Financial market infrastructures (FMI) refer to all parts of the financial system that facilitate financial market transactions, including settlement. According to IOSCO, an FMI is defined as a multilateral system among participating financial institutions, including the operator of the system, used for the purposes of recording, clearing or settling payments, securities, derivatives or other financial transactions. Several systems are considered systemically important financial market infrastructures based on the criteria set by each respective country. Nevertheless, most definitions refer to post-trade systems.

Referring to the Principles for Financial Market Infrastructures (CPSS-IOSCO, 2012), FMIs are categorized as systemically important if they involve multilateral systems for the following functions: Payment System (PS), Central Securities Depositories (CSD), Securities Settlement System (SSS), Central Counterparty (CCP) and Trade Repository (TR). In its implementation, each jurisdiction has full discretion on whether to consider a system a systemically important FMI. For example, New Zealand does not consider a trade repository (TR) a systemically important FMI because it is not currently included in the regulatory framework. India has designated its trading system, namely the Negotiated Dealing System-Order Matching (NDS-OM) in the government securities market, as an FMI because it dominates 90% of the transaction volume of government securities in the secondary market.

In Indonesia, the Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system as well as the Bank Indonesia – Scripless Securities Settlement System (BI-SSSS) are categorized as systemically important FMIs, both of which are owned, operated and supervised by Bank Indonesia.

In addition, FMIs are also operated by self-regulatory organizations (SROs), as regulated and supervised by the financial market authority. In terms of the capital market, the Indonesia Stock Market Clearing House (KPEI) and the Indonesian Central Securities Depository (KSEI) fall under the authority of the Indonesian Financial Services Authority (OJK). Regarding, commodity futures trading, PT Kliring Berjangka Indonesia (persero) and the Indonesia Clearing House (ICH) are under the jurisdiction of the Commodity Futures Trading Regulatory Agency (BAPPEBTI).

To illustrate the role of FMIs, businesses require a Payment System (PS) to receive payment transactions for goods and services. The public uses a payment system to receive salary and allowance payments. Central Securities Depositories (CSD) administrate equity and bond transactions securely and efficiently, while Central Counterparties (CCP) reduce counterparty risk by providing clearing and settlement services for over-the-counter (OTC) derivatives without going through an exchange.

Considering the crucial role of FMIs in financial markets in the event of operational constraints, which could undermine the financial markets contribution to economic development financing and even trigger financial system instability risk if not well-managed, financial sector authorities around the world are recognising the importance of FMI regulation and supervision.

Regulation and supervision typically involve the minimum requirements for an FMI operator and the coordination mechanism for domestic financial authorities and international authorities if the FMI is providing cross-border transactions.

Fundamentally, strengthening an FMI must strike an optimal balance between increasing financial market efficiency and development and minimizing the potential risks that could disrupt financial system stability. Therefore, identifying the types of risk associated with an FMI is crucial for the authorities to implement the regulatory and supervisory functions.

A clear and comprehensive supervisory framework based on a solid legal foundation and covering all aspects of the FMI business is a prerequisite for effective and efficient FMI regulation and supervision.

The regulatory approach to FMIs fundamentally relates to the legal and regulatory system governing the financial sector of a country.

In line with the legislation in the financial sector and related authorities in Indonesia, especially Law No. 4 of 2023 on Financial Sector Development and Strengthening (“PPSK Law"), the current regulation of FMI in Indonesia, in addition to being related to the payment system, is carried out through a financial market segment approach consisting of money and forex markets, capital markets and commodity markets, including derivative markets. The issuance of the PPSK Law emphasizes Bank Indonesia's authority in regulating, developing, and supervising FMIs in the Money Market and Foreign Exchange Market. FMIs regulated in the PPSK Law include trading venue, clearing, and/or central counterparty, securities settlement system, central securities depository, payment system, and trade repository of financial instruments and/or derivatives.

The regulatory approach of FMIs is also reflected in the framework for the development and deepening of Indonesia's financial markets, which is a joint effort of the relevant authorities in the financial markets, namely the Ministry of Finance, Bank Indonesia, and the Financial Services Authority. This framework for financial market development and deepening in Indonesia is known as the National Strategy for Financial Market Development and Deepening (SN-PPPK).

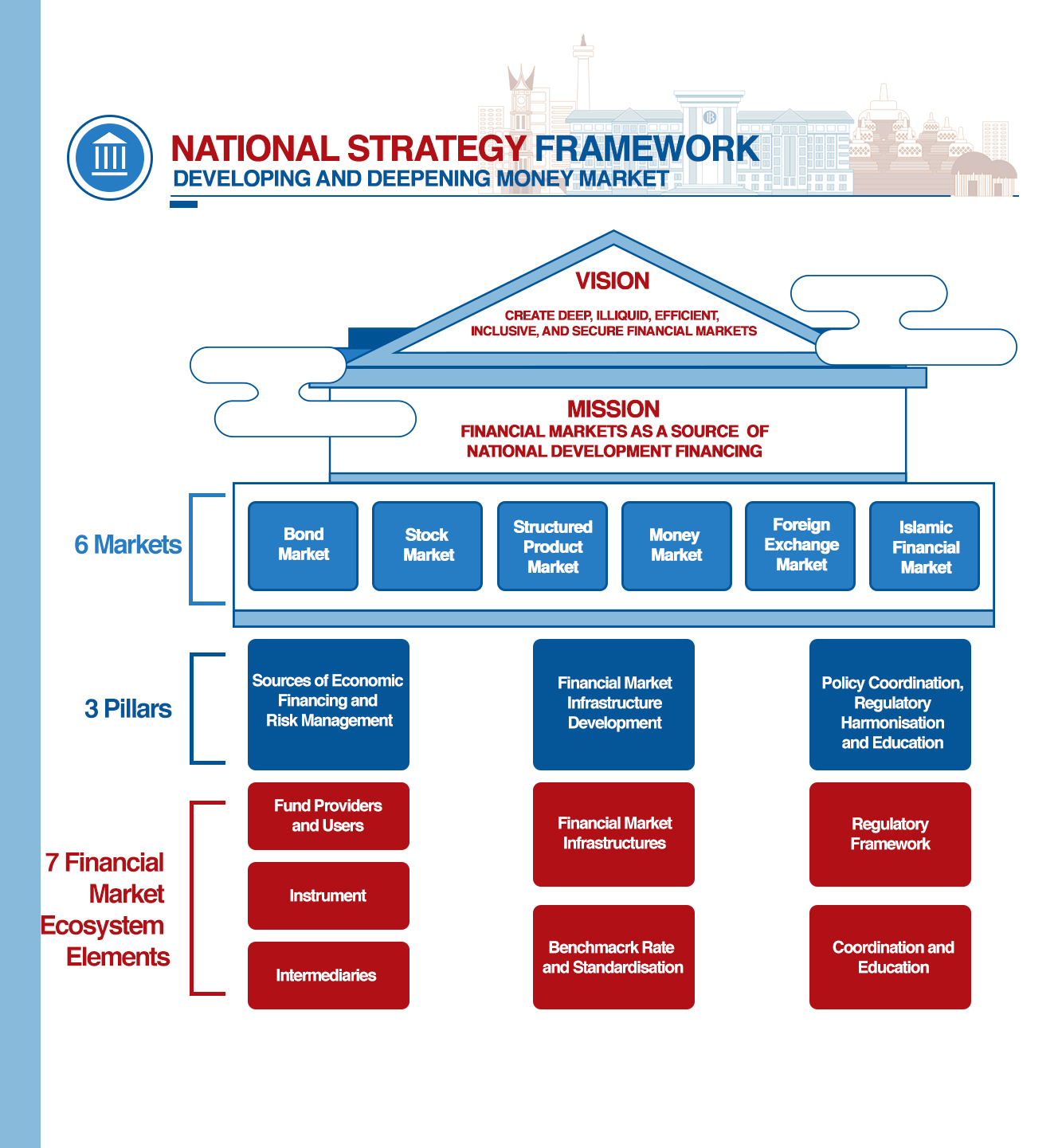

Figure:. National Financial Market Development and Deepening Strategy Framework

That approach is reflected in the financial market deepening and development framework, as a joint concern of the relevant authorities, namely the Ministry of Finance, Bank Indonesia, and the Indonesian Financial Services Authority (OJK). In Indonesia, the financial market deepening and development framework is known as the National Financial Market Development and Deepening Strategy (SN-PPPK), which is a comprehensive and measured single policy framework directed towards realizing the vision of deep, liquid, efficient, inclusive, and secure financial markets. SN-PPPK stipulates three main pillars underlying the development framework, namely: (i) sources of economic financing and risk management; (ii) financial market infrastructure development; and (iii) policy coordination, regulatory harmonization, and education. Financial market infrastructure development is a key pillar that is expected to support access to information as well as rapid, secure and efficient transaction settlement. To that end, inter-authority coordination in terms of developing the FMIs under each respective authority is essential.

FMI development in Indonesia refers to best international practices adjusted to the local profile, conditions, policy preferences and national interest, which is currently considered the best approach. FMI regulation is constantly aligned with principles adopted internationally, specifically by the Committee on Payment and Settlement Systems (CPSS) and the International Organisation of Securities Commissions (IOSCO) as contained in the Principles for Financial Market Infrastructures (PFMI) (BIS, 2012).

Guaranteeing the operational continuity of reliable, secure, and efficient FMIs vis-à-vis the purview of authority and responsibilities necessitates an unambiguous regulatory and supervisory framework.

Legally mandated as the monetary authority and the Money Market and Foreign Exchange Market, Bank Indonesia is authorized to regulate and supervise the money market and foreign exchange market, including those based on Islamic principles.

Figure:. FMIs Play an Important Role in terms of Monetary Policy Transmission, Payment System Function and Financial System Stability

More specifically, to strengthen Bank Indonesia's role in the payment system in Indonesia, Bank Indonesia released the Indonesia Payment System Blueprint (BSPI) for 2025 in 2019, which aims to support national digital economic and financial integration and, therefore, safeguard the central bank functions of currency circulation, monetary policy, and financial system stability, including financial market infrastructure development.

As one of the initiatives contained in the Indonesia Payment System Blueprint (BSPI) for 2025, financial market infrastructure development will be achieved through infrastructure modernization and strengthening the regulatory framework for financial market infrastructures in line with best practices to support optimal policy implementation. The key deliverables of this initiative include the modernization of BI-RTGS, BI-SSSS (including the CSD function), and the Bank Indonesia-Electronic Trading Platform (BI-ETP), while strengthening the regulatory framework in relation to CCP and TR development.

The lessons learned from the Global Financial Crisis in 2008 have motivated all countries to strengthen global financial market resilience through stronger policies and supervision in each jurisdiction, including infrastructures.

As part of the G20, FMI development in Indonesia has been accelerated through efforts to meet the OTC Derivatives Market Reform mandate as a G20 initiative of the Pittsburgh Summit in 2009. The efforts aim to increase transparency, prevent market abuse, and mitigate systemic risk through five key agenda items for OTC derivatives market reforms as follows:

- Standardised OTC derivatives must be transacted through Electronic Trading Platforms (ETP) or exchanges.

- Standardised OTC derivatives must be cleared through a Central Counterparty (CCP).

- Standardised OTC derivatives must be reported through a Trade Repository (TR).

- OTC derivative transactions not cleared through a CCP will be subject to higher capital charges.

- OTC derivative transactions not cleared through a CCP will be subject to margining rules.

Implementation of the five agenda items with a focus on derivatives transactions is expected to reinforce domestic and global financial market resilience and, thus, mitigate similar crises, while supporting the sustainability of healthy financial markets. To that end, Bank Indonesia is committed to other financial authorities to actively support efforts to fulfill its mandate in various areas under Bank Indonesia's authority.

There are currently 3 types of systemically important FMIs under the regulation and supervision of Bank Indonesia as mandated by the PPSK Law and in accordance with Bank Indonesia Regulation (PBI) No. 19/14/PBI/2017 concerning Transaction Processing, Securities Administration and Real-Time Settlement as follows:

- Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system, namely an electronic funds transfer system that allows for the instantaneous (real-time) transfer and settlement of individual transactions (Payment System function).

- Bank Indonesia – Scripless Securities Settlement System (BI-SSSS), namely infrastructure used to administrate transactions and securities electronically (Central Securities Depositories and Securities Settlement System).

- BI-Fast Payment (BI-FAST) is Bank Indonesia's payment system infrastructure to facilitate retail payments that can be accessed at any time.

Referring to the mandate for OTC Derivatives Market Reforms, as well as to implement the Indonesia Payment System Blueprint (BSPI) for 2025 and alignment of the PPSK Law, Bank Indonesia is currently developing a Trading Venue & Central Counterparty for OTC interest rate and exchange rate derivatives (CCP SBNT) as well as a Trade Repository as follows:

Figure: Bank Indonesia Regulations concerning FMIs in Indonesia

Moving forward, Bank Indonesia is firmly committed to financial market infrastructure development to support deep, liquid, efficient, inclusive, and secure domestic financial markets that meet international best practices and standards.