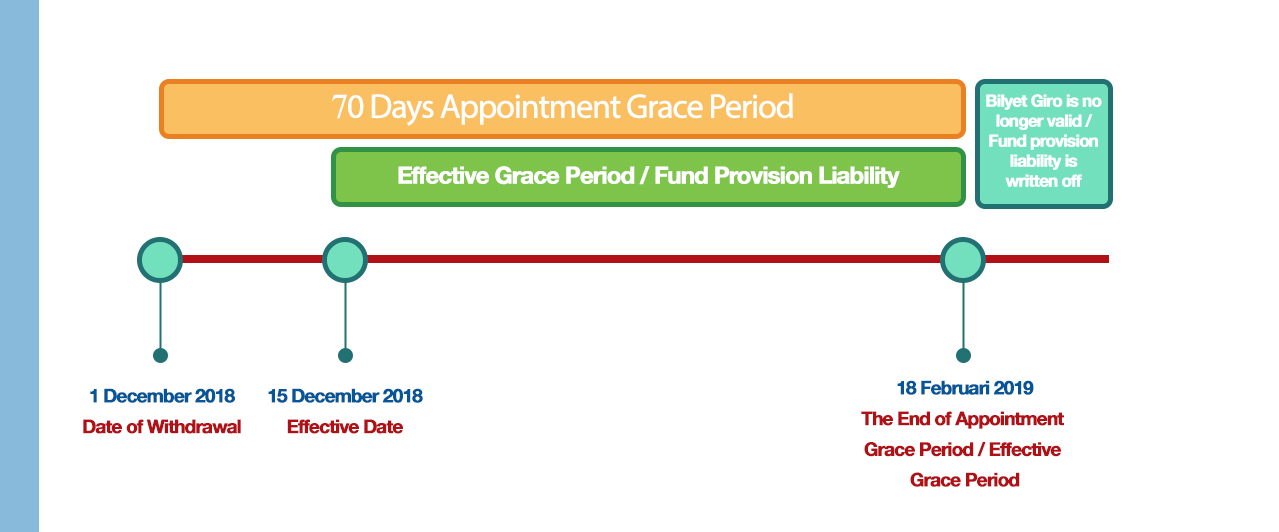

Honour Period and Effective Period

-

Honour period of a Funds Transfer is 70 days from the date of issue.

-

Effective Date must be within the honour period, namely 70 days from the date of issue.

-

Effective Period of a Funds Transfer is calculated from the Effective Date until the end of the honour period.

-

After the honour period, a Funds Transfer is no longer valid, thus removing the responsibility of the Drawer to maintain sufficient funds available.

-

Date of issue can be the same as the Effective Date. It is important to ensure the Effective Date is within the honour period.

Figure 3: Honour Period and Effective Period for Funds Transfers

Figure 3 Note

-

Honour Period Effective Period of the Funds Transfer

-

Effective Period: The period available during which the Drawer can order the Drawee to transfer funds to the Payee.

-

Date of Issue: Date on the funds transfer form, representing the date of issue of the funds transfer.

-

Effective Date: Date on the funds transfer form, representing the date upon which the funds can be transferred.

Corrections on Funds Transfer Forms

-

In the event of a mistake written on the funds transfer form, the Drawer is required to make a correction.

-

Each correction must be initialled by the Drawer on a blank part of the form closest to the correction.

-

A maximum of three corrections are permitted on a funds transfer form. Corrections can only be made to the following:

-

Name of Payee.

-

Payee account number.

-

Name of Beneficiary Bank.

-

Transfer amount in numbers.

-

Transfer amount in words.

-

Date of Issue.

-

Effective Date.

-

Name of Drawer.

-

The signature and business stamp cannot be corrected.

Figure 4: Sample Corrections on Valid Funds Transfer Form

Figure 5: Sample Corrections on Invalidated Funds Transfer Form

Cancelling and Blocking Funds Transfers

-

Drawer cannot cancel a Funds Transfer order during the Honour Period.

-

Drawer can request to block a Funds Transfer order during the honour period for specific reasons.

-

Drawer can request to block a Funds Transfer order due to loss or theft and/or due to a damaged Funds Transfer form

-

If lost or stolen, the request to block a Funds Transfer order must be accompanied by a police report.

-

If damaged, the request to block a Funds Transfer order must be accompanied by the damaged Funds Transfer Form.

Difference between Cheques and Funds Transfers

Understanding Debit Notes

A Debit Note is used to formally collect funds from another participant for the benefit of the participant’s customer or the participant issuing the debit note

Sample Debit Note:

For further clarification please refer to Board of Governors Regulation (PADG) No. 21/12/PADG/2019, dared 31st May 2019, concerning Funds transfers and Scheduled Clearing by Bank Indonesia.

About the Indonesian Credit Card

The Indonesian credit card (KKI) is a retail payment system instrument with credit facilities processed domestically via the national infrastructure,

Gerbang Pembayaran Nasional (GPN/National Payment Gateway).

Purpose for Issuing the Indonesian Credit Card

KKI was initiated by Bank Indonesia in collaboration with the Government (Coordinating Ministry for Maritime Affairs and Investment, Ministry of Finance and Ministry of Home Affairs) and developed by the payment system industry in conjunction with the Indonesia Payment System Association, national state-owned banks and regional government banks to create a national scheme to facilitate domestic credit card transaction.

Function of the Indonesian Credit Card

KKI serves a crucial function in the early phase of its development to fulfill the transactional needs for procurement of goods and services by both the central and regional governments. KKI aims to support the transaction principles of transparency, accountability, and professional budgetary governance. By utilizing KKI, the government can ensure a more transparent and efficient procurement process, allowing for better oversight and control over budget allocation. KKI also represents a tangible action of support for the government's efforts in boosting the use of domestic products (Peningkatan Penggunaan Produk Dalam Negeri/P3DN) initiative as a contribution to promoting the Proud of Indonesian-Made (Gerakan Bangga Buatan Indonesia/GBBI) movement.

Development Stages of the Indonesian Credit Card

KKI is available in terms of QRIS feature, and physical card and will facilitate online payment moving forward. Currently, KKI is intended for the procurement of goods and services by the central and regional government and, as such, is only available to civil servants working in the central and regional government.

Moving forward, KKI is expected to target the retail segment (general public) in line with payment system development based on the

Indonesia Payment System Blueprint (BSPI) 2025, earmarked for full implementation in 2025.

KKI implementation for the Government Segment encompasses three stages as follows:

-

First stage, KKI for the Government Segment with QRIS features launched by the President of the Republic of Indonesia on 29th August 2022, for use in more than 20 million merchants throughout Indonesia with a transaction limit of Rp10 million.

-

Second stage, KKI for the Government Segment with physical cards launched on 8th May 2023, which can facilitate government procurement transactions via EDC machines owned by Payment Service Providers (PSP) available at merchants with a transaction limit of Rp200 million.

-

Third stage, KKI for the Government Segment with online payment features developed to facilitate online transactions through two mechanisms, namely QRIS MPM beginning on 3rd October 2023 and Virtual Cards (tokenization) planned for the end of 2023. These features will allow government procurement transactions via online government platforms.

Parties Involved with the Indonesian Credit Card

-

Bank Indonesia: Authorised to formulate, determine, and communicate payment system policies and issue payment system regulations, as well as determine the obligations and prudential aspects, such as pricing schemes, granting permits/approvals, supervision, and consumer protection.

-

Central Government Ministries and Agencies and Regional Governments: Government is responsible for the overall use of the Indonesian Credit Card in terms of the State Revenue and Expenditure Budget (APBN) and Regional Revenue and Expenditure Budget (APBD), including cardholder acquisition, use and payment policies, monitoring usage and the Supervision Management Information System.

-

Payment System Industry and Associations: Responsible for transaction processing procedures through GPN infrastructure, reconciliation, and settlement procedures, including fraud handling and risk mitigation as well as other operational activities.

Legal Basis for the Indonesian Credit Card

The legal basis of the Indonesian Credit Card for the Government Segment on the customer side (government work units) is under government regulations, namely Minister of Finance Regulation (PMK) No. 196/PMK.05/2018, Minister of Home Affairs Regulation No. 79 of 2022 and Regional Head Regulations (Perkada).

Benefits of the Indonesian Credit Card for the Government Segment

Implementation of the Indonesian Credit Card for the Government Segment is in line with the vision of the Indonesia Payment System Blueprint (BSPI) 2025, as a solution to resolve several issues plaguing existing credit cards. The benefits of KKI for the Government Segment are as follows:

-

Increasing the use of domestic products.

-

Increasing the transparency of central and regional government procurement transactions.

-

Expanding acceptance with non-exclusivity principles.

-

Cost efficiency.

-

Safeguarding the security of government transaction data.

-

Supporting innovation to meet government needs.