As a form of consistency to develop the Islamic economy and Finance in Indonesia and, thus, have a positive impact on strengthening monetary stability, financial system stability and social prosperity, Bank Indonesia released the Islamic Economy and Finance Blueprint on 6th June 2017 as guidelines for internal and external parties in relation to blueprint activities and implementation.

Through the Islamic Economy and Finance Blueprint, Bank Indonesia as the monetary and financial system stability authority, continues to participate in Islamic economy and finance development in conjunction with other relevant stakeholders in reference to multi-dimensional Islamic economic and financial principles and values, namely fairness, transparency, productivity and good governance.

The Islamic Economy and Finance Blueprint contains four salient aspect as follows:

- Values and guiding principles of the Islamic economy and finance;

- Policy development framework;

- Strategy and action plan;

- Cooperation and coordination with internal and external parties to develop the Islamic economy and finance.

Blueprint for the Islamic Economy and Finance

Bank Indonesia functions as the Islamic money market regulator. In addition, a new function is required, namely acceleration and initiation, particularly when development of the Islamic economy and finance applies an ecosystem approach. The Islamic economic and financial ecosystem already exists in Indonesia yet lacks systematic development. To that end and within the concept of the blueprint, Bank Indonesia's development role in the Islamic economy and finance includes the functions of Accelerator, Initiator and Regulator (AIR).

Development efforts for the Islamic economy and finance cannot be implemented partially. If unaccompanied by solid growth across other economic sectors, financial sector development will remain suboptimal. Furthermore, research, assessments and education are an integral and intrinsic part of Islamic economic and financial development. Similarly, close coordination amongst institutions is necessary to effectively implement the strategy and programs. Therefore, the development blueprint for the Islamic economy and finance has been designed based on three main pillars as follows:

- Islamic Economic Empowerment

- Islamic Financial Market Deepening

- Strengthening Research, Assessments and Education

Currently, the development framework for the Islamic economy and finance is being applied to the national economic policy platform. This includes the establishment of a National Islamic Finance Committee (KNKS), which was formed on 3rd November 2016 in accordance with Presidential Regulation No. 91 of 2016 concerning the National Islamic Finance Committee (KNKS).

The National Islamic Finance Committee (KNKS) is chaired by the President of the Republic of Indonesia with members from 10 relevant government ministries and agencies, namely Bank Indonesia, Ministry of Economic Affairs, National Development Planning Agency, Ministry of Finance, Ministry of Cooperatives and SMEs, Ministry of State-Owned Enterprises, Ministry of Religious Affairs, Deposit Insurance Corporation (LPS), Indonesian Financial Services Authority (OJK) and Indonesian Council of Ulama (MUI). In practice, the framework for the blueprint compiled by Bank Indonesia has been proposed as the national strategy framework through several refinements in line with the purview and jurisdiction of each respective institution as members of KNKS.

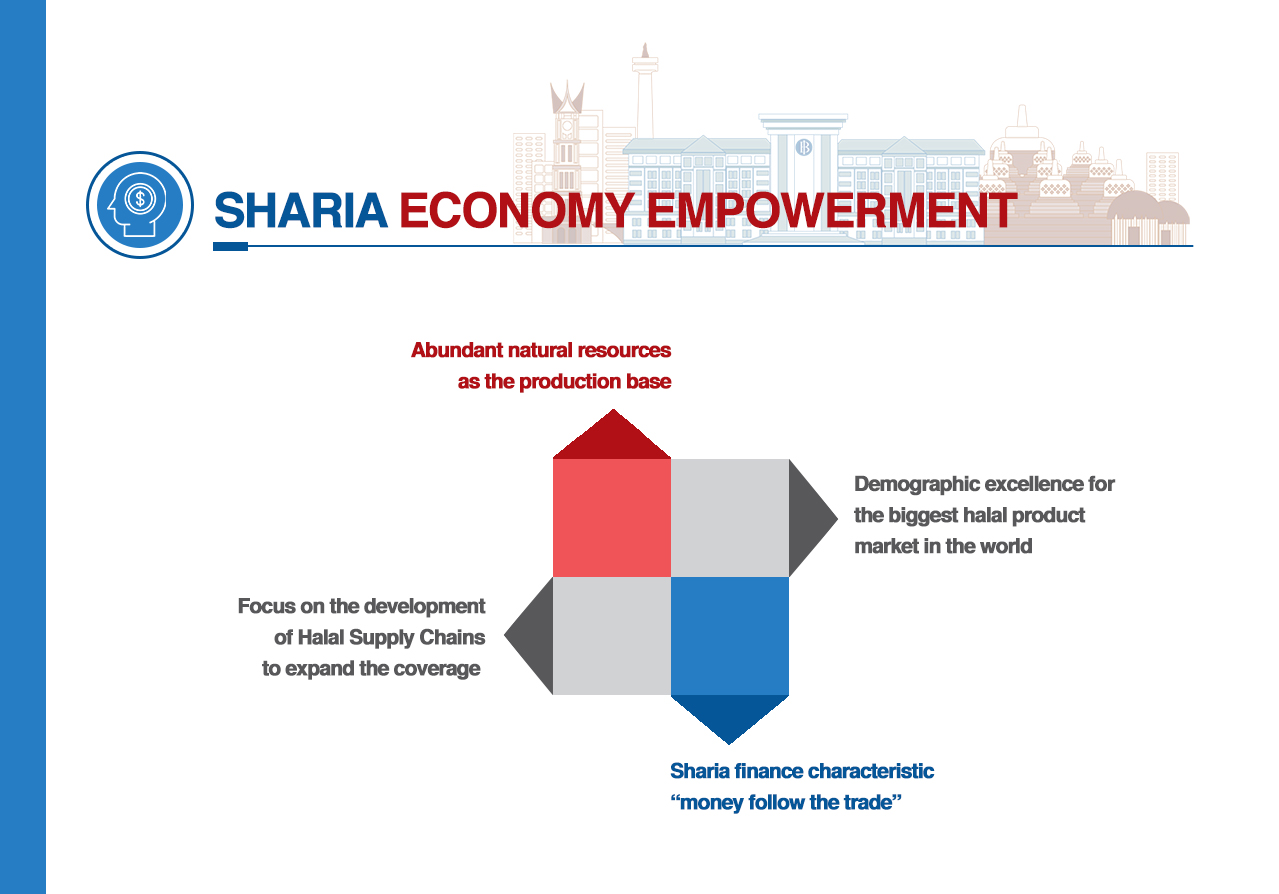

Efforts to develop the Islamic economy and finance began in the early 1990s. Nevertheless, growth of Islamic finance has been slower-than-expected. Consequently, the approach has been honed through a paradigm change, namely that Islamic financial sector development is determined by successful development of the trade and corporate sectors, otherwise known as the Islamic economic sector, based on the paradigm "money follows trade”.

Sharia Economy Empowerment

The ‘money follows trade’ concept departs from common understanding that money plays a social role and money must be invested in activities that aim to increase social and economic fairness, while providing value added in terms of individual and social prosperity. Thus differing from the conventional concept that allows money to be sold or rented for value gain (surplus value by itself). Within a sharia context, money can only be obtained from halal (lawful) investment and trade through risk sharing and profit sharing (Ayub, 2002). In Islam, money can only be obtained through the trade of goods and services and, therefore, the development policy strategy for the Islamic financial sector must follow the economic sectoral development policy strategy.

Bank Indonesia also compiled a comprehensive blueprint covering various areas of the Islamic economy and finance in order to anticipate the impact of global economic volatility on domestic economic stability. This new approach is strategic in terms of optimising economic potential internally and simultaneously as a structured response to the external challenges. The global economy is characterised by increasing cyclical turmoil, primarily since the great depression of the 1930s and the collapse of the Bretton Woods system in 1971, which eliminated USD convertibility with gold.

Ultimately, such conditions gave rise to Joseph A Schumpeter’s conclusion that “economic progress in capital society means turmoil”. Turmoil persists and its effect is felt in the domestic economy. Over the past two decades, Indonesia has directly experienced the adverse impact of regional crisis conditions in the form of the Asian Financial Crisis in 1998 and Global Financial Crisis in 2008.

After the Global Financial Crisis in 2008, the economy reeled from the negative impact for a protracted period. In the World Economic Situation and Prospects 2017, the World Bank evaluated global economic developments, concluding that the global economy is stuck in a prolonged episode of low growth. In the World Economic Outlook 2017, the International Monetary Fund (IMF) recorded global economic growth in 2016 at just 3.1%, projecting 3.5% for 2017 and 3.6% for 2018.

Low global growth has been attributable to low global investment, thus undermining global productivity growth in various countries, edging up the aggregate level of external debt and gradually reducing world trade growth. Which slumped to just 1.2% in 2016. Ironically, the period of low economic growth persisted despite efforts by advanced economies to inject liquidity, thus overdosing on more than USD4 trillion in order to avoid a global recession.

Addressing such weaknesses in the global economic system, Bank Indonesia acknowledged the need to intensively develop the Islamic economy and finance based on confidence that such a system has potential as a new source of growth, would improve domestic economic and financial stability and lead to sustainable and equitable growth.

A set of values and guiding principles as moral and ethical guidelines is what differentiates the Islamic economy and finance from other economic systems. In the Islamic Economy and Finance Blueprint, Islamic economic values are translated into Ownership is Absolute, Justice, Cooperation in Righteousness and Balanced Growth as follows:

-

Ownership is Absolute

DIn Islam, absolute ownership of all things in essence belongs to Allah (QS Yunus: 55, 66; QS Ibrahim: 2). Mankind is merely the Khalifah, ordained and entrusted to manage (QS Al Baqarah: 30, 195; QS Ali Imran: 180). Despite absolute ownership of all things belonging to Allah, Islam respects the relative right of private ownership of assets, labour and ideas obtained through the transfer of ownership based on economic transactions, grants or inheritance. Islam respects the relative right of private ownership of assets, while maintaining balance between the relative rights of individuals, collectives and the state. Understanding that ownership is absolute is fundamental in Islam because Islam encourages philanthropic efforts.

-

Justic

In Islam, mankind is encouraged to try (QS Al Jumuah: 10; QS Al Isra: 12; QS An Nahl: 14) and utilise all abundant resources created by Allah for mankind (QS Al Baqarah: 29; QS Ibrahim: 34). In contrast, recognition of private ownership is not permitted for the excessive accumulation of wealth (QS Al Humazah: 1-3). Islam acknowledges mankind's inherent love of wealth (QS Ali Imron: 14; QS Al Fajr: 20; QS Asy Syura: 27; QS Al Fajr: 20). Therefore, mankind's tendency to hoard wealth must be managed and directed towards commerce and social participation (QS An Nisa: 29). Meanwhile, individual accumulation of wealth is restricted to avoid becoming excessive, and social participation involves providing a portion of wealth for the common interest through infaq, sadaqah and waqf (QS Hadid: 7; QS An Nur: 33; QS Al Baqarah: 267-268).

-

Cooperation in Righteousness

Individual and communal economic activities are permitted in Islam but communal economic activity based on cooperation and the spirit of kindness (QS Al Maidah: 2) and fairness (QS Shaad: 24) is preferred in line with Islamic values. Similarly, competition is encouraged but not in negative form. Competition in Islam is based on cooperative competition, namely competition for righteousness (QS Al Baqarah: 148; QS Al Maidah: 48).

-

Balanced Growth

In Islam, growth of the Islamic economy and finance aims to realise human existence in the world, namely in the worship of God and for the betterment of the universe (rahmatan lil ‘alamin) (QS Al Anbiya: 107; QS Al Ankabut: 51). Therefore, economic growth is important, namely growth that maintains a natural balance between spiritual well-being and the preservation of nature (QS Al Baqarah: 11-12).

Guiding Principles of the Islamic Economy and Finance

Regarding development of the Islamic economic and financial system, Islam adheres to several guiding principles. Those principles are implemented in zakat instruments, prohibit riba and maysir, include ISWAF development and muamulah as follows:

-

Zakat

Zakat has a function in terms of two principles::

- Compulsory zakat payments on excess assets (nisab) remaining idle for a specific period (one year) that control the accumulation of individual wealth through productive economic activities

-

Compulsory assistance for disadvantaged individuals through a percentage (2.5%) of distributed zakat income to guarantee social inclusion.Zakat

-

Masyir (Gambling) is Forbidden

Financial transactions must be linked to the real sector, proscribing speculative and unproductive transactions

-

Riba is Forbidden

Riba impedes the flow of money. Businesses profiting from riba (interest) are difficult to develop and restrict job availability. Together with forbidding riba, Islam encourages business optimisation and the application of risk sharing principles.

-

Infak, Sedekah and Waqf (Iswaf)

-

Muamalah

Muamalah transactions are based on fairness, no dharar, no gharar, no dzalim, no muharramat, free from asymmetric information and moral hazard and not deviating from the Medina Market Rules.

The aforementioned Islamic economic values based on a foundation of akidah, akhlaq and syariat (rules/laws) can be presented and formulated as six guiding principles of the Islamic economy and finance together with five instruments. The six guiding principles are mutually interconnected with the Islamic economic and financial instruments, where each instrument has a function that reflects implementation of the six guiding principles.

The Islamic economic and financial instruments along with each guiding principle as an interrelated function are as follows:

1. Zakat Instruments

Zakat is a religious obligation for all Muslims who meet the necessary criteria. The etymology of the word zakat is derived from zaka, which means growing, clean and good (Qaradawi, 1999). According to fiqh, zakat refers to the portion of wealth determined by God for distribution amongst certain groups, namely the compulsory spending of wealth above a minimum amount (nisab) to certain parties using specific means. This academic paper does not comprehensively or explicitly explain the fiqh aspects of zakat, instead providing an explanation in the macroeconomic context. Zakat instruments have two main functions as the first and second guiding principles as follows:

Principle 1: Individual Wealth Management

Relative ownership of wealth must be managed towards productive purposes. This guiding principle as a function of zakat it is not often explicitly found in other discussions or studies. Nevertheless, this principle is the most important economic function of zakat instruments. Zakat facilitates the flow of excessive and idle wealth towards productive economic activities in the form of productive investment in the real sector or as infaq, sadaqah and waqf (ISWAF). Through productive wealth flows, economic activity will continue to prosper.

Principle 2: Inclusive Income Distribution

Income and opportunity distribution to guarantee economic inclusion for all. This principle is the most commonly known function of zakat instruments. Based on this principle, income distribution from individuals with wealth exceeding nisab to the recipients (individuals with wealth below nisab) can be created.

Zakat not only functions as an income distribution mechanism, zakat also distributes opportunities. By increasing public purchasing power amongst the Poor through zakat, the opportunity to work and do business productively is also achieved. Zakat disbursements increase purchasing power amongst recipients (mustahik) in order to maintain inclusive consumption activity and bolster demand, which will in turn stimulate the supply of consumer goods and services

.

2.

Riba is Forbidden

Riba is the additional or predetermined return. Etymologically, riba implies ziyadah (additional). Linguistically, riba also means to grow and enlarge. In this context, riba is often interpreted as interest, functioning as the additional or predetermined return (ex-ante) on the use of funds. This is possible because conventional economics considers money as its own commodity with its own price, namely interest.

On the other hand, the Islamic economy views money as a unit of exchange that cannot be traded, therefore funds may only be considered productive when linked to real sector activity. Therefore, riba is connected with maysir (gambling), which will be explained with the next instrument

.

(1)-ENB.jpg)

Riba Impedes Investment

Riba as a predetermined addition, shows the transfer of risk from one party to another. In terms of interest-based lending activity, lenders seek a predetermined additional return on the funds lent when the transaction is initiated. Furthermore, the lender is not required to participate or even know for what purpose the funds are intended. On the other hand, the borrower bears all the risks associated with using the funds. If the funds are used in the real sector, the borrower is required return the funds with additional interest payments as determined by the lender.

Real sector investors are only profitable if their returns are higher than the predetermined interest rate. Consequently, returns on investment that are below the interest rate are not feasible (Figure 1). In addition to violating the principle of fairness, where only one party bears the risk, riba can also impede economic activity, particularly in the real sector. In fact, this phenomenon has led to the introduction of negative interest rates in several jurisdictions in order to stimulate investment

Based on that description, instruments that forbid riba also relate to the third guiding principle as follows:

Principle 3: Productive Transactions and Profit Sharing

The Islamic economy upholds justice and emphasises profit sharing and risk sharing. Forbidding riba negates the predetermined additional capital as interest, with the investor therefore bearing some of the risks associated with the business activity. Proscribing riba also expands feasible investment regions. Figure 1 shows that forbidding riba, in this case interest (%), would expand feasible investment regions and, thus, stimulate economic activity and absorb more labour. The application of this principle would catalyse creativity and productivity, thus competing to offer investment opportunities in the real sector.

3. Maysir is forbidden

Maysir, or gambling, is not limited to general gambling activities typically associated with casinos or betting on the outcome of games and competitions. Maysir also includes speculative activity (relying on probability), which is uncertain and not linked to productive activity in the real sector. Linkages with the real sector are what differentiate investment from gambling activities.

In terms of investment activity, there is uncertainty and linkages between the use of capital and the profits/losses generated/incurred from the trade of goods and services in the real sector, which can be utilised by other members of the community. Meanwhile, gambling involves speculation that contains uncertainty yet does not link the use of capital and the profits/losses with real sector activities. In this case, speculative activity has no economic benefit and only serves those willing to gamble (Figure 2).

-EN.jpg)

Difference between Investment and Gambling

Based on that description, instruments that forbid maysir, or gambling, also relate to the fourth guiding principle as follows:

Principle 4: Financial Transactions relating to the Real Sector

Islamic economics require that all financial transactions must be based on real sector transactions. Therefore, financial transactions can only occur if a real sector transaction needs to be facilitated by a financial transaction. The financial sector serves to facilitate the real sector because money follows trade, not vice versa. This principle seeks to avoid financial bubbles that often occur in the conventional economy. In fact, the financial sector can crowd out the real sector in line with the findings of a BIS paper authored by Cecchetti and Kharroubi (2015).

4. Infaq, Sadaqah and Waqf (ISWAF) Instruments

In terms of characteristics, infaq, sadaqah and waqf (ISWAF) instruments differ from zakat. Zakat is a religious obligation, while infaq, sadaqah and waqf (ISWAF) are voluntary. Infaq is wealth disbursed by an individual or business entity outside zakat for general prosperity. Infaq is derived from nafaqa, which means exit or disbursement. Infaq, therefore, means to spend for the greater good (such as meeting family needs) or other purposes.

The meaning of sadaqah is broader, implying the earnest giving of material and non-material alms or wealth for public prosperity. Etymologically, sadaqah is derived from shidq, which means right or true. On the other hand, waqf is a charitable endowment for religious or charitable purposes, as defined by the Great Dictionary of the Indonesian Language (2002). Similar to Zakat instruments, this academic paper does not comprehensively or explicitly explain the fiqh aspects of infaq, sadaqah and waqf, instead providing a macroeconomic explanation.

Infaq, sadaqah and waqf instruments are issued voluntarily in the public interest and can have a significant economic impact if managed productively and optimally. The implementation of infaq, sadaqah and waqf (ISWAF) instruments relates to the fifth principle as follows:

Principle 5: Social Participation in the Public Interest

SIn accordance with Islamic economic values, the pursuit of social goals is maximised through utilisation of wealth towards a common interest (QS Al Hadid: 7; QS An Nur: 33; QS Al Baqarah: 267-268). Implementation of this principle, if managed optimally and productively, will increase public resources in economic activity. Figure 3 shows how optimal zakat, infaq, sadaqah and waqf (ZISWAF) management and implementation can be used to achieve the Sustainable Development Goals (SDGs) issued by the United Nations in order to end poverty and set the world on a path of peace, prosperity and opportunity for all on a healthy planet.

ZISWAF Optimisation in line with Sustainable Development Goals (SDGs)

5.

Muamalah Transactions

Fundamentally, the four previous instruments related to their function within the economic system, yet none directly related to the rules and regulations for each muamalah transaction in the Islamic economy. Compliance is prerequisite to the creation of an Islamic economy supported by the four other instruments because failure to meet transactional requirements will disrupt the balance and effectiveness of other guiding principles in an Islamic economic system. The regulatory tools of

muamalah transactions, particularly in terms of economic trade and exchange, are as follows:

- No

gharar or ambiguity, transparency is required in every element of the transaction;

-

No

dharar or items that endanger safety, for example firecrackers and weapons (non-state owned);

-

No

muharammat or items containing haram substances, including pork, alcoholic beverages, etc;

-

No Dzalim or injustice, transactions may not incur losses or exploit one party for the gain of another.

Compliance with muamalah transaction rules relates to the sixth guiding principle as follows:

Principle 6:

Muamalah Transactions Based on Cooperation and Fairness

Consistent with Islamic economic values that uphold the general doctrine of fairness, cooperation and balance, each muamalah transaction, particularly for economic trade and exchange, must comply with prevailing rules. More specific rules to regulate trade transactions were determined by Muhammed at Medina Market, which remain effective and applicable in essence to the present day. The Medina Market Rules set by Muhammed are as follows (Iqbal and Mirakhor, 2013):

-

Freedom of exchange; freedom of economic agents to choose trade and partners in accordance with Islamic principles without subjugation;

-

Markets are places of exchange; market infrastructure and exchange facilities are complemented with transparent information concerning quantity, quality and prices. Avoid ambiguity (gharar) and minimise asymmetric information;

-

Interference in the pre-market supply process was abolished because it could hamper the original interests of the seller or buyer (no middlemen);

-

Free market; unrestricted trade areas (interregional, cross-border) without tariffs/taxes or price controls;Comprehensive transaction contracts; each contract must contain the rights and responsibilities, transfer of ownership and other rules in full. Observing the contract and submitting correct and accurate information are considered sacred.

-

The jurisdiction of the relevant authorities and law enforcers seeks to maintain compliance to the rules and contracts.

In the same way Islamic economic values stem from the realisation that absolute ownership of all things in essence belongs to Allah, the six guiding principles of the Islamic economy cannot be implemented partially and rely on all of the Islamic economic values. Application of the guiding principles will stimulate the economic cycle in perpetuity according to the will of God. Interactions between the five instruments and six principles have been mapped in Figure 4.

As elucidated previously, the interactions and implementation of Principle 1 - Principle 5 fundamentally influence the flow of wealth and resources in determining the course of the economic system, while Principle 6 regulates the interactions of each individual transaction in the market as an interaction between producers and consumers or interactions therein. In Figure 4, this is illustrated by a dotted line, where the left-hand side shows systemic economic interactions and the right-hand side shows individual muamalah transactions within the economy.

Commencing with the implementation of Principle 1 through zakat instruments, idle wealth in the form of land, houses/property, gold, currency and others exceeding the predetermined threshold (nisab) will be used to stimulate commercial investment in order to generate profit or to purchase infaq, sadaqah and waqf (ISWAF) instruments in accordance with Principle 5 in the public interest to support productive activity or increase purchasing power amongst the Poor through consumption spending. The depiction of land and building tax (PBB) as well as motor vehicle tax (PKB) together with wealth zakat demonstrate a similar function if PBB and PKB are enforced progressively and not applicable to a primary house or residence, assuming the property is used purely to meet the basic necessities.

Description: Circled numbers correspond to the guiding principles.

Conceptual Islamic Methods to Stimulate the Economy

Wealth will not flow optimally in the presence of riba, which denotes the lower limit of potential investment. Consequently, proscribing riba in accordance with Principle 3 will maximise investment potential. Nevertheless, the function of Principle 3 does not guarantee that all wealth will flow to productive activity in the real sector without forbidding gambling (maysir) through Principle 4 because gambling will direct the wealth flow back to the originator. Only through the implementation of Principle 4 will all transactions in the financial sector reflect real sector transactions in order to facilitate production or consumption activities.

On the other hand, regarding the flow of wealth from economic agents with adequate or high income, zakat instruments applying Principle 2 ensure that the Poor can also participate in the economy by increasing purchasing power as a result of zakat disbursements to meet the basic consumption needs of those towards the bottom of the pyramid. Furthermore, through the utilisation of social funds, namely infaq, sadaqah and waqf (ISWAF), accompanied by mentoring and capacity building as illustrated in Figure 3, zakat recipients (mustahiq) will receive an opportunity to produce and gradually become a zakat donor (muzakki).

The economic map in Figure 4 also observes the role of Islamic economic principles in the components of domestic demand, namely through consumption (C), investment (I), government spending (G) sourced from tax revenues and locally generated revenue (PAD) as well as total income (Y). In Figure 4, the economy is mapped as a closed system due to the omission of open economy components, such as exports (X) and imports (M). Fundamentally, the diagram could accommodate an open economy if a portion of domestic demand was met through imports rather than domestic production. In contrast, domestic production that is not absorbed by domestic demand could be traded internationally through exports.

Fundamentally, the interactions between Principle 1, Principle 2 and Principle 5, through zakat, infaq, sadaqah and waqf (ZISWAF) instruments, will boost growth, as reflected by an increase in the Production Possibility Frontier (PPF), by increasing both production factors, namely capital goods (investment) and consumer goods (Figure 2-2).

In general, the implementation of Islamic economic instruments and principles does not change the flow of funds within an economy. Islamic economic instruments and principles are implemented in order to strengthen existing instruments and mechanisms in line with the concept of the public economy. When observed using the Financial Programming and Policies (FPP) framework approach, which shows the interactions between macroeconomic components and their use in economic development policymaking, the Islamic economy can also use similar instruments based on sharia principles (Figure 2-3

.

-EN.jpg)

Financial Programming and Policies (FPP) Framework

Role of the Islamic Economy and Finance in the FPP Framework

For example, the Islamic economy also incorporates the concept of economic financing through government and private financing with issuances of government sukuk and corporate sukuk. In addition, private sector financing can utilise various financing contracts as required, such as musyarakah and Mudharabah for joint businesses, or ijarah and murabahah for leasing and trade. Furthermore, the application of Islamic principles and instruments will strengthen existing instruments through zakat, infaq, sadaqah and waqf (ZISWAF) instruments, which may already be used for transfers between households. Nevertheless, considering ZISWAF instruments have functions in line with Principles 1, 2 and 5, the resulting interactions would be strengthened compared with regular transfers between households. The utilisation of ZISWAF instruments would encourage more sustainable transfer flows and create a broader resource base due to the creation of productive assets in perpetuity through waqf. This would expand the base for capital goods formation, thus increasing the PPF curve.

In addition, the use of Islamic social finance would also strengthen economic financing mechanisms through the application of Principal 3 and Principal 4, which guarantee system stability through balance between the financial sector and real sector, and between the production sector and consumption sector as well as the risk-sharing mechanism. Zakat instrument implementation through Principle 1 will strengthen the economic financing mechanism by minimising the accumulation of idle wealth or assets through real sector investment.