JOINT PRESS RELEASE

SP-61/KLI/2021

No.23/189/DKom

SP 30/DHMS/OJK/VIII/2021

PRESS-29/SEKL/2021

Jakarta, 3rd August 2021 – Under the auspices of the Coordination Forum for Development Financing through Financial Markets (FKPPPK), the Ministry of Finance (MoF), Bank Indonesia (BI), Financial Services Authority (OJK) and Indonesia Deposit Insurance Corporation (LPS) organised Indonesia's pre-eminent financial literacy event (Like It) virtually as a joint endeavour to increase financial literacy amongst millennials and the public as a means to expand the retail investor base and develop the financial sector in Indonesia.

Financial inclusion fosters economic growth through the equitable distribution of income, lower poverty and financial sector stability. Greater public financial literacy is a prerequisite of an inclusive financial system. Efforts to improve financial literacy are not merely the preserve of one or two institutions, yet represent the shared responsibility of all authorities, necessitating the involvement of all stakeholders, including millennials and the public in general.

In her speech at the opening ceremony of the Like It event, the Finance Minister reiterated that “one of the measures undertaken by the Ministry of Finance to provide education and a greater choice of investment instruments to the public was the introduction of Retail SBN (government securities). We will continue to market Retail SBN and I have asked the Director General of Budget Financing and Risk Management to persist with public education efforts. Alhamdulillah, I have seen great progress on that front and our investor base continues to expand."

Successful efforts to build public awareness around investing in safe instruments are reflected by the surge of Retail SBN sales during the pandemic, with Series 10, issued in July 2021, setting the all-time sales record for non-tradable Retail SBN in terms of total investors and value.

The Finance Minister also emphasised that the convenience afforded via online orders has also established Retail SBN as the foremost investment choice during public mobility restrictions. “By providing investment options to the public in the form of Retail SBN, investing has become like online shopping."

The Bank Indonesia Governor, Perry Warjiyo, delivered three salient reasons why the retail investor base is so important for financial market development in Indonesia. First, retail investors are required to build the country and invest funds for the country. Second, the velocity of money accelerates through greater retail investor participation, thus supporting effective economic advancement. Third, the retail investor base is necessary to strengthen economic resilience, the financial markets in particular. This is part of the ongoing structural reforms. A larger retail investor base strengthens financial markets in the face of global economic uncertainty. In addition, Bank Indonesia is also implementing a program of financial market deepening by developing money market and foreign exchange market instruments, while modernising financial market infrastructure.

“Retail investors, we need you. For the country, the economy and financial markets, and for yourselves," stressed Perry Warjiyo.

Chairman of the OJK Board of Commissioners, Wimboh Santoso, confirmed that OJK continues to increase financial literacy in line with the growth of individual investors purchasing various financial instruments for investment. Total investors in the capital market increased 96% (yoy) to 5.60 million in June 2021, dominated by retail investors, millennials in particular, accounting for 70% of the total.

“Financial literacy is a critical aspect for retail investors as followers of the capital market, thereby protecting investors from illegal investment activity and mitigating short-term speculative investment without due consideration of risk, the legality of financial products or fair offers."

In his speech, the Chairman of the LPS Board of Commissioners, Purbaya Yudhi Sadewa, mentioned that “creating efficient and deep financial markets will increase financial market efficiency and expand financial market access to all social strata through greater choice of diverse investment instruments. In addition, efficient and deep financial markets also support financial system stability."

“LPS, as a banking regulatory authority, exists to build public confidence and trust in the national banking industry through deposit guarantee programs. Currently, all banks operating in Indonesia fall under the protection of LPS guarantees, including commercial banks as well as (sharia) rural banks," added Purbaya Yudhi Sadewa.

The Government will continue to develop other innovative instruments and improve public awareness of financial market investment. In addition to creating an inclusive financial sector in Indonesia, the participation of millennials and the public in investment activity will build national independence in terms of development financing, while reinforcing financial sector stability.

'Like It' is part of a financial literacy series initiated in collaboration and organised alternately amongst institutional members of the Coordination Forum for Development Financing through Financial Markets (FKPPPK). The literacy series provides greater understanding concerning products, investing in government securities and capital market products as well as wise financial management. 'Like It' is made possible through synergy and collaboration amongst all relevant authorities to improve financial literacy, expand the retail investor base and develop the financial sector in Indonesia.

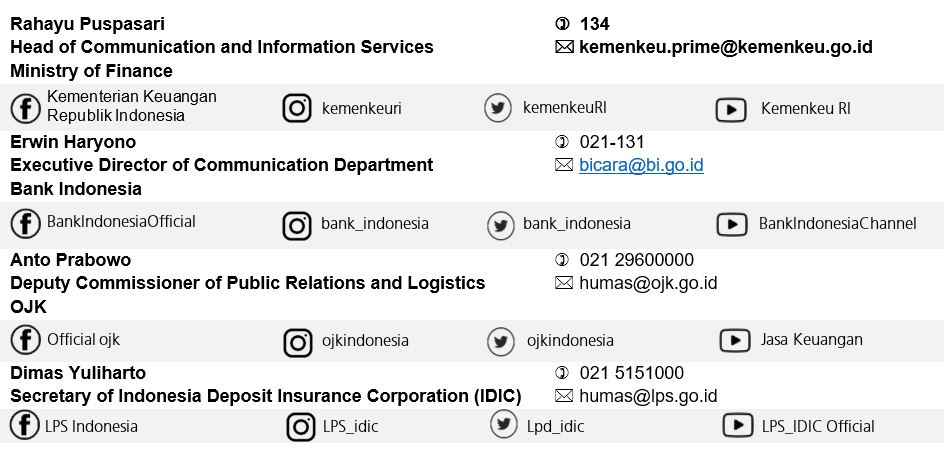

Media Contacts: